NVIDIA 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Equivalents and Marketable Securities

Cash equivalents consist of financial instruments which are readily convertible into cash and have original maturities of three

months or less at the time of acquisition. Marketable securities consist primarily of highly liquid investments with maturities of

greater than three months when purchased. We generally classify our marketable securities at the date of acquisition as available- for-

sale. These securities are reported at fair value with the related unrealized gains and losses included in accumulated other

comprehensive income (loss), a component of stockholder’s equity, net of tax. Any unrealized losses which are considered to be

other-than-temporary impairments are recorded in the other income (expense) section of our consolidated statements of

operations. Realized gains (losses) on the sale of marketable securities are determined using the specific-identification method and

recorded in the other income (expense) section of our consolidated statements of operations. Please refer to Note 18 of the Notes to the

Consolidated Financial Statements in Part IV, Item 15 of this Form 10-K. We measure our cash equivalents and marketable securities

at fair value. The fair values of our financial assets and liabilities are determined using quoted market prices of identical assets or

quoted market prices of similar assets from active markets. Level 1 valuations are obtained from real-time quotes for transactions in

active exchange markets involving identical assets. Level 2 valuations are obtained from quoted market prices in active markets

involving similar assets. Level 3 valuations are based on unobservable inputs to the valuation methodology and include our own data

about assumptions market participants would use in pricing the asset or liability based on the best information available under the

circumstances. Each level of input has different levels of subjectivity and difficulty involved in determining fair value. While most of

our cash equivalents and marketable securities are valued based on Level 2 inputs, the valuation of our holdings of the Reserve

International Liquidity Fund, Ltd., or International Reserve Fund are classified as a Level 3 input due to the inherent subjectivity and

the significant judgment involved in its valuation. Total financial assets at fair value classified within Level 3 were 0.4% of total assets

on our Consolidated Balance Sheet as of January 31, 2010.

All of our available-for-sale investments are subject to a periodic impairment review. We record a charge to earnings when a

decline in fair value is significantly below cost basis and judged to be other-than-temporary, or have other indicators of

impairments. If the fair value of an available-for-sale debt instrument is less than its amortized cost basis, an other-than - temporary

impairment is triggered in circumstances where (1) we intend to sell the instrument, (2) it is more likely than not that we will be

required to sell the instrument before recovery of its amortized cost basis, or (3) a credit loss exists where we do not expect to recover

the entire amortized cost basis of the instrument. If we intend to sell or it is more likely than not that we will be required to sell the

available-for-sale debt instrument before recovery of its amortized cost basis, we recognize an other-than- temporary impairment in

earnings equal to the entire difference between the debt instruments’ amortized cost basis and its fair value. For available-for-sale

debt instruments that are considered other-than-temporarily impaired due to the existence of a credit loss, if we do not intend to sell

and it is more likely than not that we will be required to sell the instrument before recovery of its remaining amortized cost basis

(amortized cost basis less any current-period credit loss), we separate the amount of the impairment into the amount that is credit

related and the amount due to all other factors. The credit loss component is recognized in earnings.

Stock-based Compensation

Our stock-based compensation cost is measured at grant date, based on the fair value of the awards, and is recognized as expense over

the requisite employee service period.We recognize stock-based compensation expense using the straight-line attribution method. We

estimate the fair value of employee stock options on the date of grant using a binomial model and we use the closing trading price of

our common stock on the date of grant as the fair value of awards of restricted stock units, or RSUs. The determination of fair value

of share-based payment awards on the date of grant using an option-pricing model is affected by our stock price as well as

assumptions regarding a number of highly complex and subjective variables. These variables include, but are not limited to, the

expected stock price volatility over the term of the awards, actual and projected employee stock option exercise behaviors, vesting

schedules, death and disability probabilities, expected volatility and risk-free interest. Our management has determined that the use of

implied volatility is expected to be more reflective of market conditions and, therefore, can reasonably be expected to be a better

indicator of our expected volatility than historical volatility. The risk-free interest rate assumption is based upon observed interest

rates appropriate for the term of our employee stock options. The dividend yield assumption is based on the history and expectation of

dividend payouts. We began segregating options into groups for employees with relatively homogeneous exercise behavior in order to

calculate the best estimate of fair value using the binomial valuation model.

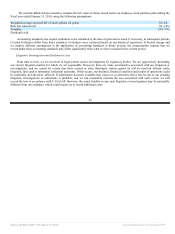

Using the binomial model, we estimated the fair value of the stock options granted under our stock option plans using the following

assumptions during the fiscal year ended January 31, 2010:

Weighted average expected life of stock options (in years) 3.7-5.8

Risk free interest rate 1.8% - 2.9%

Volatility 45% - 72%

Dividend yield -

44

Source: NVIDIA CORP, 10-K, March 18, 2010 Powered by Morningstar® Document Research℠