Olympus 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 OLYMPUS Annual Report 2013 29OLYMPUS Annual Report 2013

At a Glance

0

200

100

400

300

500

(¥ Billion)

2011/3 2012/3 2013/3 2014/3

(Forecast)

195.5

159.9

191.8

157.4

218.7

176.1

255.7

214.3

355.3 349.2 394.7

470.0

(¥ Billion)

0

40

80

120

44.5

56.3

42.7

49.8

38.9

46.6

45.8

54.2

2011/3 2012/3 2013/3 2014/3

(Forecast)

100.8 92.4 85.5

100.0

(¥ Billion)

0

50

100

150

116.9

14.6

115.2

13.3

95.1

12.5

90.3

13.7

2011/3 2012/3 2013/3 2014/3

(Forecast)

131.4 128.6

107.6 104.0

(¥ Billion)

0

20

40

60

50.0 48.9

41.7

26.0

2011/3 2012/3 2013/3 2014/3

(Forecast)

0

50

100

150

0

5

10

15

20

25

71.7 68.2

87.1

20.2 19.5

22.1

101.0

21.5

(¥ Billion)

2011/3 2012/3 2013/3 2014/3

(Forecast)

(%)

(¥ Billion) (%)

0

10

5

15

0

4

2

6

8

10

8.6

5.4

3.5

8.5

5.9

4.1 7.0

7. 0

2011/3 2012/3 2013/3 2014/3

(Forecast)

(¥ Billion)

–25

0

–10

–15

–20

–5

5

15

10

(15.0)

(10.8)

(23.1)

0

2011/3 2012/3 2013/3 2014/3

(Forecast)

(3.6)

(8.0)

(4.9) (5.0)

–10

–5

0

5

(¥ Billion)

2011/3 2012/3 2013/3 2014/3

(Forecast)

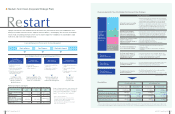

Olympus commands the world’s highest

market share in its gastrointestinal

endoscope operations and is playing an

important role in realizing early diagnoses.

Currently, the Company is focusing on

accelerating growth in the surgical and

endotherapy device fi eld, which is central

to developing minimally invasive

treatments, and in rapidly expanding

emerging markets.

Business DescriptionBusiness Segment Net SalesResults of Operations (FY2013) Operating Income (Loss) / Margin Share of Net Sales

Share of Net Sales by Region

The Company’s life science operations support

the advanced life science fi eld. Olympus is

a global market share leader for biological

microscopes in this fi eld. Key products

provided in our industrial operations include

industrial microscopes as well as industrial

endoscopes and ultrasonic fl aw detectors

that help ensure the safety and security of

social infrastructure through applications in

the non-destructive testing fi eld.

Olympus boasts the leading domestic

share for mirrorless cameras, a fi eld in

which it offers the PEN and OM-D series

of cameras designed with a focus on

being small and light weight and having high

image quality and operability. The Company

also provides unique digital cameras, such

as its high-end, high-power zoom compact

cameras, as well as voice recorders that

command a high market share.

The segment is developing business in

the medical and healthcare fi elds, such as

bone replacement material, and new

businesses operated by Olympus

Business Creation Corp.

On September 28, 2012, the Company transferred its Information & Communication

Business to Japan Industrial Partners, Inc. As a result, performance for fi scal 2013 only

includes the six months ended September 30, 2012. Accordingly, net sales were down

50% year on year, to ¥114.2 billion, and operating income was ¥1.7 billion.

New products introduced into Japan and

overseas in the gastrointestinal endoscope

and surgical and endotherapy device fi elds

made strong contributions to earnings. As a

result, net sales increased 13% year on year,

operating income was up 28%, and the

operating margin improved 2.0 percentage

points, to 22%. With these strong results,

the Medical Business supported the

performance of the entire Company. Endoscopes Surgical & Endotherapy

Life Science Industrial

Digital Cameras Others Operating loss

Operating loss

Operating income Operating margin (right)

Operating income Operating margin (right)

53.1%

Others

2.7%

Asia and

Oceania

13.8%

11.5%

14.5%

15.3%

Both net sales and operating income

were down year on year due to the

impacts of limited capital expenditure by

companies and delayed government

budgets. Regardless, we introduced new

products in both the life science and

industrial fi elds, rationalized production

sites, and otherwise advanced

preparations for growth in fi scal 2014

and onward.

The market for low-priced compact

cameras shrunk rapidly, resulting in a 16%

year-on-year decrease in net sales and the

recording of an operating loss of ¥23.1

billion. Conversely, we saw a 15% increase

in sales of mirrorless cameras, an area of

focus for the Company, with sales growth

particularly prominent in Japan.

Non-core business domains were

reorganized, entailing the sale and

liquidation of unprofi table businesses.

This resulted in a year-on-year decrease

in net sales, but the operating loss

contracted nonetheless.

Medical Business

Company History

Life Science &

Industrial Business

Imaging Business

Others

Information &

Communication

Business

P. 3 0

P. 3 8

P. 4 2

Europe

21.1%

North

America

23.8%

Japan

38.6%

1919

Established as

Takachiho Seisakusho

to manufacture

microscopes in Japan

1936

Semi-Olympus I, the fi rst

Olympus camera intro-

duced, marking entry

into camera business

1920

Asahi 600x microscope

introduced

1975

Entry into medical

surgical endoscopy field

1949

Name changed

to Olympus Optical

Co., Ltd.

The Company listed on

the TSE

1996

Entry into digital camera

business

1950

Development of the

world’s fi rst practical

gastrocamera

1968

Entry into industrial

endoscope field

2008

Acquisition of Gyrus

Group PLC to strengthen

surgical area of Medical

Business

2009

Olympus launches its

fi rst mirrorless inter-

changeable lens camera,

OLYMPUS PEN E-P1

1969

The world’s fi rst micro-

cassette tape recorder

developed

5.6%