LeapFrog 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 LeapFrog annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

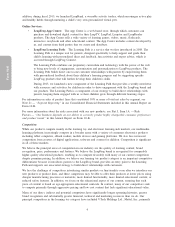

Our seasonal net sales patterns for the years ended March 31, 2015, 2014 and 2013 are shown in the

table below:

Years Ended March 31,

2015 2014 2013

Percent of total net sales:

Quarter ended June 30 ....................... 14% 16% 12%

Quarter ended September 30 ................... 33% 38% 33%

Quarter ended December 31 ................... 43% 35% 41%

Quarter ended March 31 ...................... 10% 11% 14%

Total ................................... 100% 100% 100%

Seasonal purchasing patterns and their related production lead times create risk in our business due to possible

under-production of popular items or over-production of items that do not match consumer demand. In

addition, our retail customers continue to manage their inventories stringently, requiring us to ship products

close to the time of expected consumer demand. For more information about the effects of seasonality on our

business see Part I, Item 1A. — Risk Factors — ‘‘Our business is highly seasonal, and our annual operating

results depend, in large part, on sales relating to the brief holiday season.’’

Financial Information about Geographic Areas

Financial information regarding U.S. sales and operations versus international sales and operations is included

in Note 21 — ‘‘Segment Reporting’’ in our Consolidated Financial Statements included in this Annual Report

on Form 10-K. For information regarding risks associated with our foreign operations upon which our

international segment depends, see Part I, Item 1A. — Risk Factors — ‘‘We face risks associated with

international operations.’’

Employees

As of March 31, 2015, we employed 524 people on a full-time basis as compared to 587 as of March 31,

2014. The decrease is primarily due to the restructuring plan we implemented in February 2015 to reduce

our global workforce in an effort to streamline our operations and reduce our cost structure. We also retain

independent contractors to provide various services. Except with respect to some of our foreign subsidiaries,

we are not subject to any collective bargaining agreements. Some of our foreign subsidiaries are subject to

collective bargaining agreements whose benefits and terms are codified and required under local labor laws.

We believe that our relationship with our employees is good.

Executive Officers of the Registrant

The following table sets forth information with respect to our executive officers as of May 31, 2015:

Name Age Position Held

John Barbour 56 Chief Executive Officer

Raymond L. Arthur 56 Chief Financial Officer

Gregory B. Ahearn 48 Executive Vice President and Chief Marketing Officer

Kenneth A. Adams 59 Senior Vice President of Sales

Antony Hicks 43 Chief International Officer

John Barbour has served as our Chief Executive Officer and as a board member since March 2011. Prior to

joining LeapFrog, he served as President of the GameHouse Division of RealNetworks, Inc., a digital media

company, from October 2008 to August 2010. From October 2006 to October 2008, Mr. Barbour served as the

Managing Partner of Volta Capital, LLC, a strategy and investment consulting firm. From 1999 to June 2006,

Mr. Barbour was employed by Toys ‘‘R’’ Us, Inc., a leading retailer of children’s toys and products. He served

as President of Toys ‘‘R’’ Us U.S. from August 2004 to June 2006. Prior to that, he served as President of

Toys ‘‘R’’ Us International and Chairman of Toys ‘‘R’’ Us Japan from February 2002 to August 2004. From

1999 to 2002, Mr. Barbour served as President and Chief Executive Officer of toysrus.com, a subsidiary of

Toys ‘‘R’’ Us, Inc. Mr. Barbour has also held senior-level positions with Hasbro, Inc., OddzOn Products, Inc.,

8