Marks and Spencer 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.marksandspencer.co m 13

Remuneration report

Strategy

The success of Marks & Spencer is dependant upon the skill and experience of motivated employees throughout all levels

of the business. It is part of our strategy to have a range of alternative rewards to attract, motivate and retain high calibre

individuals to drive the performance of the business and secure new paths for growth. The Board considers the principles

of good governance when deciding remuneration strategy. The type and level of remuneration and benefits we offer are key

to supporting this strategy and maintaining our market position as an employer of choice.

Remuneration Committee

The Committee comprises Dame Stella Rimington (Chairman), Brian Baldock and Jack Keenan all of whom are independent,

non-executive directors. Tony Ball was also a member of the Committee until he retired from the Board in September 2002.

The Committee recommends to the Board a reward framework to enable the Company to attract and retain its

executive directors and senior management, giving due regard to the financial and commercial health of the Company.

The Committee’s approach reflects the Company’s overall philosophy that all employees should be appropriately and

competitively rewarded, in particular for delivering superior performance which contributes to improved business results.

The Committee keeps itself fully informed of all relevant developments and best practice in the field of remuneration

and seeks advice where appropriate from external advisors. New Bridge Street Consultants have provided material advice

to the Committee on directors’ remuneration in the past year. They also provide advice to the Company in respect of

share schemes.

The Company Chairman, Chief Executive, Company Secretary and Head of Senior Remuneration also materially assisted the

Committee in its deliberations, except in relation to their own remuneration.

Remuneration policy

Total remuneration for executive directors comprises fixed pay, variable pay and benefits. Fixed pay and benefits are set

at around median levels when compared with retailers and FTSE 100 companies of similar size. Variable pay provides

the opportunity to earn greater amounts for superior performance. The performance-related element forms a significant

proportion of the total potential package. There are two components to variable pay: annual bonus and two long-term

incentives in the form of share options and participation in the Executive Share Matching Plan.

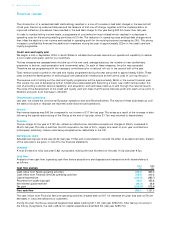

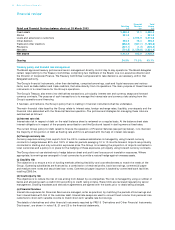

Approximate expected relative value of future annual remuneration package for full-time executive directors

Fixed Performance related

The value placed on long-term incentives is an estimate of the expected value of option grants and matching shares awarded under the

Executive Share Matching Plan based upon the Black-Scholes methodology. In addition to salary and performance pay, executive directors

receive benefits in kind as detailed in the emoluments table on page 16. The analysis excludes potential benefits from the pension scheme.

Following the Chairman’s change of status from full-time to part-time during the year, his remuneration package consists

of salary, annual bonus and benefits. He no longer participates in any share incentive schemes.

The remuneration for the non-executive directors is determined by the Chairman and executive directors and is designed

both to recognise the responsibilities of non-executive directors and to attract individuals with the necessary skills and

experience to contribute to the future growth of the Company. The non-executives are paid a basic fee with an additional fee

payable to the chair of the Remuneration Committee. Their fees are neither performance related nor pensionable. They do not

participate in any of the Company’s Share Schemes nor the Annual Bonus Scheme. The next review of fees is due in 2003.

Salaries and benefits

Salaries and benefits for executive directors are reviewed annually. Salaries are benchmarked against equivalent market

salaries for large retailers and for other FTSE 100 companies with a similar turnover and market capitalisation and are

currently set around the median point of the comparator groups. The salaries are set by the Committee after consideration

of the Company’s performance, market conditions, the level of increase awarded to employees throughout the business

and the need to reward individual performance. Consistent with his part-time status, the Chairman’s salary is pro-rated

accordingly. Current salaries for executive directors are set out in the Directors’ emoluments table on page 16.

Annual Bonus Scheme

The Annual Bonus Scheme is designed to reinforce the relationship between individual and corporate performance

and reward.

The targets are determined annually by the Committee and incorporate a mixture of financial measures and personal

business targets. The achievement of targets for all executive directors is assessed by the Committee, with the help and

advice of the Company Chairman.

The current bonus for executive directors starts at 40% of salary for on-target performance rising to a maximum of 100% for

exceeding targets.

Long-term incentives

30%

On-target annual bonus

20%

Salary

50%