Office Depot 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

economy. Consumer spending declined as a result of economic factors such as the higher cost of such basic

consumer staples as gas and food, rising levels of unemployment and personal debt, and reduced access to consumer

credit. Management expects the Company to continue to face a very difficult economic environment throughout

fiscal 2009. As the global financial crisis has broadened and intensified, other sectors of the global economy have

been adversely impacted and a severe global recession of uncertain length now appears likely. As a company that is

dependent upon consumer discretionary spending, we expect to face an extremely challenging 2009 because of these

economic conditions.

Division operating performance in 2008 resulted in a $29 million loss, compared to $355 million operating profit in

2007. This measure of operating performance is consistent with the internal reporting of results used to manage the

business but does not include charges associated with the strategic decision to close 126 stores and one crossdock

facility as well as certain other items. Please see Charges discussion in the MD&A Overview section above.

Operating profit as a percentage of sales decreased by 570 basis points in 2008 and 150 basis points in 2007 as

compared to the prior year. Product margins in 2008 were essentially flat with increased promotional and clearance

activity largely offsetting an increase from a shift in product mix away from lower margin technology products. In

2007, product margins decreased approximately 120 basis points from increased promotional activities and a shift in

category mix to lower margin items. Although flat for the full year of 2007, we experienced a significant decrease in

vendor program funds in the second half of 2007 from reduced purchasing levels and as vendors experienced

slowdown in their own businesses. Operating margin was negatively impacted in 2008 by approximately 160 basis

points from a de-leveraging of fixed property costs and 90 basis points from higher inventory shrink and valuation

charges and higher supply chain costs as a percentage of sales. In 2007, de-leveraging of fixed costs, higher supply

chain costs and higher levels of inventory shrink reduced operating margins by 120 basis points. During 2008,

consistent with the downturn in the economy and our performance, we recognized approximately $98 million of

asset impairment charges, or 160 basis points expressed as a percentage of sales. Partially offsetting these factors,

we expanded our selection of private brands which had a positive impact on operating margins in 2008 and 2007.

While payroll, advertising and other expenses were lower in 2008, because of the reduced sales base, they

contributed approximately 160 basis points to the decline in operating margin. The 2007 operating expenses

improved operating margin approximately 90 basis points reflecting a reduction in advertising costs as well as lower

bonus accruals commensurate with lower Division performance and lower pre-opening expenses related to a

reduction in new store openings.

As we look into 2009, we believe the uncertain economic outlook will continue to challenge our sales and operating

profit margin.

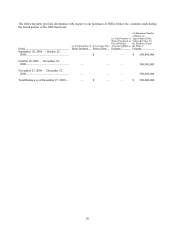

We opened 59 new stores during 2008 and 71 stores during 2007, all using our M2 store design. At the end of 2008,

we operated 1,267 retail stores in the U.S. and Canada. We anticipate opening approximately 15 stores in 2009.

During 2009, we plan to close 118 stores in North America, of which 116 are part of the strategic review launched in

the fourth quarter of 2008. For additional information on this strategic review, see the Overview to MD&A above.

During 2008 and 2007, we remodeled 16 stores and 177 stores, respectively. We exclude the brief remodel period

from our comparable store sales calculation to partially account for the disruption.

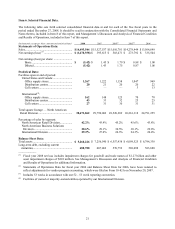

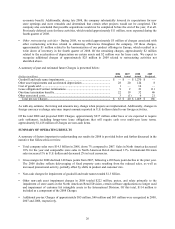

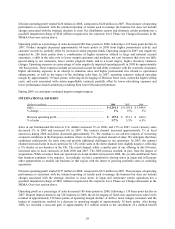

NORTH AMERICAN BUSINESS SOLUTIONS DIVISION

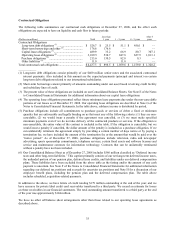

(Dollars in millions) 2008 2007 2006

Sales .............................................................................................. $ 4,142.1 $ 4,518.4 $ 4,576.8

% change ....................................................................................... (8)% (1)% 6%

Division operating profit ............................................................... $ 119.8 $ 220.1 $ 367.0

% of sales ...................................................................................... 2.9% 4.9% 8.0%

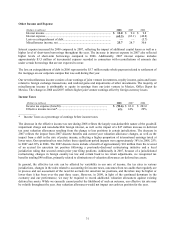

Sales in our North American Business Solutions Division decreased 8% in 2008 and 1% in 2007. The sales decrease

in 2008 reflects the impact of worsening economic conditions and the resulting decline in sales to our small- to

medium-size customer base. Sales to our larger account customers, including the public sector, also declined,

especially following the fourth quarter banking crisis, as customers confined more of their purchases to core

supplies. Both our contract and direct channels experienced sales declines, with contract down 8% and direct down

9%. The 2007 decrease reflects an 11% reduction in sales from the direct channel, partially offset by sales increases

in large and national account customers in the contract channel.