Marks and Spencer 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Marks and Spencer Group plc Annual report and financial statements 2012 02

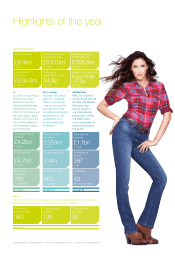

Interim dividend paid on

13 January 2012

6.2p per share

Final dividend to be paid

on 13 July 2012

10.8p per share

Total dividend for

2011/12

17.0 p per share

DIVIDEND

Chairman’s statement

“Our plan has

stood the test

of continued

evaluation and

debate.”

Robert Swannell

Chairman

My first full year as Chairman has been one of continued progress for M&S.

Our executive team has driven forward our business plans with consistency

and pace. The strategy, set out by Marc Bolland in November 2010, withstood

the test of continued evaluation by the Board. Despite challenging market

conditions that have put ongoing pressure on our customers’ budgets, we are

all agreed on our course. The key now is execution of our strategy to become

an international, multi-channel retailer.

As a Board, we have undertaken an

ordered transition towards our now

established governance structure.

We have in place a talented group of

individuals with a rich mix of experience.

We are unified by a shared ambition to

guide M&S to the very best future;

delivering sustainable growth as an

international, multi-channel retailer.

Performance and dividend

In a tough market, M&S has made

progress on a number of fronts, with

sales up 2%. Our results demonstrate

a good performance against our

strategic goals. We made important

improvements in our UK business –

enhancing our stores and products

and strengthening our brand.

Our Multi-channel business grew

ahead of the market and we saw

double digit growth in our priority

international markets.

We are committed to delivering

consistent returns to our shareholders.

We intend to pay a final dividend of

10.8p; in line with the dividend policy

set out last year.

Governance and the Board

Last year, I set three clear priorities for

the Board:

–First, to debate and agree the best

strategy for the Company and hold

the executive team accountable for

its execution;

–Second, to ensure we have the most

talented team to execute this strategy

and plan effectively for their succession;

–And finally, to set the tone of ‘doing

the right thing’, supported by the right

governance structures and their

effective implementation.

Over the last 12 months we maintained

our focus on these key aspects and will

continue to do so in the year ahead.

With implementation of our strategy

underway, the Board provided ongoing

enquiry and support to our executive

directors; ensuring they deliver the

business plan effectively and efficiently

in a difficult trading environment.

We looked carefully at our Board

composition, considering the skills

required to better inform our debate. We

recognised the need to strengthen our

consumer and international experience

and were therefore delighted to welcome

our two new non-executive directors;

Vindi Banga and Miranda Curtis, both of

whom have abundant expertise in these

fields. We will continue to ensure that we

have the right balance of skills as we

move forward.

Louise Patten and Sir David Michels

retired this year. I would like to thank

them both for their considerable

contributions to the Board and I must

pay particular tribute to David in his

roles as Deputy Chairman and Senior

Independent Director. I am delighted

that Jan du Plessis agreed to succeed

David as Senior Independent Director.

Having the right people in this business

is critical to our success. Over the last

12 months the Board has devoted more

time to ensuring we have the best team

to deliver the best results, not just today

but over the longer term.

As set out by Marc Bolland on page 14,

our executive directors are part of a

strong Management Committee, which

was further strengthened this year by the

arrival of Laura Wade-Gery as Executive