Marks and Spencer 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Marks and Spencer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual report

and financial statements

2003

Table of contents

-

Page 1

Annual report and ï¬nancial statements 2003 -

Page 2

... Financial Statement 2003, comprise the full Annual Report and Accounts of Marks and Spencer Group p.l.c. for 2003, prepared in accordance with the Companies Act 1985. 1 2 3 10 13 21 21 22 25 26 26 26 27 28 29 51 53 Chairman's me ssag e Chie f Exe cutive 's re vie w Financial re vie w Co rpo rate... -

Page 3

... in Home including the opening of our ï¬rst stand-alone store next spring and proceeding to the next stage of the programme prior to the national launch of our credit and loyalty card in Financial Services. These opportunities conï¬rm our view that we can widen the Marks & Spencer offering... -

Page 4

.../06. In Financial Services, we are very pleased with the progress of our credit and loyalty card pilot, and have started entering into the commitments necessary to enable a national roll-out in the second half of the year. In Home we will be unveiling our ï¬rst Home concept store 'Marks & Spencer... -

Page 5

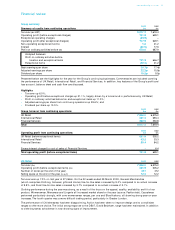

...• Proï¬t on ordinary activities before tax and exceptional items up 11.5%; • Adjusted earnings per share from continuing operations up 39.6%; and • Dividend per share up 10.5%. Group turnover from continuing operations UK Retail International Retail Financial Services 2003 £m 2002 £m 7,066... -

Page 6

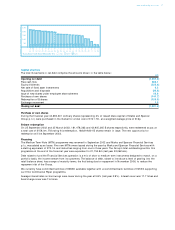

... up p.l.c. Financial review 15 2003 10 5 0 -5 14 weeks to 6 July 12 weeks to 28 Sept 15 weeks 11 weeks 52 weeks to 11 Jan to 29 March to 29 March 2002 £1,863m £1,776m UK Retail sales performance per quarter against last year % Clothing Home Food UK Retail operating costs £m Employee costs... -

Page 7

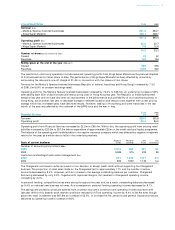

... by negative investment returns for the year as a whole due to falls in the underlying markets. Scale of current business Number of accounts/policy holders (000s) 2003 2002 Customer outstandings/funds under management 2003 2002 Account Cards Personal Lending Unit Trusts Life Assurance 5,016... -

Page 8

... of the credit and loyalty card will mean that Financial Services proï¬t will reach a low point in 2003/04 and grow from that base in 2004/05. Discontinued operations Last year, we closed the Continental European operations and sold Brooks Brothers. The results of these businesses up until... -

Page 9

...158.0m. Following this redemption, 168,819,801 B shares remain in issue. The next opportunity for redemption will be September 2003. Financing The Medium Term Note (MTN) programme was renewed in September 2002 and Marks and Spencer Financial Services p.l.c. was added as an Issuer. Five new MTNs were... -

Page 10

...help of interest rate swaps. (b) Foreign currency risk Currency exposure arising from exports from the UK to overseas subsidiaries is managed by using forward currency contracts to hedge between 80% and 100% of sales for periods averaging 10 to 15 months forward. Imports are primarily contracted in... -

Page 11

... increase by approximately 3%. These incremental investment costs cover initiatives such as Simply Food, Home and marketing and system costs in UK Retail associated with the loyalty elements of a national roll-out of the combined credit and loyalty card. The revenue costs of the head ofï¬ce move... -

Page 12

... on Group business. Key features of the corporate governance structure are: • As Chairman, Luc Vandevelde remains closely involved with the development of corporate strategy and is also Chairman of the Board of Marks and Spencer Financial Services and of the Board's corporate social responsibility... -

Page 13

... of the social, environmental and ethical impacts of the Group's activities. It is chaired by Luc Vandevelde, comprises main Board members (executive and non-executive) and senior management and meets formally three times per year. The Group's risk assessment process is applied to identify key CSR... -

Page 14

... reporting of accounting and legal developments to the Board; • review of treasury policies by the Treasury Committee with changes approved by the Board; and • review of social, environmental and ethical matters by the Corporate Social Responsibility Committee. Assurance On behalf of the Board... -

