Office Depot 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

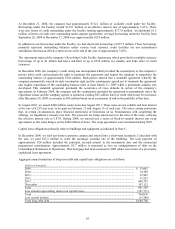

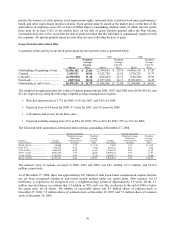

one-time termination benefit accruals, and $1 million represents other facility closure costs. As mentioned above

six of the stores were closed by year end 2008 and approximately $6 million was recognized for the estimated

period of economic loss under the associated operating lease contracts. Additional severance of approximately

$3 million will be recognized as services are performed over the closure period and applicable lease accruals will

be recognized when the facilities are closed during 2009. We currently estimate approximately $88 million of

lease charges to be recognized in 2009, but the amount may change as sublease assumptions are refined and the

then-current risk-adjusted discount rates applied. We are currently using discount rates ranging from 13.5% to

15.0% to discount these multi-year obligations.

• Reduction in store openings (North America) – We have reduced the number of new store openings for 2009 to

approximately 15, from the previous estimate of 40 stores. This reduction resulted in the recognition in 2008 of

approximately $9 million for the estimated period of economic loss under the operating lease contracts

associated with the stores that will not be opened. We expect to record approximately $3 million in lease costs

for these activities during 2009.

• Store closures (International) – We have decided to exit the retail sales channel in Japan during 2009 because

most of our stores in that country are unprofitable. The total charges for these closures is estimated to be $13

million, with approximately $6 million recorded in the fourth quarter of 2008 and the balance to be recognized

during 2009 as the stores are closed. The 2008 charges are primarily associated with asset impairments, and the

2009 charges include severance related expenses, lease costs and other facility closure costs of $4 million, $2

million and $1 million, respectively. Additionally, we expect to incur charges associated with residual inventory

values from these closed facilities, however, these values cannot be reasonably estimated.

• Supply chain consolidation (North America) – During 2009, our current plan is to close five distribution centers

and one crossdock facility to streamline our supply chain. These facilities are near the end of their initial lease

terms and projected closure costs total approximately $8 million, with $2 million recognized during 2008 for

severance related costs. The remainder of the charges relate to one-time termination benefits of $1 million, lease

costs of $2 million and other exit costs including deconstruction expenses of $3 million. Additionally, we expect

to incur charges associated with residual inventory values from these closed facilities, however, these values

cannot be reasonably estimated.

• Supply chain consolidation (International) – We have substantially completed the consolidation of our

distribution centers in Europe with one closure planned for 2009. During 2008, we recorded approximately $20

million in exit costs associated with this activity. These costs consisted primarily of accelerated depreciation,

severance related expenses and future lease obligations, which totaled $8 million, $4 million and $4 million,

respectively. We also recorded $4 million in charges related to other facility closure costs in 2008. We expect to

record approximately $23 million in charges for these activities during 2009. The 2009 charges include lease

costs, severance related expenses, accelerated depreciation and other facility closure costs of $11 million, $4

million, $4 million and $4 million, respectively.

• Call center and back office restructuring (International) – During 2007, we began the consolidation of our call

centers and back office operations in Europe. We recorded approximately $13 million of charges related to these

activities in 2008, of which $12 million was associated with severance and other one-time termination benefits.

The remaining $1 million of charges incurred in 2008 related to other exit activities. We expect to record

approximately $10 million in severance related charges and $1 million in lease costs for these activities during

2009.

• Additional employee reductions – Each of the Divisions, as well as Corporate, have identified positions that have

been or will be eliminated in an effort to be more responsive to either customer needs or to centralize activities

and eliminate geographic redundancies. Total severance and one-time benefit costs associated with these actions

are estimated to be approximately $33 million, with $13 million recognized during 2008.

• Asset write downs – As a result of the fourth quarter 2008 business review, the company determined that it

would no longer use the functionality in certain software applications and accordingly, recognized a charge of

approximately $31 million to write down previously capitalized software costs that will not be providing future

economic benefit. Additionally, during late 2008, the company substantially lowered its expectations for new