Ingram Micro 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Joe B. Wyatt Director since October 1996

Mr. Wyatt, age 72, has been Chancellor Emeritus of Vanderbilt University in Nashville, Tennessee, since his

retirement as Chancellor of Vanderbilt University, a position that he held from 1982 to 2000. Mr. Wyatt has

also been a principal of The Washington Advisory Group since August 2000. Mr. Wyatt was previously a

Director of Ingram Industries from April 1990 through October 1996. Mr. Wyatt is a Director of El Paso

Corporation and Hercules Incorporated. He also serves as Chairman of the Universities Research Association.

Martha R. Ingram is the mother of John R. Ingram and Orrin H. Ingram II. There are no other family

relationships among our directors or executive officers.

BOARD OF DIRECTORS

The Board of Directors held 7 meetings during fiscal year 2007. All directors attended more than 75% of the

total number of meetings of the Board and the committees on which he or she served in 2007. The Board and its

committees regularly hold executive sessions of non-management directors without management present. As a

matter of policy, directors are encouraged and expected to attend the annual meeting of shareholders. All directors,

with the exception of Howard Atkins, attended Ingram Micro’s 2007 annual meeting of shareholders.

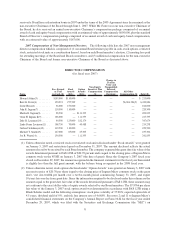

Compensation of Board of Directors

Ingram Micro pays directors who are not employed by the Company (“non-management directors”) (1) an

annual retainer award of cash, stock options and restricted stock/restricted stock units with an estimated value of

$180,000 for Board members who do not chair a committee, $195,000 for chairs of Board committees other than the

Audit Committee, and $200,000 for the Audit Committee Chair, and (2) meeting fees for attending meetings of the

Board.

Annual Retainer Award. The mix of cash, stock options and restricted stock/restricted stock units for the

annual retainer award must be selected by each non-management director prior to December 31 of each year or

promptly upon initial election to the Board, as the case may be. The award is pro rated for partial year service. The

mix of cash, stock options and restricted stock/restricted stock units for the annual retainer award is subject to the

following assumptions and restrictions:

•Cash. If cash is selected as a component of compensation, the amount that may be selected ranges from $0

to $70,000. Committee chairs are paid a minimum of $15,000 cash and may elect a maximum amount of

$85,000. The Audit Committee Chair is paid a minimum of $20,000 in cash and may elect a maximum of

$90,000. Board members are allowed to defer 100% of their cash compensation in accordance with

Section 409A of the Internal Revenue Code of 1986 (the “Code”) and Department of Treasury regulations

and other interpretive guidance issue thereunder.

•Equity-based Compensation. Equity-based compensation must be selected as a component of compen-

sation. The equity-based compensation may consist of stock options, restricted stock/restricted stock units or

a combination thereof and must have a value of at least $110,000. The sum of the cash retainer and the value

of the equity-based compensation selected may not exceed $180,000 ($195,000 for Committee Chairs and

$200,000 for the Audit Committee Chair).

•Stock Options. Options are granted as non-qualified stock options at the time of the annual stock option

grant made to our management each year (the first trading day in January) (the “management grant date”).

For 2007 awards, the number of options to be granted was based on the dollar value of the amount of stock

options selected, divided by the value per share of the Company’s stock options, rounded up to the next

whole share. The value per share was determined in accordance with Statement of Financial Accounting

Standards No. 123R (“FAS 123R”). The options have an exercise price equal to the closing price of our

common stock on the New York Stock Exchange (the “NYSE”) on the date of grant, vest one-twelfth per

month and have a term of ten years less one day.

•Restricted Stock/Restricted Stock Units. Restricted stock/restricted stock units are also granted on the

management grant date. The number of shares granted are equal to the dollar value of the amount of

6