Page 15

... of the business and secure new paths for growth. The Board considers the principles of good governance when deciding remuneration strategy. The type and level of remuneration and beneï¬ts we offer are key to supporting this strategy and maintaining our market position as an employer of choice... -

Page 16

...Marks and Spe nce r Gro up p.l.c. Remuneration report Long-term Incentive Schemes (a) Executive Share Option Scheme Executive Share Option Schemes, now open to approximately 400 senior management, have operated for over 20 years. Under the current Scheme, annual awards of up to 150% of basic salary... -

Page 17

... later) should hold shares whose market value at that time is equivalent to or greater than their then current gross annual base salary. Service contracts All members of senior management have service contracts which can be terminated by the Company with 12 months' notice. Exceptions may exist where... -

Page 18

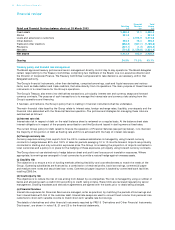

... financial year-ends. Marks & Spencer FTSE 100 Index Source: Datastream 1 Directors' emoluments Current annual salary/fee £000 Salary/fee £000 Beneï¬ts £000 Bonus £000 Termination payments £000 Total 2003 £000 Total 2002 £000 Chairman Luc Vandevelde Chief Executive Roger... -

Page 19

... Share Option Scheme with a market value at the date of employment of four times base salary (see Long Term Incentive Schemes). 3 Directors' pension information The M arks & Spencer Pension Scheme The executive directors, management and employees (except for staff employed by Marks & Spencer... -

Page 20

... Silver is supplemented by an additional, unfunded pension paid by the Company. 3 Robert Colvill continued to receive a fee as non-executive chairman of Marks & Spencer Financial Services until 31 August 2002. 5 Directors' interests in long-term incentive schemes Share Option Schemes The Company... -

Page 21

... by shareholders in 1987 and 1997. The Scheme is open to all employees, including executive directors, who have completed one year's service and who open an approved savings contract. Inland Revenue rules limit the maximum amount which can be saved to £250 per month. When the savings contract is... -

Page 22

...end of the ï¬nancial year was 289.25p; the highest and lowest share price during the ï¬nancial year were 423.0p and 262.5p respectively. 3 Executive Share M atching Plan Maximum potential number of matching shares1 Market price on award date Performance period for matching award Name of director... -

Page 23

... regarding employee share option schemes is given in note 10E. There have been no other changes in the directors' interests in shares or options granted by the Company and its subsidiaries between the end of the ï¬nancial year and one month prior to the notice of the Annual General Meeting. The... -

Page 24

...retail activities under the Marks & Spencer and Kings Super Markets brand names. Financial Services consists of the operations of the Group's retail ï¬nancial services companies, which provide account cards, personal loans, unit trust management, life assurance, personal insurance and pensions. The... -

Page 25

...and other legal obligations. The main trading company's (Marks and Spencer p.l.c.) policy concerning the payment of its trade creditors is as follows: • General merchandise is automatically paid for 11 working days from the end of the week of delivery; • Food is paid for 13 working days from the... -

Page 26

... the UK in support of the community. Within this ï¬gure, direct donations to charitable organisations amounted to £4.9m (last year £2.8m). At the Annual General Meeting in J uly 2002, shareholders authorised the Company, Marks and Spencer p.l.c. and Marks and Spencer Financial Services p.l.c. to... -

Page 27

... the corporate governance statement reï¬,ects the Company's compliance with the seven provisions of the Combined Code speciï¬ed for our review by the Listing Rules of the Financial Services Authority, and we report if it does not. We are not required to consider whether the Board's statements on... -

Page 28

... Consolidated statement of total recognised gains and losses Notes 52 weeks ended 29 M arch 2003 £m 52 weeks ended 30 March 2002 £m Proï¬t attributable to shareholders Exchange differences on foreign currency translation Unrealised (deï¬cit)/surplus on revaluation of investment properties... -

Page 29

... up share capital Share premium account Capital redemption reserve Revaluation reserve Other reserve Proï¬t and loss account Shareholders' funds (including non-equity interests) Minority interests (all equity) Total capital employed Equity shareholders' funds Non-equity shareholders' funds 24... -

