Office Depot 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

economic benefit. Additionally, during late 2008, the company substantially lowered its expectations for new

store openings and store remodels and determined that certain other projects would not be completed. The

company also concluded that possible acquisitions would not be completed before the end of the year, if at all.

Previously deferred costs for these activities, which totaled approximately $11 million, were expensed during the

fourth quarter of 2008.

• Other restructuring activities - During 2008, we recorded approximately $5 million of charges associated with

other restructuring activities related to enhancing efficiencies throughout the company. Of these charges,

approximately $1 million related to the harmonization of our product offerings in Europe, which resulted in a

write down of inventory in the fourth quarter of 2008. Of the remaining charges, approximately $2 million

related to the acceleration of depreciation on certain assets and $2 million was for lease costs. We expect to

recognize additional charges of approximately $25 million in 2009 related to restructuring activities not

identified above.

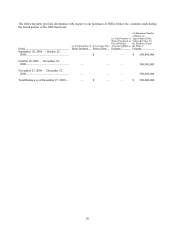

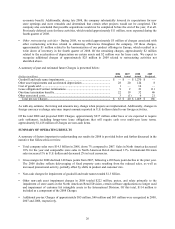

A summary of past and estimated future Charges is presented below:

2006 2007 2008 2009

(Dollars in millions) Actual Actual Actual Projected

Goodwill and trade name impairments.............................................................. $ — $ — $ 1,270 $ —

Other asset impairments and accelerated depreciation ...................................... 28 20 124 8

Cost of goods sold ............................................................................................. 1 — 16 —

Lease obligations/Contract terminations ........................................................... 9 2 21 111

One-time termination benefits ........................................................................... 22 19 32 46

Other associated costs........................................................................................ 3 (1) 6 21

Total pre-tax Charges .................................................................................... $ 63 $ 40 $ 1,469 $ 186

As with any estimate, the timing and amounts may change when projects are implemented. Additionally, changes in

foreign currency exchange rates may impact amounts reported in U.S. dollars related to our foreign activities.

Of the total 2008 and projected 2009 Charges, approximately $237 million either have or are expected to require

cash settlement, including longer-term lease obligations that will require cash over multi-year lease terms;

approximately $1,418 million of Charges are non-cash items.

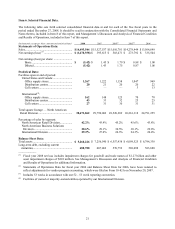

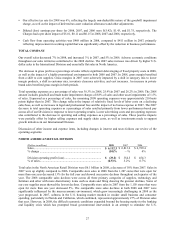

SUMMARY OF OPERATING RESULTS

A summary of factors important to understanding our results for 2008 is provided below and further discussed in the

narrative that follows this overview.

• Total company sales were $14.5 billion in 2008, down 7% compared to 2007. Sales in North America decreased

10% for the year and comparable store sales in North American Retail decreased 13%. International Division

sales increased 1% in U.S. dollars and decreased 2% in local currencies.

• Gross margin for 2008 declined 140 basis points from 2007, following a 200 basis point decline in the prior year.

The 2008 decline reflects deleveraging of fixed property costs resulting from the reduced sales, as well as

increased promotional activity, partially offset by shifts in product and customer mix.

• Non-cash charges for impairment of goodwill and trade names totaled $1.3 billion.

• Other non-cash asset impairment charges in 2008 totaled $222 million, pretax, and relate primarily to the

impairment of store assets in the North American Retail Division, certain software applications no longer used

and impairment of customer list intangible assets in the International Division. Of this total, $114 million is

included as a component of the 2008 Charges.

• Additional pre-tax Charges of approximately $85 million, $40 million and $63 million were recognized in 2008,

2007 and 2006, respectively.