NVIDIA 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Product Defect

During fiscal year 2010, we recorded an additional net warranty charge of $95.8 million against cost of revenue to cover

anticipated customer warranty, repair, return, replacement and other costs arising from a weak die/packaging material set in certain

versions of our previous generation MCP and GPU products used in notebook systems. This charge included an additional accrual of

$164.4 million for related estimated costs, offset by reimbursements from insurance carriers of $68.6 million that we recorded against

cost of revenue during fiscal year 2010. During fiscal year 2009, we recorded a net warranty charge of $189.3 million charge against

cost of revenue for the purpose of supporting the product repair costs of our affected customers around the world. This charge

included an accrual of $196.0 million for related estimated costs, offset by reimbursements from insurance carriers of $6.7 million that

we recorded against cost of revenue during fiscal year 2009. Although the number of units that we estimate will be impacted by this

issue remains consistent with our initial estimates in July 2008, the overall cost of remediation and repair of impacted systems has

been higher than originally anticipated. The weak die/packaging material combination is not used in any of our products that are

currently in production.

We continue to seek access to our insurance coverage regarding reimbursement to us for some or all of the costs we have

incurred and may incur in the future relating to the weak material set. However, there can be no assurance that we will recover any

additional reimbursement.

Through January 31, 2010, we have made an aggregate of $233.5 million in cash payments related to the warranty accrual

associated with incremental repair and replacement costs from the weak die/packaging material set and our remaining accrual balance

was $88.1 million.

In September, October and November 2008, several putative class action lawsuits were filed against us, asserting various claims

related to the impacted MCP and GPU products. Please refer to Note 13 of the Notes to the Consolidated Financial Statements in

Part IV, Item 15 of this Form 10-K for further information regarding this litigation.

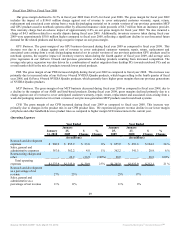

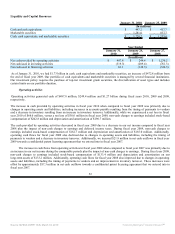

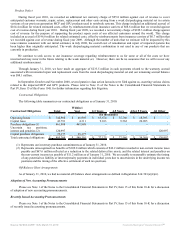

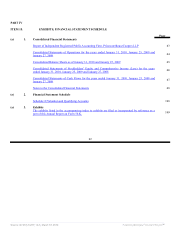

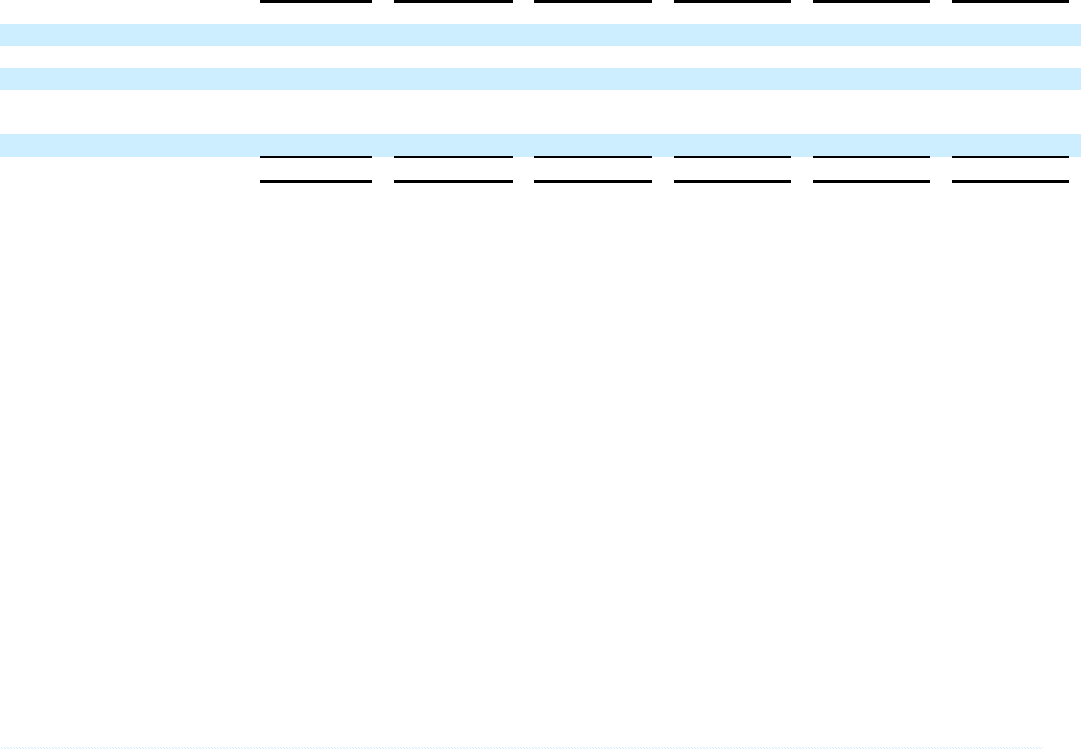

Contractual Obligations

The following table summarizes our contractual obligations as of January 31, 2010:

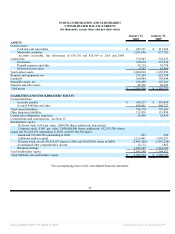

Contractual Obligations Total

Within 1

Year 2-3 Years 4-5 Years After 5 Years All Other

(In thousands)

Operating leases $ 144,960 $ 46,905 $ 63,874 $ 15,786 $ 18,395 $ -

Capital lease 43,791 4,311 9,013 9,562 20,905 -

Purchase obligations (1) 461,988 461,988 - - - -

Uncertain tax positions,

interest and penalties (2) 120,997 - - - - 120,997

Capital purchase obligations 25,177 25,177 - - - -

Total contractual obligations $ 805,269 $ 540,301 $ 77,125 $ 27,546 $ 39,300 $ 120,997

(1) Represents our inventory purchase commitments as of January 31, 2010.

(2) Represents unrecognized tax benefits of $109.8 million which consists of $42.2 million recorded in non-current income taxes

payable and $67.6 million reflected as a reduction to the related deferred tax assets, and the related interest and penalties on

the non-current income tax payable of $11.2 million as of January 31, 2010. We are unable to reasonably estimate the timing

of any potential tax liability or interest/penalty payments in individual years due to uncertainties in the underlying income tax

positions and the timing of the effective settlement of such tax positions.

Off-Balance Sheet Arrangements

As of January 31, 2010, we had no material off-balance sheet arrangements as defined in Regulation S-K 303(a)(4)(ii).

Adoption of New Accounting Pronouncements

Please see Note 1 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Form 10-K for a discussion

of adoption of new accounting pronouncements.

Recently Issued Accounting Pronouncements

Please see Note 1 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Form 10-K for a discussion

of recently issued accounting pronouncements.

Source: NVIDIA CORP, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