NVIDIA 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

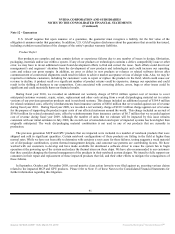

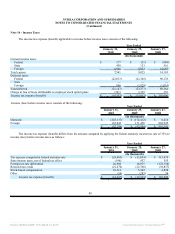

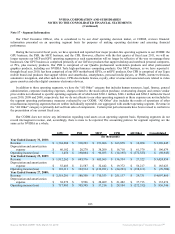

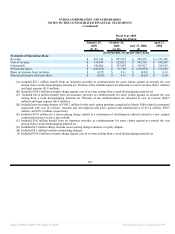

The tax effect of temporary differences that gives rise to significant portions of the deferred tax assets and liabilities are

presented below:

January 31,

2010

January 25,

2009

(In thousands)

Deferred tax assets:

Net operating loss carryforwards $ 33,955 $ 27,593

Accruals and reserves, not currently deductible for tax purposes 14,027 26,015

Property, equipment and intangible assets 35,282 23,935

Research and other tax credit carryforwards 193,528 123,620

Stock-based compensation 40,202 55,680

Gross deferred tax assets 316,994 256,843

Less: valuation allowance (113,442) (92,541)

Total deferred tax assets 203,552 164,302

Deferred tax liabilities:

Unremitted earnings of foreign subsidiaries (211,778) (223,223)

Net deferred tax asset (liability) $ (8,226) $ (58,921)

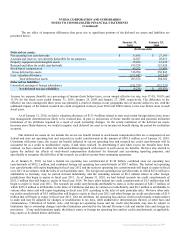

Income tax expense (benefit) as a percentage of income (loss) before taxes, or our annual effective tax rate, was 17.4%, 30.0% and

11.5% for the fiscal years ended January 31, 2010, January 25, 2009 and January 27, 2008, respectively. The difference in the

effective tax rates amongst the three years was primarily a result of changes in our geographic mix of income subject to tax, with the

additional impact of the federal research tax credit recognized in fiscal years 2010 and 2009 relative to the loss before taxes in such

fiscal years.

As of January 31, 2010, we had a valuation allowance of $113.4 million related to state and certain foreign deferred tax assets

that management determined not likely to be realized due, in part, to projections of future taxable income and potential utilization

limitations of tax attributes acquired as a result of stock ownership changes. To the extent realization of the deferred tax assets

becomes more-likely-than-not, we would recognize such deferred tax asset as an income tax benefit during the period the realization

occurred.

Our deferred tax assets do not include the excess tax benefit related to stock-based compensation that are a component of our

federal and state net operating loss and research tax credit carryforwards in the amount of $401.5 million as of January 31, 2010.

Consistent with prior years, the excess tax benefit reflected in our net operating loss and research tax credit carryforwards will be

accounted for as a credit to stockholders’ equity, if and when realized. In determining if and when excess tax benefits have been

realized, we have elected to utilize the with-and-without approach with respect to such excess tax benefits. We have also elected to

ignore the indirect tax effects of stock-based compensation deductions for financial and accounting reporting purposes, and

specifically to recognize the full effect of the research tax credit in income from continuing operations.

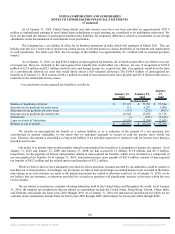

As of January 31, 2010, we had a federal net operating loss carryforward of $1.24 billion, combined state net operating loss

carryforwards of $852.3 million, and combined foreign net operating loss carryforwards of $59.7 million. The federal net operating

loss carryforwards will expire beginning in fiscal year 2012 and the state net operating loss carryforwards will begin to expire in fiscal

year 2011 in accordance with the rules of each particular state. The foreign net operating loss carryforwards, of which $53.4 million is

attributable to Germany, may be carried forward indefinitely, and the remaining amount of $6.3 million relates to other foreign

jurisdictions that begin to expire in fiscal year 2011. As of January 31, 2010, we had federal research tax credit carryforwards of

$251.2 million that will begin to expire in fiscal year 2018. We have other federal tax credit carryforwards of $1.3 million that will

begin to expire in fiscal year 2011. The research tax credit carryforwards attributable to states is in the amount of $241.7 million, of

which $233.4 million is attributable to the State of California and may be carried over indefinitely, and $8.3 million is attributable to

various other states and will expire beginning in fiscal year 2011 according to the rules of each particular state. We have other state

tax credit carryforwards of $5.5 million that will begin to expire in fiscal year 2011 and other foreign tax credit carryforwards of $1.9

million that will begin to expire in fiscal year 2013. Our tax attributes, net operating loss and tax credit carryforwards, remain subject

to audit and may be adjusted for changes or modification in tax laws, other authoritative interpretations thereof, or other facts and

circumstances. Utilization of federal, state, and foreign net operating losses and tax credit carryforwards may also be subject to

limitations due to ownership changes and other limitations provided by the Internal Revenue Code and similar state and foreign tax

provisions. If any such limitations apply, the federal, states, or foreign net operating loss and tax credit carryforwards, as applicable,

may expire or be denied before utilization.

Source: NVIDIA CORP, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