Ingram Micro 2007 Annual Report Download - page 16

Download and view the complete annual report

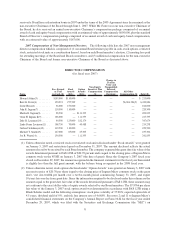

Please find page 16 of the 2007 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(9) Board member access to management and independent advisors; (10) director compensation; (11) director

orientation and continuing education; (12) management evaluation and management succession; and (13) annual

performance evaluation of the effectiveness of the Board and its committees.

Our Board expects to consider further amendments to the Guidelines from time to time as rules and standards

are revised and/or finalized by various regulatory agencies, including the SEC and the NYSE, and to address any

changes in our operations, organization or environment.

Independence Determination for Directors

The Board of Directors adopted director independence standards as part of the Guidelines. Pursuant to the

Guidelines, the Board undertook its annual review of director independence in March 2008. During this review, the

Board considered any transactions and relationships between each director or any member of his or her immediate

family and the Company and its subsidiaries and affiliates, including holdings of stock of the Company by Martha,

John and Orrin Ingram and certain arms-length commercial relationships between Ingram Micro and Wells Fargo

(where Mr. Atkins serves as Chief Financial Officer), which are immaterial in amount and nature to both Wells

Fargo and Ingram Micro and did not create conflicts of interests under Ingram Micro’s Code of Conduct, relating to

(i) a sublease between Ingram Micro Canada and a Wells Fargo subsidiary in Canada and (ii) ordinary course lease

financing provided by a Wells Fargo finance subsidiary to certain of Ingram Micro’s end-user customers pursuant to

which Ingram Micro US receives immaterial customary referral fees. The Board also considered Ms. Heisz’s

position as a managing director at Lazard Freres & Co. and the ownership of Ingram Micro common stock by

Lazard Asset Management LLC, together with Ms. Heisz’s representation that she had no investment authority, or

decision making responsibility, with respect to Lazard Asset Management LLC’s position in Ingram Micro

common stock.

The purpose of this review was to determine whether any such relationships or transactions were inconsistent

with a determination that the director is independent.

As a result of this review, the Board determined that all of the directors nominated for election at the annual

meeting, as well as all other directors serving on the Board are independent of the Company and its management

under the standards set forth in the Guidelines, as well as under Audit Committee independence requirements of the

SEC and the NYSE, with the exception of Gregory Spierkel. Mr. Spierkel is considered an inside director because of

his current employment as a senior executive of the Company. All of the members of the Human Resources, Audit

and Governance Committees are independent.

Audit Committee Financial Qualifications

Our Board of Directors has determined that each member of the Audit Committee: (1) meets the independence

criteria prescribed by applicable law and rules of the SEC for Audit Committee membership and (2) is an

“independent director” within the meaning of NYSE listing standards and the standards established by the

Company. Each member of the Audit Committee also meets the NYSE’s financial literacy requirements. No

member of our Audit Committee serves on more than three audit committees of public corporations.

In addition, the Board of Directors has designated each of Michael Smith and Leslie Heisz as an “audit

committee financial expert” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the

SEC. The Board has also determined that they meet the NYSE’s accounting or related financial management

expertise requirements through experience gained, for Mr. Smith, in previous positions as former Chairman of the

Board and Chief Executive Officer of Hughes Electronics Corporation, Vice Chairman of Hughes Electronics and

Chairman of Hughes Aircraft Company, as Senior Vice President and Chief Financial Officer of Hughes

Electronics, and in nearly 20 years with General Motors Corporation in a variety of financial management

positions; and for Ms. Heisz, as an experienced investment banking and finance executive, and currently as a

managing director of the Los Angeles office of Lazard Freres & Co., where she provides strategic advisory services

for clients in a variety of industries.

13