Office Depot 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

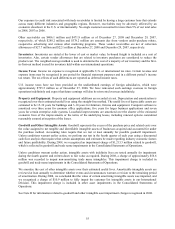

Derivative Financial Instruments: Certain derivative financial instruments may be used to hedge the exposure to

foreign currency exchange rate, fuel price change and interest rate risks, subject to an established risk management

policy. Financial instruments authorized under this policy include swaps, options, caps, forwards and futures. Use of

derivative financial instruments for trading or speculative purposes is prohibited by company policies.

Vendor Arrangements: We enter into arrangements with substantially all of our significant vendors that provide

for some form of consideration to be received from the vendors. Arrangements vary, but generally specify volume

rebate thresholds, advertising support levels, as well as terms for payment and other administrative matters. The

volume-based rebates, supported by a vendor agreement, are estimated throughout the year and reduce the cost of

inventory and cost of goods sold during the year. This estimate is regularly monitored and adjusted for current or

anticipated changes in purchase levels and for sales activity. Other promotional consideration received is event-

based or represents general support and is recognized as a reduction of cost of goods sold or inventory, as

appropriate based on the type of promotion and the agreement with the vendor. Some arrangements may meet the

specific, incremental, identifiable criteria that allow for direct operating expense offset, but such arrangements are

not significant.

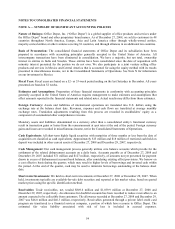

New Accounting Standards: In September 2006, the FASB issued Statement of Financial Accounting Standards

No. 157, Fair Value Measurements (“FAS 157”). This Standard defines fair value, establishes a framework for

measuring fair value in generally accepted accounting principles and expands disclosures about fair value

measurements. FAS 157 was effective for fiscal years beginning after November 15, 2007 for financial assets and

liabilities, as well as for any other assets and liabilities that are carried at fair value on a recurring basis in financial

statements. Certain aspects of this Standard were effective at the beginning of the first quarter of 2008 and had no

impact on the company. In November 2007, the FASB provided a one year deferral for the implementation of FAS

157 for other nonfinancial assets and liabilities. We do not anticipate that the adoption of the deferred portion of

FAS 157 will have a material impact on our financial condition, results of operations or cash flows.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (R), Business

Combinations (“FAS 141R”). This Standard retains the fundamental acquisition method of accounting established in

Statement 141; however, among other things, FAS 141R requires recognition of assets and liabilities of

noncontrolling interests acquired, fair value measurement of consideration and contingent consideration, expense

recognition for transaction costs and certain integration costs, recognition of the fair value of contingencies, and

adjustments to income tax expense for changes in an acquirer’s existing valuation allowances or uncertain tax

positions that result from the business combination. The Standard is effective for annual reporting periods beginning

after December 15, 2008 and shall be applied prospectively. However, the Standard did not address transition

provisions for items such as in progress transactions costs that were capitalized under FAS 141 but are considered

period costs under FAS 141R. During the fourth quarter of 2008, we expensed previously deferred costs because

they no longer were considered assets that would provide future economic benefit. The impact was not material to

our results of operations.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, Noncontrolling

Interests in Consolidated Financial Statements (“FAS 160”). This Standard changes the way consolidated net

income is presented, requiring consolidated net income to report amounts attributable to both the parent and the

noncontrolling interest but earnings per share will be based on amounts attributable to the parent. It also establishes

protocol for recognizing certain ownership changes as equity transactions or gain or loss and requires presentation of

noncontrolling ownership interest as a component of consolidated equity. The Standard is effective for annual

reporting periods beginning after December 15, 2008 and is to be applied prospectively. We have not yet completed

our assessment of the impact FAS 160 will have on the presentation of our financial condition, results of operations

or cash flows.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, Disclosures about

Derivative Instruments and Hedging Activities — an amendment of FASB Statement No. 133 (“FAS 161”). This

Standard requires enhanced disclosures regarding derivatives and hedging activities, including: (a) the manner in

which an entity uses derivative instruments; (b) the manner in which derivative instruments and related hedged

items are accounted for under Statement of Financial Accounting Standards No. 133, Accounting for Derivative

Instruments and Hedging Activities; and (c) the effect of derivative instruments and related hedged items on an

entity’s financial position, financial performance, and cash flows. The Standard is effective for financial statements

issued for fiscal years and interim periods beginning after November 15, 2008. As FAS 161 relates specifically to

disclosures, the Standard will have no impact on our financial condition, results of operations or cash flows.