JVC 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 JVC KENWOOD Holdings, Inc.

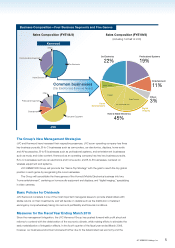

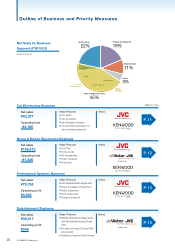

Overview of Business Segments and Priority Measures

Home & Mobile Electronics Business

In the display business of the home entertainment business, which faces profitability

issues, the Group restructured its global production, reformed sales systems in the

Americas and Europe, reviewed domestic production and sales structures in response to

substantial business downsizing in Japan, and reorganized systems for logistics and

services. We also improved earnings by reducing in-house development and production

of consumer LCD TVs for overseas markets through the use of outsourcing, ODM*1 and

EMS*2, and shifted development resources to sectors where businesses such as next-

generation displays are fostered. Going forward, we are accelerating our business expansion

into the professional market with the introduction of the industry’s thinnest*3 (6.4mm*4)

and lightest weight*3 (5.7kg) professional LCD monitors and professional 3D LCD monitors

into domestic and international markets with the goal of enhancing our product lineup by

leveraging our strengths.

In the home audio business, the Group endeavored to improve earnings through

structural reforms of both companies. We also integrated the planning, engineering,

marketing, quality assurance, production and other functions of both companies’ audio

business, excluding the domestic and overseas sales functions, into JVC on July 1,

2009, aiming for new growth through further strengthening of our competitiveness and

improvement of our presence in the global market. We are capitalizing on the integration

effects at the earliest possible time by making the maximum use of both companies’

brands, products and technologies, and increasing our competitiveness by reducing

costs. In addition, we are continuing to further enhance sales of profitable AV accessories.

Based on these measures, we are making existing businesses profitable by utilizing

the accumulated visual and audio technologies of both companies in the home

entertainment market, and making these businesses more profitable by creating new

genre products and strengthening the B-to-B business.

*1. ODM (original design manufacturing: production outsourcing from the design phase onward)

*2. EMS (electronics manufacturing service)

*3. As of June 8, 2009: as 32-LCD displays

*4. At the thinnest section: the depth between the LCD panel surface and the rear of the cabinet

Home Entertainment

Thinnest*3 (6.4mm*4) and lightest weight*3 (5.7kg)

32” Class Full HD LCD Display

Used wood, an ideal material for use

as a vibration board DVD/CD Woodcone

Speakers Micro System

Kseries, a compact Hi-Fi system making full

use of the audio-quality technology that has

been developed over the years

Consumers can enjoy color coordinating with a

digital audio player or fashion items Gumy

earbud headphones

The Home & Mobile Electronics business consists of the home entertainment business, which

includes LCD TVs and home audio systems, and the digital imaging business, which encompasses

video cameras and D-ILA projectors based on proprietarily-developed optical devices.

Home & Mobile Electronics

Business

FYE’09/9 (Millions of yen)

Net sales ¥105,413

Operating loss -¥1,346

Home Entertainment

Major Products

n LCD TVs

n Home Audio

n AV Accessories

Brand

(Japan only)