Marks and Spencer 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8Marks and Spencer Gro up p.l.c.

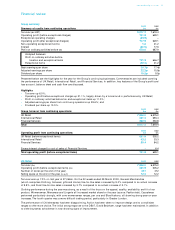

Financial review

Financial Total

Retailing Services Group

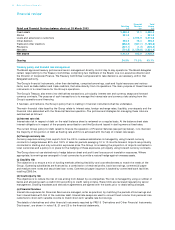

Retail and Financial Services balance sheets at 29 March 2003 £m £m £m

Fixed assets 3,455.5 11.1 3,466.6

Stocks 361.8 –361.8

Loans and advances to customers –2,015.9 2,015.9

Other debtors 363.2 76.3 439.5

Trade and other creditors (838.5) (347.1) (1,185.6)

Provisions (227.1) (1.3) (228.4)

Net debt (701.5) (1,129.9) (1,831.4)

Net assets 2,413.4 625.0 3,038.4

Gearing 24.3% 71.0% 43.1%

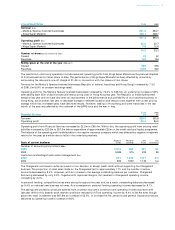

Treasury policy and financial risk management

The Board approves treasury policies and senior management directly control day-to-day operations. The Board delegates

certain responsibility to the Treasury Committee, comprising two members of the Board, one non-executive director and

the Director of Corporate Finance. The Treasury Committee is empowered to take decisions, as necessary, within that

delegated authority.

The Group’s financial instruments, other than derivatives, comprise borrowings, cash and liquid resources and various

items, such as trade debtors and trade creditors, that arise directly from its operations. The main purpose of these financial

instruments is to raise finance for the Group’s operations.

The Group’s Treasury also enters into derivatives transactions, principally interest rate and currency swaps and forward

currency contracts. The purpose of such transactions is to manage the interest rate and currency risks arising from the

Group’s operations and financing.

It has been, and remains, the Group’s policy that no trading in financial instruments shall be undertaken.

The main financial risks faced by the Group relate to interest rates, foreign exchange rates, liquidity, counterparty and the

financial risks associated with the Financial Services operation. The policies and strategies for managing these risks are

summarised as follows:

(a) Interest rate risk

Interest rate risk in respect of debt on the retail balance sheet is reviewed on a regular basis. At the balance sheet date

interest obligations in respect of the property securitisation and the Eurobond issued in sterling were at fixed rates.

The current Group policy for debt raised to finance the operation of Financial Services (see part (e) below), is to maintain

the majority of this portion of debt as floating rate and this is achieved with the help of interest rate swaps.

(b) Foreign currency risk

Currency exposure arising from exports from the UK to overseas subsidiaries is managed by using forward currency

contracts to hedge between 80% and 100% of sales for periods averaging 10 to 15 months forward. Imports are primarily

contracted in sterling and only economic exposures arise. The Group is increasing the proportion of imports contracted in

local currencies and a policy is in place for the hedging of these exposures, principally using forward currency contracts.

The Group does not use derivatives to hedge balance sheet and profit and loss account translation exposures. Where

appropriate, borrowings are arranged in local currencies to provide a natural hedge against overseas assets.

(c) Liquidity risk

The objective is to ensure a mix of funding methods offering flexibility and cost effectiveness to match the needs of the

Group. Operating subsidiaries are financed by a combination of retained profits, bank borrowings, commercial paper

and medium term notes and securitised loan notes. Commercial paper issuance is backed by committed bank facilities

totalling £385.0m.

(d) Counterparty risk

The objective is to reduce the risk of loss arising from default by counterparties. The risk is managed by using a number of

banks and allocating each a credit limit according to credit rating criteria. These limits are reviewed regularly by senior

management. Dealing mandates and derivative agreements are agreed with the banks prior to deals being arranged.

(e) Financial Services

Interest rate exposures for Financial Services are managed, as far as practical, by matching the periods of borrowings and

their interest basis with that of the customer debt. Interest rate swaps are used to convert fixed income from personal loan

customers to short-term variable income to match short-term variable rate borrowings.

The details of derivatives and other financial instruments required by FRS 13 ‘Derivatives and Other Financial Instruments:

Disclosures’, are shown in notes 18, 21 and 23 to the financial statements.