Mercedes 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Mercedes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

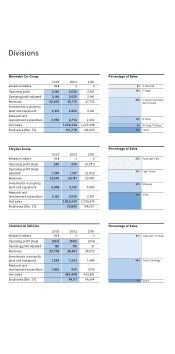

Significant earnings improvement due to measures

taken to improve competitiveness

In 2002, DaimlerChrysler achieved an operating profit

excluding one-time effects of 15.8 billion. Despite

difficult market conditions worldwide, this result is more

than four times as high as in 2001 (11.3 billion). The

significant improvement in earnings was primarily due

to the successful implementation of programs to

increase efficiency and improve competitiveness in all

business units, in particular at Chrysler Group and

Freightliner.

Operating profit including one-time effects was 16.9

billion, after an operating loss of 11.3 billion in 2001.

Positive one-time effects were reported totalling 12.6

billion. These include one-time gains as a result of the

sale of our 49.9% ownership interest in T-Systems ITS

(formerly debis Systemhaus) and of the sale of our 40%

stake in TEMIC. One-time expenses of 11.6 billion were

incurred at Chrysler Group in connection with the turn-

around plan announced in February 2001, as well as

at the Commercial Vehicles and Services divisions (see

pages 68-71).

Despite higher expenditure on the introduction of new

models and difficult market conditions, the contribution

to earnings of 13.0 billion made by the Mercedes Car

Group division slightly exceeded the high prior year’s

result. Chrysler Group again achieved a positive operat-

ing profit, 11.3 billion excluding and 10.6 billion includ-

ing one-time effects, reflecting in particular the positive

effects on profitability from the activities aimed at

cutting costs and improving efficiency. The moderate

increase in the Commercial Vehicles division’s operating

Business Review

8|Business Review

profit (adjusted to exclude one-time effects) over the

prior year’s result was partly the result of the progress

made at Freightliner and was achieved against the back-

drop of an unfavorable market situation. The Services

division succeeded in increasing its adjusted operating

profit due to more favorable refinancing conditions and

a lower risk-provisioning requirement in the financial-

services business. Other Activities contributed a total of

1747 million (2001: 1205 million) to the Group’s total

operating profit excluding one-time effects, reflecting in

particular the higher profit contribution from Mitsubishi

Motors (see pages 50-51). The MTU Aero Engines

business unit and EADS also made positive contributions

to DaimlerChrysler’s operating profit once again (see

pages 48-50).

Net income excluding one-time effects rose to 13.3

billion, after 10.7 billion in 2001 (net earnings per share

of 13.30 after earnings per share of 10.73 in 2001).

Including one-time effects, net income rose to 14.7

billion after a net loss of 10.7 billion in the prior year,

and earnings per share improved to 14.68 after a loss

per share of 10.66 in 2001.

Proposed higher dividend of 31.50

As a result of the significant improvement in earnings,

the Board of Management and the Supervisory Board

will propose to the shareholders at the Annual Meeting

that the dividend for 2002 is increased to 11.50 per

share (2001: 11.00). The total dividend distribution will

therefore increase from 11,003 million to 11,519

million.

No stimulus from the global economy

In the first half of 2002 there were still hopes of a global

economic upswing in the second half of the year.

Unfortunately this did not materialize. Although growth

in North America was a little stronger than in the weak

prior year, it was not strong and stable enough to deliver

any real stimulus to the world economy, and growth

rates in Western Europe remained at a low level. Japan’s

economic output declined once again in 2002, and

economic and financial crises led to recession in many

of the countries of South America. However, there were

above-average growth rates in the emerging markets of

Operating profit excluding one-time effects of 35.8 billion,

more than four times as high as in 2001 despite unfavorable

global economic backdrop |Continued high earnings

at Mercedes Car Group |Significantly improved efficiency at

Chrysler Group and Freightliner |Increased earnings at

Services |Net income of 34.7 billion again strongly positive

(2001: net loss of 30.7 billion); adjusted to exclude one-time

effects 53.3 billion (2001: 50.7 billion) |Proposed dividend

of 51.50 per share (2001: 51.00)