Goldman Sachs 2004 Annual Report Download - page 8

Download and view the complete annual report

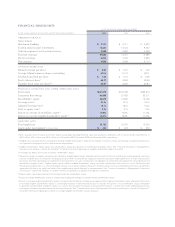

Please find page 8 of the 2004 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Of course, committing capital requires us to take risk. We

believe our willingness to take meaningful risk for appropriate

reward is one of the distinguishing features of our firm. It is

what places risk management at the center of our core

competencies. One measure of our market risk-taking is

Value-at-Risk (VaR), a statistical measure of potential loss in

the value of our trading positions over a defined time horizon

with a specified level of confidence. In 2004, our average daily

VaR was $67 million, 16% higher than the $58 million

average in 2003. During the year, the components of VaR,

which include risks related to interest rates, equity prices,

currencies and commodities, varied significantly. This

illustrates the extent to which we dynamically allocate risk

capital to take advantage of perceived opportunities.

As we have said before, VaR is only one risk management

tool. It does not capture worst case outcomes, and we

continue to use scenario analyses, stress testing and other

analytical tools as key components of our risk management

discipline. In addition, we constantly analyze imbalances

in global markets which may affect our clients and our firm.

For example, in the past year many have commented on

unprecedented global liquidity, narrow credit spreads and the

rapid pace of hedge fund formation. We monitor these risks

carefully, although we believe that hedge funds and credit

products as asset classes will continue to grow over time.

Competition in our businesses continues to be intense.

A few years ago, many thought that there would be significant

consolidation in our industry, with weaker players being

acquired by larger firms trying to enter the investment banking

and securities business. Instead, large and well-funded

competitors have been growing their presence organically,

adding to excess capacity in many areas. Notwithstanding

their efforts, we are pleased with our competitive strength

and breadth across our core businesses.

Many of our competitors are much larger and conduct a

wider range of businesses than we do. We do not view the size

of our firm as a disadvantage, because we have never been

constrained by a lack of capital. Furthermore, in most of the

businesses in which we compete, we are at least as large as

any other competitor. We view our focus as an advantage that

helps us attract high-quality people who share our culture of

teamwork and serving our clients through excellence.

We believe that the experience of the last few years

supports our judgment that size and diversification by

themselves are not the universal advantages that many have

believed them to be. In our view, many of the synergies

sought in the combination of disparate businesses are difficult

to achieve. Just as important, managing and controlling a

wide array of global businesses is likely to prove even more

challenging in an environment of increasing regulatory

scrutiny. We think our focused business model has served us

well, and that was particularly evident in our performance

relative to our key competitors in 2004.

Our greatest challenge is to continue to execute to the

highest standard as we grow larger. As always, the most

important factor will be our ability to recruit and retain

talented people and preserve our distinctive culture of

teamwork. In this effort, we face competition both from

traditional firms and from private pools of capital such

as hedge funds and private equity businesses. But in a

challenging environment, we are pleased with our success in

keeping our team together. We believe that our partnership

culture has played a vital role in maintaining our position as

an employer of choice in our industry.

BusinessPractices

The financial services industry continues to be subject

to intense regulatory scrutiny. Contrary to what many

had predicted and some may still think, the scope of this

scrutiny has continued unabated in the last year. We

accept this scrutiny as an ongoing part of our business, and

are working very hard to maintain the highest standards

in our business practices.

One significant part of our response was the establishment

of the firm’s Business Practices Committee more than a year

ago. The Business Practices Committee, which evolved from

our Global Compliance and Control Committee, is part

of our continuing effort to reinforce the firm’s culture of

integrity and our commitment to excellence in compliance

and reputational judgment. In addition to oversight of

compliance and operational risks, the committee reviews the

firm’s policies and procedures for consistency with our

business principles as well as regulatory requirements. The

committee’s oversight is intended to mitigate potential risks

and to ensure full adherence to our business principles. Some

of the firm’s most senior leaders are members of the committee,

including our President, Vice Chairs and other Managing

Directors (MD) engaged in our core businesses and risk

management functions.

At Goldman Sachs, we have always considered our assets

to be our people, our capital and our reputation, the last being

the most difficult to restore if ever lost. When we look back to

the late 1990s, we wish that we had differentiated ourselves

more positively than we did. While we cannot remedy past

errors of judgment, we know that we must learn from them.

Over the last three years, we have implemented a firmwide

program of Compliance and Reputational Judgment training

to reinforce our compliance culture. In 2005, as part of our

continuing efforts, we will be hosting a Chairman’s Forum

which will include every MD of the firm. This will involve us

in more than 20 meetings with small groups of our MDs at

which we will discuss at length business practices, reputational

judgment and compliance leadership. We will emphasize to

all our MDs that our highest priority is to enhance our

reputation for integrity in every aspect of our business.

Business conflicts continue to be a particularly important

area of focus for us. How we identify, disclose and manage

real and apparent conflicts of interest will be critical to

the long-term success of our business. We operate with the

knowledge that what many may have considered acceptable

6GOLDMAN S A C H S 2 0 0 4ANNU A L R E P O RT

6GOLDMAN S A C H S 2 0 0 4ANNU A L R E P O RT