Olympus 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 OLYMPUS Annual Report 2013 31OLYMPUS Annual Report 2013

Review of Business Segments

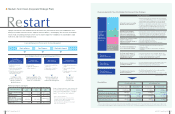

(Millions of yen)

Years ended March 31 2011 2012 2013

Operating Results

Net Sales 355,322 349,246 394,724

Operating Expenses 283,640 281,058 307,655

Operating Income 71,682 68,188 87,069

Operating Margin (%) 20.2 19.5 22.1

Sales by Product

Endoscopes 195,459 191,798 218,674

Domestic 43,848 43,803 47,335

Overseas 151,611 147,995 171,339

Surgical & Endotherapy 159,863 157,448 176,050

Domestic 35,582 36,615 42,177

Overseas 124,281 120,833 133,873

Segment Data

R&D Expenditures (¥ Billion) 28.5 26.9 31.3

Capital Expenditures (¥ Billion) 15.5 15.6 17.1

Number of Employees* 15,646 16,225 16,552

* Including average number of temporary employees

Olympus developed the world’s fi rst practical gastrocamera in 1950, contributing signifi cantly to the establishment of a

method for the early diagnosis of gastric cancer, the leading cause of death in Japan at the time. Subsequently, we have

worked to develop a wide variety of detection and treatment methods using endoscopes and endoscopic devices.

Today, the trend toward minimally invasive treatment is revolutionizing medical care. Surgery that previously required opening

the abdominal cavity can now be performed through the use of an endoscope, which enters the body through a natural orifi ce

or small incision in the skin, resulting in nearly undetectable scars. These breakthroughs in minimally invasive procedures have

helped reduce the physical burden on patients and have contributed to overall improvements in the quality of life.

Main Areas and Products

Composition (Fiscal year ended March 31, 2013)

Gastrointestinal Endoscopes

Endoscopy systems:

Videoscopes, video processors, light

sources, liquid crystal display (LCD)

panels, etc.

Peripheral equipment:

Image recording device, endoscope

cleaning systems, sterilization systems, etc.

Surgical Devices

Medical equipment for surgical

therapy and surgery:

Surgical video endoscopy systems

(surgical endoscopes, video processors,

light sources, LCD panels, etc.),

peripheral devices for endoscopic

surgery, electrosurgical knives, etc.

Endotherapy Devices

Endoscopic devices for all disciplines

of endoscopy:

Approximately 1,000 different devices

for various diagnostic and treatment

procedures, including biopsy forceps,

high-frequency polypectomy snares,

grasping forceps, stone retrieval and

lithotriptor baskets, hemostasis

accessories, etc.

Share of

Net Sales

(Consolidated net sales)

53.1%

Share of

Net Sales

by Product

Japan

22.7%

Others

2.6%

North America

34.9%

Europe

26.0%

Asia /

Oceania

13.8%

Share of

Net Sales

by Region

e

e

e

nts

Endoscopes

55.4%

Surgical &

Endotherapy

44.6%

MEDICAL

BUSINESS

Universal upper

digestive video-

scope (Gastrointes-

tinal videoscope)

Laparoscope

(Surgical endoscope)

ITknife nanoTM

disposable,

high-frequency knife

(Endotherapy device)

EVIS LUCERA ELITE

(Video endoscopy system)

THUNDERBEAT (integrated with both

Advanced Bipolar and Ultrasonic Energy)

Grasping forceps (Endotherapy device)