Office Depot 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

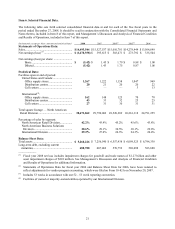

30

pension plan in the UK and non-cash impairment charges of approximately $11 million related to our customer list

intangible assets. The 2007 decrease reflects lower performance of approximately 80 basis points, primarily from the

UK, and to a lesser extent, a greater percentage of contract sales in our sales mix. During 2007, the Division

established regional offices in Asia and Latin America, centralized certain support functions in Europe, expanded

into Poland and consolidated certain warehouse facilities. These investments lowered 2007 operating margin by

approximately 80 basis points. Partially offsetting the decrease in operating margin in 2007 were positive impacts

totaling approximately 30 basis points, which resulted primarily from lower performance-based variable pay as a

result of lower Division performance.

We believe the uncertain economic outlook will continue to challenge our sales and operating profit margin in 2009.

For U.S. reporting, the International Division’s sales are translated into U.S. dollars at average exchange rates

experienced during the year. The Division’s reported sales were positively impacted by approximately $127 million

in 2008 and $322 million in 2007 from changes in foreign currency exchange rates. Division operating profit was

also positively impacted from changes in foreign exchange rates by $2 million in 2008 and $20 million in 2007.

Internally, we analyze our international operations in terms of local currency performance to allow focus on

operating trends and results.

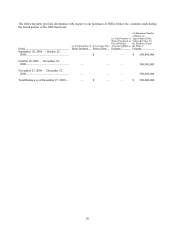

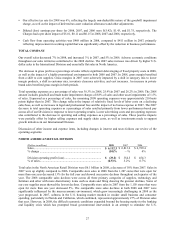

CORPORATE AND OTHER

General and Administrative Expenses

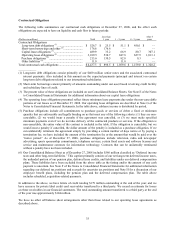

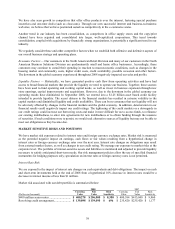

Total general and administrative expenses (“G&A”) increased from $646 million in 2007 to $743 million in 2008.

The portion of G&A expenses considered directly or closely related to division activity is included in the

measurement of Division operating profit. Other companies may charge more or less G&A expenses and other costs

to their segments, and our results therefore may not be comparable to similarly titled measures used by other

companies. The remainder of the total G&A expenses are considered corporate expenses. A breakdown of G&A is

provided in the following table:

(Dollars in millions) 2008 2007 2006

Division G&A..................................................................................... $ 394.6 $ 341.8 $ 319.0

Corporate G&A................................................................................... 348.6 303.9 332.7

Total G&A ...................................................................................... $ 743.2 $ 645.7 $ 651.7

% of sales ............................................................................................ 5.1% 4.2% 4.3%

Increases in Division G&A in 2008 were primarily driven by higher levels of performance-based variable pay and

the impact of changes in foreign exchange rates.

Corporate G&A includes Charges of approximately $17 million, $15 million and $18 million in 2008, 2007 and

2006, respectively. Additionally in 2006, we recognized a charge of approximately $16 million to resolve a wage

and hour litigation in California. After considering these charges, corporate G&A expenses as a percentage of sales

increased approximately 40 basis points from 2007 to 2008 and decreased by approximately 10 basis points from

2006 to 2007. The 2008 increase primarily reflects higher performance-based variable pay as well as costs for

professional and legal fees associated with the company’s proxy challenge and legal matters described in Part I -

Item 3. “Legal Proceedings.” Also, during 2008, the company initiated a voluntary exit incentive program for certain

employees that resulted in charges for severance expenses of approximately $7 million during the year. The 2007

decrease reflects lower performance-based pay, partially offset by higher professional fees and outside labor costs.

Gain on Sale of Building

In December 2006, in connection with a decision to move to a new, leased, headquarters facility, we sold our

corporate campus and entered into a leaseback agreement pending completion of the new facility. The sale resulted

in a gain of approximately $21 million recognized in 2006 and $15 million deferred over the leaseback period. We

recognized approximately $7 million in amortization of the deferred gain on the sale during both 2008 and 2007.

This amortization largely offset the rent expense during the leaseback period. During 2007, we entered into a longer-

term lease on our new corporate campus, and we moved into this new facility during the fourth quarter of 2008.