Marks and Spencer 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.marksandspencer.co m 9

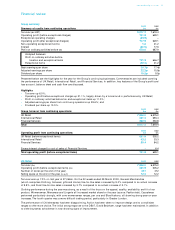

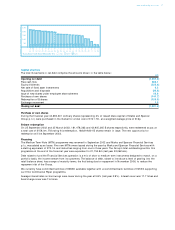

Pro-forma profit and loss account

The sale and leaseback transaction last year, which has increased property rental costs, and the return of capital to

shareholders which introduced a level of debt to the retail balance sheet, have had a significant effect on earnings in the

current year. If these transactions had occurred at the beginning of last year, then we estimate that our earnings from

continuing operations, but before exceptional items, for last year would have been as follows:

As Sale and Return of Pro-forma

reported leaseback capital earnings

Continuing operations before exceptional items £m £m £m £m

Operating profit629.1 (14.8) –614.3

Interest 17.6 –(66.6) (49.0)

Profit before tax 646.7 (14.8) (66.6) 565.3

Tax (195.1) 4.4 20.0 (170.7)

Profit after tax 451.6 (10.4) (46.6) 394.6

Adjusted earnings per share 15.9p 17.1p

Number of shares (m) 2,841 2,307

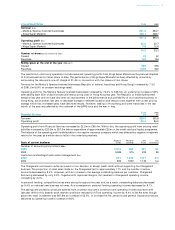

Accounting for pensions

We continue to account for pension costs under SSAP 24 and our UK pension cost for the year was £136m. Under FRS 17

this would have been £95m.

The actuary of the Group’s UK defined benefit pension scheme carried out a formal actuarial valuation of the scheme as at

31 March 2001. This valuation revealed a shortfall of £134m (£94m after deferred tax) in the market value of the assets of

£3,102m compared to the actuarial liability for pension benefits (a funding level of 96%). As a result, the contributions to

the scheme were increased to fund this deficit over 12 years.

Last year, the actuary prepared a valuation of the UK scheme as at 30 March 2002 in accordance with FRS 17. The FRS 17

valuation basis is a more volatile measure reflecting market values at a point in time. This valuation showed a deficit of

£400m (£280m after deferred tax). The actuary has updated this FRS 17 valuation as at 29 March 2003. The results of this

update reflect the poor performance of the financial markets during the year and show that the deficit has increased to

£1.2bn (£0.9bn after deferred tax). On this basis, the profit and loss account charge under FRS 17 in 2003/04 would

increase to £142m.

The pension scheme has a positive cash flow which is expected to continue for some time as the Group’s contribution to

the scheme, together with investment income, is greater than the annual payments to pensioners. It is therefore expected to

be many years before the defined benefit scheme needs to liquidate a material portion of scheme assets.

We recognise the importance of pension provision to our employees and we continue to review the long-term funding

strategy for the defined benefit scheme. As a result of the deterioration in the value of equities, we will bring forward the

next formal actuarial valuation planned for March 2004 to allow us to make an earlier informed decision as to contribution

level and asset mix going forward. We recognise this will require increased funding.

Outlook for 2003/04

We anticipate further improvement in the clothing primary margin (bought-in margin) of approximately 1 percentage point

for 2003/04 and a further 1 percentage point in each of the two subsequent years.

Underlying UK retailing operating costs, including logistics, for 2003/04 are planned to be held level on this year. However,

as a result of investment in growth initiatives, total UK retailing operating costs will increase by approximately 3%. These

incremental investment costs cover initiatives such as Simply Food, Home and marketing and system costs in UK Retail

associated with the loyalty elements of a national roll-out of the combined credit and loyalty card.

The revenue costs of the head office move to Paddington Basin will be approximately £25m to £30m, compared to £7.6m

incurred this year. These costs will be treated as exceptional.

The impact of a national roll-out of the combined credit and loyalty card will be to reduce Financial Services profits by

approximately £60m for the financial year 2003/04, compared to the £25m in 2002/03. This is in line with the guidance

given at the time of our Interim Results in November 2002.

The financial year incorporates a 53rd week. This will add £30m to £40m to full year profit before tax.

Group capital expenditure will be approximately £560m in 2003/04, compared to £311m this year. This is due to the

acquisition of the UK general merchandise warehouses owned by contractors (£100m), the head office move to Paddington

Basin (£45m), together with investment in the Simply Food roll-out and the Home business.

Going concern statement

After making enquiries, the directors have a reasonable expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason, they have adopted the going concern basis in preparing the

financial statements.