Olympus 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 OLYMPUS Annual Report 2013 19OLYMPUS Annual Report 2013

President’s Message

2. Our Growth Strategies

Accomplishment of Medium-Term Vision Goals and Further Forward-Looking Growth

in the Medical Business

The medium-term vision describes the measures we will

implement to regain the trust of our stakeholders. Therefore,

accomplishing the goals of this vision over the next four years

will be of fi rst and foremost importance. However, I believe we

must also turn our attention toward farther down the line. In

order to ensure that the growth of the Medical Business, a

major earnings driver, continues to accelerate after the vision’s

completion, it will be essential to develop strategies that take

us a step further. This will be one of our main tasks going

forward, and one that we must address with both caution and

speed. To support efforts to this end, it will be crucial to

develop a robust fi nancial base that will suffi ciently enable

us to invest in growth stably and fl exibly, even in an ever

changing and consistently opaque operating environment.

149.1

44.8

112.5

155.7

103.5

10.0 14.1 11.0 4.6

15.5

2009/3 2010/3 2011/3 2012/3 2013/3 2017/3

(Target)

0

100

200

300

400

0

10

20

30

40

50

60

560.4

642.4

648.8

661.5

642.8

2009/3 2010/3 2011/3 2012/3 2013/3 2017/3

(Target)

0

200

400

600

800

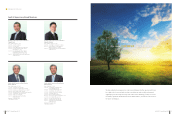

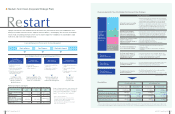

Equity / Equity Ratio

(¥ Billion)

Interest-Bearing Debt

(¥ Billion)

Equity (left) Equity ratio (right)

(%)

Major Uses of Proceeds Amount

Capital expenditures at principal gastrointestinal endoscope manufacturing facilities (3 factories in Tohoku district) ¥19.7 billion

R&D expenditures in the Medical Business ¥54.0 billion

Sales promotion expenses focused on new Medical Business products ¥24.0 billion

Others ¥14.9 billion

Total ¥112.6 billion

expand into new fi elds. By introducing new products into such

fi elds, we hope to expand our earnings base. Going forward,

we will develop more robust business and earnings structures

that take advantage of our biological microscopes and our

industrial microscopes and endoscopes, all items for which

we hold the world’s leading market shares. By creating such

structures, we aim to improve performance at the earliest

possible date. At the same time, we are thoroughly revising

cost structures. In this pursuit, we have assembled a

specialized team, which is guiding us in quickly realizing

Companywide cost reductions, with a particular focus being

placed on cutting costs in indirect depertments.

In the Imaging Business, we recorded an operating loss of

more than ¥10 billion for the third consecutive fi scal year, a

fact that I fi nd most unfortunate and that represents a

pressing issue for management to address. Needless to say,

this issue was the subject of much discussion among the

board of directors. In these discussions, rather than focusing

only on numerical targets, we discussed all available options,

including the possibility of only accumulating technologies.

The end decision was the restructuring measures announced

along with our fi scal 2013 fi nancial results in May 2013.

These measures include ceasing production of low-priced

compact cameras and signifi cantly shrinking operations,

measures through which we aim to greatly reduce inventory

risks and other business risks. At the same time, we will

construct cost structures appropriate for the scale of this

business. By implementing these measures, we will fi rst work

to breakeven on the operating income level in fi scal 2014.

We will then shift to a profi table business structure over the

medium-to-long term.

In regard to our efforts to reorganize non-core businesses,

the transference of the Information & Communication Business

as well as the liquidation and sale of other businesses

progressed more quickly than expected. We were thereby

able to recover the equity ratio to around 15% on March

31, 2013, showing that our fi nancial position had grown

much sounder. In the future, we will work toward our

medium-to-long-term goal of an equity ratio of approximately

30% while targeting the quick resumption of dividend

payments and other shareholder returns.

Construction of a Robust Financial Base Allowing for Global Action

In addition to strengthening operating foundations, the

quick recovery of our fi nancial credibility is an important

management task as such credibility is inseparable from

business growth. In recognition of this fact, we reorganized

and sold non-core businesses and commenced a business

and capital alliance with Sony Corporation during fi scal

2013.Also, we worked to reduce interest-bearing debt. As

mentioned, these efforts enabled us to recover the equity

ratio. Specifi cally, we saw the ratio recover to 15.5% on

March 31, 2013, a signifi cant improvement compared with

the level of 4.6% on March 31, 2012. We thus exceeded

our short-term goal of 10% and are seeing the steady

improvement of our fi nancial base. Still, our current fi nancial

position remains insuffi cient in comparison to other globally

active medical equipment manufacturers.

One characteristic of the Medical Business is that the

development and commercialization of products requires a

great deal of time and expense. This is because of the need

to acquire approval, among other considerations. Moreover,

our Medical Business is not one of simply selling products.

Rather, operations entail ensuring the reliability of products,

which is critical considering how they can impact people’s

lives, as well as developing the necessary after-sales support

and maintenance systems. We must also continue to

supply new products and maintain effective training systems.

As such, we need a fi nancial base that can support these

activities over the long term, as well as the credibility to back

this base. Aiming to secure the funds needed to conduct

capital and R&D expenditures in the Medical Business—

a growth area for Olympus—over the next three years, the

Company procured capital to the extent of ¥112.6 billion

in July 2013 by offering new shares and existing shares of

treasury stock to overseas investors. Our present focus is

on constructing the fi nancial base needed to strengthen

the Medical Business and conducting forward-looking

investment. We expect that this will enable us not only to

meet the goals of the medium-term vision but also to

implement the strategies required to realize growth thereafter.