Olympus 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

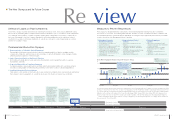

20 OLYMPUS Annual Report 2013 21OLYMPUS Annual Report 2013

75.1

87.0

140.9

EVIS

EXERA Ⅱ

(2006)

EVIS

EXERA Ⅲ

(2012)

2003/3 2006/3 2009/3

0

2017/3

(Target)

0

100

50

150

7.6

21.8

32.8

2003/3 2006/3 2009/3 2017/3

(Target)

0

100

50

150

2003/3 2006/3 2009/3 2017/3

(Target)

0

100

50

150

58.1

69.5

76.2

EVIS

LUCERA

(2002)

EVIS

LUCERA

SPECTRUM

(2006)

EVIS

LUCERA

ELITE

(2012)

57.0

79.6

125.1

EVIS

EXERA Ⅲ

(2012)

EVIS

EXERA Ⅱ

(2006)

2003/3 2006/3 2009/3 2017/3

(Target)

0

100

50

150

President’s Message

Ongoing Growth in the Medical Business

The Medical Business has continued to support the

Company’s growth as an earnings driver. As the global

need to reduce healthcare costs and limit social security

expenses become ever more pressing, I think Olympus can

play an even greater role in supporting the medical industry

by providing means of early detection and treatment. The

Olympus Group possesses technologies for developing and

manufacturing medical devices that respond to needs

ranging from early detection to minimally invasive treatment,

and it is one of the world’s leading manufacturers in this

area. We have a very strong position in the industry due to

our ability to develop simultaneously the devices needed for

new minimally invasive treatments and the early diagnosis

measures that will be linked to these new treatments. We

will grow our business while fully leveraging this strength.

And, in order to facilitate this growth, I believe that we need

to steadily conduct forward-thinking investments in a variety

of R&D areas. These include enhancing our endoscope

lineup and developing next-generation endoscopy systems

as well as conducting research and development related to

the areas of operating room imaging and energy devices

and bolstering our lineup of endotherapy devices.

Olympus boasts a dominating share of more than 70% of

the highly profi table gastrointestinal endoscope market, and it

will further strengthen its foundations in this fi eld to ensure

ongoing competitiveness. To this end, we launched new

endoscope products into developed markets, including

Japan, North America, and Europe, during fi scal 2013. We

expect that these products will help accelerate future earnings

growth. In addition, we realize that bolstering production

capabilities will be key to further expanding and growing

our business going forward. For this reason, we have decided

to invest approximately ¥20 billion in our three principal

manufacturing facilities over the coming three years. At the

same time, we will create new endoscope markets by

establishing training centers in China and elsewhere in Asia

to foster the development of endoscopic physicians in

rapidly growing emerging nations and accelerate the spread

of endoscopic procedures in these countries.

Within the Medical Business, one fi eld that I think will

play a particularly signifi cant role in future growth is surgical

and endotherapy devices. To strengthen our operations in

this fi eld, our fi rst task will be enhancing sales systems.

Specifi cally, we will create sales systems that match the

scale and characteristics of markets in both emerging

countries and developed nations. If these systems are

properly installed, I believe there are certain products for

which we can expand sales by virtue of these systems

alone. However, our efforts in this area are somewhat

lacking at present. Besides sales systems, I would like to

focus on strengthening efforts to develop new products

and technologies in this fi eld. One such new product is the

THUNDERBEAT energy device, and we will work to develop

this device into a pillar for supporting operations in the

surgical device fi eld going forward. At the same time, I hope to

use this device in other fi elds. For example, it could be utilized

to accelerate expansion in the otorhinolaryngology fi eld. In

addition, the differentiated technologies of THUNDERBEAT

show potential for driving expansion in the orthopedics fi eld.

In April 2013, a joint venture medical company was

established by Olympus and Sony Corporation. This company

operates a business related to surgical endoscopes with

3D and 4K imaging capabilities. I hope to quickly develop

this business to the point where it begins producing results

and to implement expansion measures from a perspective

looking three to fi ve years into the future. I also aim to

expand operations into fi elds peripheral to surgery, and I

believe M&A activities are an option to accomplish this.

Commitment toward Stakeholders

In addition to accomplishing the goals of the medium-term

vision, the management of Olympus is also charged with the

mission of laying strategic foundations for future growth. To

facilitate these efforts, we procured ¥112.6 billion in funds. In

procuring these funds, the Company’s management, myself

included, visited institutional investors around the world to

explain our growth strategies for the Medical Business. These

interactions once again reminded us of our responsibility to

produce results. This recognition is both obvious and

important. Harsh opinions were received from many of the

institutional investors we visited. However, in the end, we

were able to collect funds to an extent that exceeded our

target, which I believe represents the high evaluations of

our response to investors and our growth strategies. As

president, the responsibility I feel is heavier than I have ever

felt in my life, and I am committed to producing results that

meet the expectations of our stakeholders.

Hiroyuki Sasa

President and Representative Director

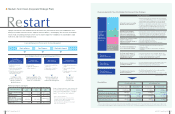

THUNDERBEAT Features—Comparison of Effectiveness

THUNDERBEAT

Ultrasonic devices

High-frequency devices (bipolar type)

Vessel sealing Precise dissection

Tissue graspingHemostasis

Incision speed

North America

(¥ Billion)

Asia / Oceania

(¥ Billion)

Japan

(¥ Billion)

Europe

(¥ Billion)

Sales Growth of Medical Business after Introduction of New Products and Future Targets