Marks and Spencer 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Marks and Spencer Gro up p.l.c.

Remuneration report

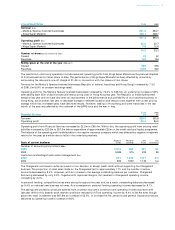

Long-term Incentive Schemes

(a) Executive Share Option Scheme

Executive Share Option Schemes, now open to approximately 400 senior management, have operated for over 20 years.

Under the current Scheme, annual awards of up to 150% of basic salary may be offered based on performance and

potential and, for exceptional performance and potential, grants of up to 250% of basic salary may be awarded.

Recruitment grants can be made up to 400% of salary.

The performance targets for the current Scheme are adjusted earnings per share growth, as disclosed in the financial

statements, measured from the most recent financial year ending prior to grant of at least:

•inflation plus an average of 3% per annum for 50% of each grant; and

•inflation plus an average of 4% per annum for the other 50% of each grant.

Performance targets are assessed over an initial three year period from the date of grant. If not met over the initial period,

the targets can be retested on two further occasions over the four and five year periods from the date of grant.

The performance conditions were chosen because they require significant improvement in the Company’s underlying

financial performance for options to become exercisable.

Since the 1996 Finance Act, grants of Inland Revenue Approved options have been limited to £30,000. Grants in excess

of this limit will be unapproved options, which confer no tax advantage on the participants.

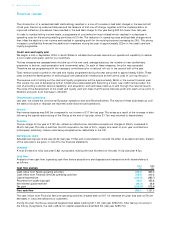

(b) Executive Share Matching Plan

An Executive Share Matching Plan for senior management was approved by shareholders at the AGM in 2002 and was

introduced for the first time in July 2002.

The Plan currently operates for approximately 25 selected members of senior management. Participants will be required

(other than in 2002 when participation was optional) to invest one-third, in shares in the Company, of any annual bonus

earned. Any part of the balance of any bonus may be invested voluntarily. In years where there is no bonus payable there

is no investment opportunity.

The pre-tax value of the invested bonus will be matched by an award of shares, with the extent of the match determined

by performance conditions. The current performance conditions are:

•50% of the invested bonus receives a matching award based on the Company’s Total Shareholder Return (‘TSR’)1

compared to the constituents of the FTSE 100 at the start of the performance period; and

•the other 50% of the invested bonus receives a matching award based on the Company’s TSR compared to a

comparator group of UK retailers at the start of the period:

Big Food Group House of Fraser New Look Tesco

Boots Kingfisher Next WH Smith

Debenhams Matalan Safeway Woolworths

Dixons MFI Sainsbury

GUS William Morrison Somerfield

Companies which have dropped out of either group by the end of the period would be included in the calculation if they

have been there for 50% or more of the period. If they have been there less than 50% they would be excluded from the

calculation.

At the end of the three year performance period2, the Company’s TSR performance is ranked against the two comparator

groups and the following matching ratios applied:

Ratio of Matching Award to relevant

TSR Performance Ranking in Group portion of Invested Bonus

Top Decile 2.5:1

Between Median and Top Decile Pro rata between 1:1 and 2.5:1

Median 1:1

Below Median Zero3

1TSR – the return to shareholders comprising the increase or decrease in the share price plus the value of dividends received assuming that they

are reinvested.

2The performance period for the plan will consist of three consecutive financial years. However, in the first year of the plan the three year

performance period started on the day after the results were announced (22 May 2002).

3Any element of bonus that is compulsorily invested in the Plan receives a minimum matching ratio of 0.25:1 irrespective of performance.

These performance conditions have been chosen because they are felt most closely to align the interests of senior

management with the interests of shareholders, by rewarding management for achieving superior relative total shareholder

return performance compared to direct competitors and the FTSE 100 as a whole.