Page 30

...ow statement Cash inï¬,ow from operating activities Dividend received from joint venture Notes 27 52 weeks ended 29 M arch 2003 £m 52 weeks ended 30 March 2002 £m 1,168.7 8.0 1,093.7 - Returns on investments and servicing of ï¬nance Interest received Interest paid Non-equity dividends paid... -

Page 31

... to customers outside the Group less returns, VAT and sales taxes, together with interest and other income attributable to the Financial Services operations. Operating leases Costs in respect of operating leases are charged on a straight line basis over the lease term. Pensions Funded pension plans... -

Page 32

... grossed up at the standard rate of corporation tax applicable to insurance companies. Derivative ï¬nancial instruments The Group uses derivative ï¬nancial instruments to manage its exposures to ï¬,uctuations in foreign currency exchange rates and interest rates. Derivative instruments utilised by... -

Page 33

...deducted in arriving at UK Retail operating proï¬t. Financial Services operating proï¬t is stated after charging £85.7m (last year £103.7m) of interest to cost of sales. This interest represents the cost of funding the Financial Services business as a separate segment, including both intra-group... -

Page 34

32 Marks and Spe nce r Gro up p.l.c. Notes to the ï¬nancial statements 3. Operating proï¬t Continuing1 Discontinued operations operations £m £m 2003 Total £m Continuing Discontinued operations operations £m £m 2002 Total £m Turnover Cost of sales Gross proï¬t Employee costs (see note 10)... -

Page 35

...: Bank loans, overdrafts and other borrowings Medium term notes Amounts repayable after ï¬ve years: Medium term notes (22.4) (70.8) (93.2) (43.8) (137.0) (38.0) (63.1) (101.1) (15.8) (116.9) 6. Taxation on ordinary activities A Taxation charge for the period £m 2003 £m £m 2002 £m Current... -

Page 36

... statements of the Company. 8. Dividends Dividends on equity shares Paid interim ordinary dividend of 4.0p per share (last year 3.7p per share) Proposed ï¬nal ordinary dividend of 6.5p per share (last year 5.8p per share) Total ordinary dividend of 10.5p per share (last year 9.5p per share) 2003... -

Page 37

... operations £m £m 2002 Total £m Wages and salaries Share Incentive Plan (see note 10D) Social security costs Pension costs (see note 11A) Employee welfare and other personnel costs Employee costs Classiï¬ed as: Employee costs (see note 3) Manufacturing cost of sales 835.1 8.8 47.7 144.8 79... -

Page 38

... 223p 156p 250p 283p F Executive Share Option Schemes Under the terms of the current Scheme, approved by shareholders in 2000, the Board may offer options to purchase ordinary shares in the Company to executive directors and senior employees at the market price on a date to be determined prior to... -

Page 39

...the UK deï¬ned beneï¬t pension scheme was carried out at 1 April 2001 by an independent actuary using the projected unit method. The key assumptions adopted were: % Inï¬,ation rate Rate of increase in pensions in payment Rate of increase in salaries Discount rate and rate of return on investments... -

Page 40

... actuaries in updating the most recent valuations of the UK and Republic of Ireland deï¬ned beneï¬t pension schemes to 29 March 2003 for FRS 17 purposes were: 2003 % 2002 % Rate of increase in salaries Rate of increase in pensions in payment Discount rate Inï¬,ation rate Long-term healthcare cost... -

Page 41

... Termination payments 6,838 451 5,987 398 B Transactions with directors During the year, transactions entered into by Marks and Spencer Financial Services p.l.c. with directors and connected persons resulted in the following outstanding balances on their combined credit and loyalty cards... -

Page 42

... land and buildings include investment properties as follows: Cost or valuation At 30 March 2002 Revaluation deï¬cit At 29 M arch 2003 The properties were valued as at 29 March 2003, by qualiï¬ed professional valuers working for the company of DTZ Debenham Tie Leung, Chartered Surveyors, acting in... -

Page 43

...employee trusts. The shares held in the QUEST have now been issued to employees; there were no shares held in the QUEST at 29 March 2003. Company Shares in group undertakings £m At 29 M arch 2003 At 30 March 2002 Shares in group undertakings represents the Company's investment in Marks and Spencer... -

