Marks and Spencer 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.marksandspencer.co m 7

Capital structure

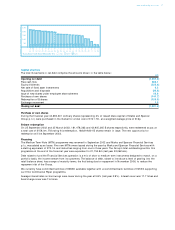

The total movements in net debt comprise the amounts shown in the table below: £m

Opening net debt (1,907.0)

Free cash flow 606.1

Equity dividends (225.4)

Net sale of fixed asset investments 4.3

Acquisitions and disposals (30.8)

Issue of new shares under employee share schemes 19.6

Purchase of own shares (141.7)

Redemption of B shares (158.0)

Exchange movement 1.5

Closing net debt (1,831.4)

Purchase of own shares

During the financial year 44,894,601 ordinary shares (representing 2% of issued share capital of Marks and Spencer

Group p.l.c.) were purchased in the market for a total cost of £141.7m, at a weighted average price of 316p.

B share redemption

On 25 September 2002 and 25 March 2003, 181,478,363 and 43,905,265 B shares respectively, were redeemed at par, at

a total cost of £158.0m. Following this redemption, 168,819,801 B shares remain in issue. The next opportunity for

redemption will be September 2003.

Financing

The Medium Term Note (MTN) programme was renewed in September 2002 and Marks and Spencer Financial Services

p.l.c. was added as an Issuer. Five new MTNs were issued during the year by Marks and Spencer Financial Services with

a sterling equivalent of £75.1m and maturities ranging from one to three years. The Group’s total outstandings within this

programme at the end of the financial year were equivalent to £1,754.8m (last year £2,062.6m).

Debt raised to fund the Financial Services operation is a mix of short to medium term instruments designed to match, on a

portfolio basis, the income stream from its customers. The balance of debt, raised to introduce a level of gearing into the

retail balance sheet, has a range of maturity terms, the first being due for repayment in November 2006, to reduce the

repayment risk of the Group.

We currently have committed facilities of £385m available together with uncommitted bank facilities of £455m supporting

our £1bn Commercial Paper programme.

Average interest rates on borrowings were lower during the year at 5.8% (last year 5.9%). Interest cover was 17.7 times and

fixed charge cover was 7.6 times.

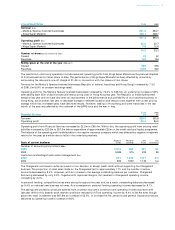

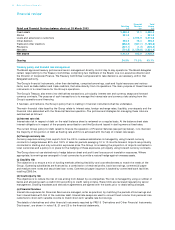

2,500

2,000

1,500

1,000

500

A

03 M

03 J

03 J

03 S

03 O

03 N

03 J

04 F

04 J

04 M

06 J

06 J

06 A

06 N

06 D

06 J

07 N

11 S

15

A

04 D

05 J

06

Cumulative UK Debt Maturity £m USD GBP EUR

D

26