Ingram Micro 2007 Annual Report Download - page 13

Download and view the complete annual report

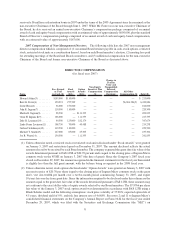

Please find page 13 of the 2007 Ingram Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.stock on the day of grant was $21.60. In addition, Dr. Laurance attended 22 meetings in 2007 where he was

entitled to earn meeting fees in the sum of $33,000. Dr. Laurance deferred receipt of all of his cash

compensation and restricted stock units until his retirement from the Board.

(11) Ms. Fayne Levinson was eligible to receive annual Board compensation in the amount of $180,000, of which

she elected $70,000 in cash, $40,000 in stock options and $70,000 in restricted stock units. When Ms. Fayne

Levinson was elected to serve as Chair of the Human Resources Committee on June 6, 2007, she was eligible

to receive an additional $8,750 in cash. The cash portion of Ms. Levinson’s annual Board compensation was

paid in four quarterly installments. In addition, Ms. Levinson attended 20 meetings in 2007 and was paid

$30,000 in meeting fees. Ms. Fayne Levinson elected to defer receipt of her restricted stock units until

December 31, 2009.

(12) Mr. Schulmeyer was eligible to receive annual Board compensation in the amount of $195,000 ($15,000 more

than non-chair Board members due to his service as Chair of the Executive and Finance Committee).

Mr. Schulmeyer elected to receive $85,000 in cash and $110,000 in restricted stock units. The cash portion was

paid in four equal quarterly installments. In addition, Mr. Schulmeyer attended 23 meetings in 2007 and was

paid $34,500 in meeting fees. Mr. Schulmeyer deferred receipt of his restricted stock units until he retires from

the Board.

(13) Mr. Smith was eligible to receive annual Board compensation in the amount of $195,000 ($15,000 more than

non-chair Board members due to his service as Chair of the Human Resources Committee through June 6,

2007 and as Chair of the Governance Committee since June 6, 2007). Mr. Smith elected to receive $85,000 in

cash, $25,000 in stock options and $85,000 in restricted stock. In addition, Mr. Smith attended 28 meetings in

2007 and was paid $42,000 in meeting fees. Mr. Smith deferred receipt of all of his cash compensation until he

retires from the Board.

(14) Mr. Wyatt was eligible to receive annual Board compensation in the amount of $200,000 ($20,000 more than

non-chair Board members due to his service as Chair of the Audit Committee). Mr. Wyatt elected to receive

$90,000 in cash and $110,000 in stock options. The cash portion was paid in four equal quarterly installments.

In addition, Mr. Wyatt attended 27 meetings in 2007 and was paid $40,500 in meeting fees.

Stock Ownership Requirement. Each director is required to achieve and maintain ownership of at least

15,000 shares of our common stock (with vested but unexercised stock options counted as owned shares) beginning

five years from the date of his or her election to the Board. All current directors, with the exception of Ms. Heisz,

who was elected as director effective March 1, 2007, meet this stock ownership requirement. Each director is also

reimbursed for expenses incurred in attending meetings of the Board and Board committees. Each director is also

able to elect to defer his or her cash compensation through a non-qualified deferral plan. Directors who defer cash

compensation may elect to have earnings, or losses, credited to their deferrals as if their deferrals were invested in

the various investment options available under the Company’s Supplemental Investment Savings Plan, a non-

qualified deferred compensation plan. Directors are not credited with “above-market” or “preferential” interest.

10