Office Depot 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

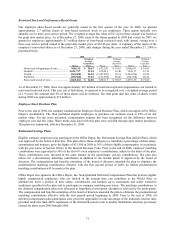

At December 27, 2008, the company had approximately $712.1 million of available credit under the Facility.

Borrowings under the Facility totaled $139.1 million at an effective interest rate of approximately 5.41%. There

were also letters of credit outstanding under the Facility totaling approximately $177.8 million. An additional $1.5

million of letters of credit were outstanding under separate agreements. Average borrowings under the Facility from

September 26, 2008 to December 27, 2008 were approximately $254 million.

In addition to our borrowings under the Facility, we had short-term borrowings of $37.5 million. These borrowings

primarily represent outstanding balances under various local currency credit facilities for our international

subsidiaries that had an effective interest rate at the end of the year of approximately 3.03%.

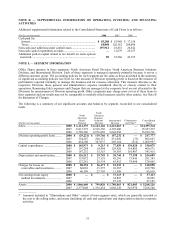

The Agreement replaced the company’s Revolving Credit Facility Agreement, which provided for multiple-currency

borrowings of up to $1 billion and had a sub-limit of up to $350 million for standby and trade letter of credit

issuances.

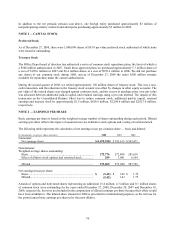

In December 2008, the company’s credit rating was downgraded which provided the counterparty to the company’s

private label credit card program the right to terminate the agreement and require the company to repurchase the

outstanding balance of approximately $184 million. Both parties entered into a standstill agreement whereby the

company permanently waived its early termination right and the counterparty agreed not to terminate the agreement

and require repurchase of the outstanding balance until at least March 31, 2009 while a permanent solution was

developed. This standstill agreement precluded the occurrence of cross defaults in certain of the company’s

agreements. In February 2009, the company and the counterparty amended the agreement to permanently waive the

repurchase clause and the company agreed to amend an existing $25 million letter of credit which may be increased,

after December 29, 2009, to as much as $45 million based on an assessment of risk in the portfolio at that time.

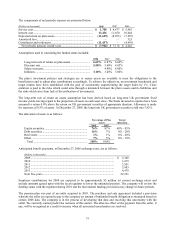

In August 2003, we issued $400 million senior notes due August 2013. These notes are not callable and bear interest

at the rate of 6.25% per year, to be paid on February 15 and August 15 of each year. The notes contain provisions

that, in certain circumstances, place financial restrictions or limitations on us. Simultaneous with completing the

offering, we liquidated a treasury rate lock. The proceeds are being amortized over the term of the issue, reducing

the effective interest rate to 5.87%. During 2004, we entered into a series of fixed-to-variable interest rate swap

agreements as fair value hedges on the $400 million of notes. The swap agreements were terminated during 2005.

Capital lease obligations primarily relate to buildings and equipment as indicated in Note C.

In December 2006, we sold our former corporate campus and entered into a short-term leaseback. Coincident with

the sale, we paid $22.2 million to settle the mortgage securing one of the buildings. The total payment of

approximately $28 million included the principal, accrued interest to the termination date and the contractual

prepayment consideration. Approximately $5.7 million is presented as loss on extinguishment of debt on the

Consolidated Statements of Operations. That mortgage had been assumed in 2005 under conversion of a previously

capitalized lease agreement.

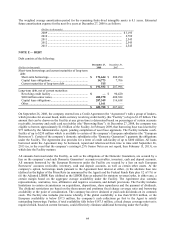

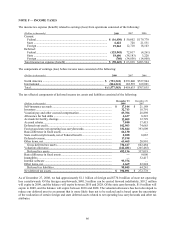

Aggregate annual maturities of long-term debt and capital lease obligations are as follows:

(Dollars in thousands)

2009........................................................................................................................................... $ 35,692

2010........................................................................................................................................... 34,760

2011........................................................................................................................................... 32,943

2012........................................................................................................................................... 31,923

2013........................................................................................................................................... 449,357

Thereafter .................................................................................................................................. 307,112

Total .......................................................................................................................................... 891,787

Less amount representing interest on capital leases .................................................................. (187,711)

Total .......................................................................................................................................... 704,076

Less current portion................................................................................................................... (15,288)

Total long-term debt.................................................................................................................. $ 688,788