Marks and Spencer 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 Marks and Spencer Gro up p.l.c.

Remuneration report

3Pension figures for Alan McWalter reflect his service to 31 July 2002 when he ceased to be an employee.

4The pension entitlements and transfer values shown exclude any additional pension purchased by Additional Voluntary Contributions.

5Inflation has been assumed to be equivalent to the actual rate of price inflation which was 1.7% for the year to 30 September 2002. This

measurement date accords with the Listing Rules.

The accrued entitlement represents the deferred pension to which directors would have been entitled had they left the

Company at the end of March 2002 and 2003 respectively. Under the Listing Rules, the ‘additional pension earned’ is the

increase during the year net of inflation, and the transfer value relating to that increase is shown under the column headed

‘transfer value of additional pension’.

Under the Directors’ Remuneration Report Regulations the ‘additional pension earned’ relates to the difference between the

accumulated pension at the end of March 2002 and 2003. Also disclosed under the new regulations is the ‘transfer value’

of the accrued entitlement at the end of March 2002 and 2003. The ‘increase in transfer value’ is the difference between

these values and is therefore dependent on the change in stock market conditions over the course of the year.

The transfer value represents an obligation of the pension fund which could be paid to another pension scheme for the

benefit of the director. It is not a sum paid or due to the director.

Luc Vandevelde and Vittorio Radice do not participate in the Company Pension Scheme.

The Marks & Spencer Retirement Plan

Employees joining the Company on or after 1 April 2002 are, on completion of one year’s service, invited to join the new,

contributory Retirement Plan. The Plan is a defined contribution arrangement, where employees may choose to contribute

between 3% and 6% of their salary, and the Company will contribute between 6% and 12%. The employee is free to

choose, from a range of investment vehicles, where the total contribution will be invested.

During the one year waiting period before joining the Plan, the employees will be covered for death in service by a capital

payment of twice salary, increasing to four times salary from the date of joining the Plan, subject to the statutory earnings cap.

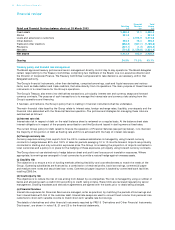

4 Payments to former directors

Details of payments made under the Early Retirement Plan and other payments made to former directors during the

year are: Paid in Paid in

2003 2002

£000 £000

Early retirement pensions1(payable until)

James Benfield (22 April 2009) 71 70

Lord Stone of Blackheath (7 September 2002) 47 93

Derek Hayes (19 November 2008) 66 65

Chris Littmoden (28 September 2003) 89 88

Keith Oates (3 July 2002) 59 174

Unfunded pensions

Clinton Silver289 88

Other

Robert Colvill319 177

Chris Littmoden –87

Sir David Sieff –13

1Under the Early Retirement Plan the Remuneration Committee could, at its discretion, offer an unfunded Early Retirement Pension, separate from

the Company pension, which was payable from the date of retirement to age 60. With effect from 31 March 2000, the Early Retirement Plan was

withdrawn but payments continue for awards made before this date.

2The pension scheme entitlement for Clinton Silver is supplemented by an additional, unfunded pension paid by the Company.

3Robert Colvill continued to receive a fee as non-executive chairman of Marks & Spencer Financial Services until 31 August 2002.

5 Directors’ interests in long-term incentive schemes

Share Option Schemes

The Company has operated Executive Option Schemes for over 20 years following shareholder approval for the first scheme

in 1977. The Remuneration Committee has imposed performance criteria for the exercise of all options granted since 1996

and the performance targets for outstanding options are described below:

2000 and 2002 Schemes

For options granted in 2001–03, the performance target is:

•earnings per share growth over three years of at least inflation plus an average of 3% per annum for 50% of each grant,

measured from a fixed base of 14.5p or the EPS figure for the year ending prior to grant if higher; and

•earnings per share growth over three years of inflation plus an average of 4% per annum for the other 50% of each

grant, measured from a fixed base of 16.5p or the EPS figure for the year ending prior to grant if higher.

Luc Vandevelde, Roger Holmes, Justin King, David Norgrove, Laurel Powers-Freeling, Vittorio Radice, Alison Reed and

Alan McWalter hold options under these schemes.