Page 44

... Card Services Limited Marks and Spencer Retail Financial Services Holdings Limited Marks and Spencer Financial Services p.l.c. Marks and Spencer Unit Trust Management Limited Marks and Spencer Savings and Investments Limited Marks and Spencer Life Assurance Limited MS Insurance Limited St Michael... -

Page 45

...Weighted average period for which rate is ï¬xed Years Sterling US dollar Euro Other 5.6 3.8 4.8 2.6 6.0 6.0 5.1 3.8 10.1 9.5 8.9 6.6 9.0 11.1 13.6 11.3 Group C Analysis of ï¬nancial assets 2003 £m 2002 £m Cash at bank and in hand Current asset investments Customer advances falling due in... -

Page 46

44 Marks and Spe nce r Gro up p.l.c. Notes to the ï¬nancial statements 19. Creditors: amounts falling due within one year 2003 £m Group 2002 £m Company 2003 £m 2002 £m Bank loans, overdrafts and commercial paper Medium term notes (see note 21B) Securitised loan notes Trade creditors ... -

Page 47

...'s subsidy of the Marks & Spencer Health Insurance Scheme, in so far as it relates to private medical beneï¬ts for retired employees and their dependants, for whom the Group meets the whole, or part, of the cost (see note 10C for further details). 2 The provision for UK restructuring costs relates... -

Page 48

... 2.1 1.3 Current asset investments and cash at bank are predominantly short-term deposits placed with banks, ï¬nancial institutions and on money markets, and investments in short-term securities. Borrowings are predominantly at ï¬,oating rates. Therefore, these fair values closely approximate book... -

Page 49

... by the Marks and Spencer p.l.c. Qualifying Employee Share Ownership Trust (the 'QUEST') at market value of £11.9m. All of these shares were allocated to employees, including executive directors, in satisfaction of options exercised under the Marks and Spencer United Kingdom Employees' Save As You... -

Page 50

... activities 2003 £m Group 2002 £m Operating proï¬t Exceptional operating charges (see note 4A) Operating proï¬t before exceptional charges Utilisation of provision against European trading losses Depreciation (Increase)/decrease in stocks Decrease in customer advances Decrease/(increase... -

Page 51

... statement Liquid resources: Deposits included in cash (see above) Current asset investments (see note 16) Liquid resources per cash ï¬,ow statement Debt ï¬nancing: Bank loans, overdrafts and commercial paper treated as ï¬nancing (see above) Medium term notes (see note 21B) Securitised loan notes... -

Page 52

... - 3.0 31. Foreign exchange rates The principal foreign exchange rates used in the ï¬nancial statements are as follows (local currency equivalent of £1): Sales average rate Proï¬t average rate Balance sheet rate 2003 2002 2003 2002 2003 2002 Euro US dollar Hong Kong dollar 1.56 1.55 12... -

Page 53

... nce r.co m 51 Group ï¬nancial record 2003 £m 52 weeks 2002 £m 52 weeks 2001 £m 52 weeks 2000 £m 53 weeks 1999 £m 52 weeks Proï¬t and loss account 1 Turnover: Continuing operations General Foods Retailing Financial Services Total continuing operations Discontinued operations 4,205.3 3,542... -

Page 54

...venture Returns on investments and servicing of ï¬nance Taxation Capital expenditure and ï¬nancial investment Acquisitions and disposals Equity dividends paid Cash inï¬,ow/ (outï¬,ow) before management of liquid resources and ï¬nancing Management of liquid resources Financing (Decrease)/ increase... -

Page 55

... Cash ï¬,ow statement Chairman's message Charitable donations Chief Executive's review Contingent liabilities Corporate governance Cost of sales Creditors Currency risk Customer balances D 47, 48 6 27 4 7, 45 Design and production: Paufï¬,ey Printing: St Ives, Westerham Press Cover printed on... -

Page 56

THE QUEEN'S AWARD FOR ENTERPRISE INNOVATION 2000 THE QUEEN'S AWARD FOR ENTERPRISE INNOVATION 2003 Additional copies of this document and the Annual Review and Summary Financial Statement 2003, the CSR Review or an audio tape giving highlights can be obtained by calling 0800 591 697