Office Depot 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

RESULTS OF OPERATIONS

GENERAL

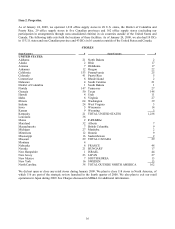

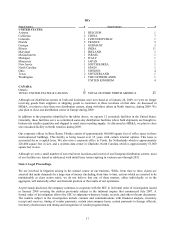

Our business is comprised of three reportable segments. The North American Retail Division includes our retail

office supply stores in the U.S. and Canada, which offer office supplies, computers and business machines and

related supplies, and office furniture. Most stores also offer a design, print and ship center offering graphic design,

printing, reproduction, mailing and shipping. The North American Business Solutions Division sells office supply

products and services in the U.S. and Canada directly to businesses through catalogs, internet web sites and a

dedicated sales force. Our International Division sells office products and services through catalogs, internet web

sites, a dedicated sales force and retail stores.

Our fiscal year results are based on a 52- or 53-week retail calendar ending on the last Saturday in December. Each

of the three years addressed in this Management’s Discussion and Analysis of Financial Condition and Results of

Operations (“MD&A”) is based on 52 weeks. Our comparable store sales relate to stores that have been open for at

least one year.

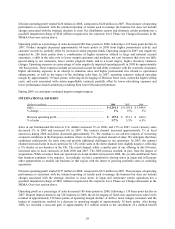

OVERVIEW

Economic factors and company performance

Fiscal year 2008 was a very difficult period for the company. The housing crisis that began in California and Florida

in 2007 deepened in 2008 and spilled over to other sectors of the U.S. economy and then the global economy. A

wide range of underlying asset values decreased and in turn, contributed to a banking and credit crisis, as well as

extreme volatility in the stock market. We entered a recessionary period combined with a systemic lack of liquidity

and deep cuts in corporate spending. All of these factors contributed to a difficult retail environment. While we

worked hard to anticipate and satisfy our customers’ needs, we clearly did not meet our goals. As a result, the

company has reported a decline in sales and gross margins, as well as significant asset impairments and other

charges, resulting in a significant loss for the year. We cannot predict the future, but most economists anticipate

another difficult year in 2009. This outlook of continued recessionary factors has contributed to the severity of some

of the impairment charges recognized in 2008. We will continue to focus on the needs of our small- to medium-

sized customers, controlling cash flows, expanding our private brands and providing solutions to all customers.

Summary of charges

At the time we reported our third quarter 2008 results, we also announced the launch of an internal review of assets

and processes with the goal of positioning the company to deal with the deepening economic crisis and to benefit

from its eventual improvement. The results of that internal review led to decisions to close stores, exit certain

businesses and write off certain assets that were not seen as providing future benefit. These decisions resulted in

material charges, some of which were recognized during the fourth quarter of 2008, and others which will be

recognized during 2009 as the related accounting criteria are met. Additional information about these activities is

provided below. We will manage these activities at a corporate level and the impacts will be disclosed as corporate

charges and will not be reflected in the Division operating results.

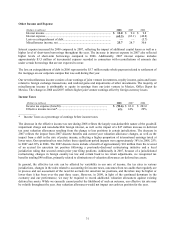

In addition to the charges that relate to these changes in business, we recognized other material charges because of

the downturn in our business. Those charges include material asset impairments relating to stores we will continue

to operate, charges to impair amortizing customer relationship intangible assets, as well as an increase in our

allowance for bad debts related to our private label credit card portfolio and certain other accounts receivable

balances to reflect the current economic downturn. These charges are considered reflective of operating an ongoing

business in difficult times and are included in Division operating results.

We also recognized material goodwill and trade name impairment charges during 2008. The factors and amounts

associated with these and other charges reported internally at the corporate level (collectively, the “Charges”) are

discussed below.