Goldman Sachs 2004 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2004 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

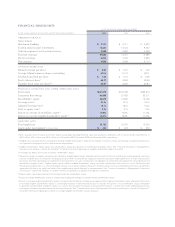

financialhighlights

ASOFORFORTHEYEARENDEDNOVEMBER

($ANDSHAREAMOUNTSINMILLIONS,EXCEPTPERSHAREAMOUNTS) 2004 2003 2002

operatingresults

Net revenues

Investment banking $ 3,374 $ 2,711 $ 2,830

Trading and principal investments 13,327 10,443 8,647

Asset management and securities services 3,849 2,858 2,509

Total net revenues 20,550 16,012 13,986

Pre-tax earnings 6,676 4,445 3,253

Net earnings 4,553 3,005 2,114

commonsharedata

Diluted earnings per share $ 8.92 $ 5.87 $ 4.03

Average diluted common shares outstanding 510.5511.9 525.1

Dividends declared per share $ 1.00 $ 0.74 $ 0.48

Book value per share(1) 50.7743.60 38.69

Tangible book value per share(2)(3) 40.9133.56 28.84

financialconditionandotheroperatingdata

Total assets $531,379 $403,799 $355,574

Long-term borrowings 80,69657,482 38,711

Shareholders’ equity 25,07921,632 19,003

Leverage ratio(4) 21.2x 18.7x 18.7x

Adjusted leverage ratio(5) 15.1x 16.5x 15.2x

Debt to equity ratio(6) 3.2x 2.7x 2.0x

Return on average shareholders’ equity(7) 19.8% 15.0% 11.3%

Return on average tangible shareholders’ equity(8) 25.2% 19.9% 15.3%

selecteddata

Total employees 20,722 19,476 19,739

Assets under management ($INBILLIONS) $ 452 $ 373 $ 348

(1)

Bookvaluepershareisbasedoncommonsharesoutstanding,includingrestrictedstockunitsgrantedtoemployeeswithnofutureservicerequirements,of

494.0million,496.1millionand491.2millionasofNovember2004,November2003andNovember2002,respectively.

(2)

Tangiblebookvaluepershareiscomputedbydividingtangibleshareholders’equitybythenumberofcommonsharesoutstanding,includingrestrictedstock

unitsgrantedtoemployeeswithnofutureservicerequirements.

(3)

Tangible shareholders’equity equalstotal shareholders’equity lessgoodwill andidentifiable intangibleassets. See“Financial Information—Management’s

DiscussionandAnalysis—CapitalandFunding”forfurtherinformationregardingourtangibleshareholders’equitycalculation.

(4)

Leverageratioequalstotalassetsdividedbyshareholders’equity.

(5)

Adjustedleverageratioequalsadjustedassetsdividedbytangibleequitycapital.Adjustedassetsexcludes(i)low-riskcollateralizedassetsgenerallyassociated

withourmatchedbookandsecuritieslendingbusinesses(whichwecalculatebyaddingoursecuritiespurchasedunderagreementstoresellandsecurities

borrowed,andthensubtractingournonderivativeshortpositions),(ii)cashandsecuritieswesegregateincompliancewithregulationsand(iii)goodwilland

identifiableintangible assets. Tangible equity capital includestangible shareholders’ equityand junior subordinateddebt issued toa trust. Webelieve that

theadjustedleverageratioisamoremeaningfulmeasureofourcapitaladequacybecauseitexcludescertainlow-riskcollateralizedassetsthataregenerally

supportedwithlittleornocapitalandreflectsthetangibleequitycapitaldeployedinourbusinesses.See“FinancialInformation—Management’sDiscussion

andAnalysis—CapitalandFunding”forfurtherinformationregardingouradjustedleverageratiocalculation.

(6)

Debttoequityratioequalslong-termborrowingsdividedbyshareholders’equity.

(7)

Returnonaverageshareholders’equityiscomputedbydividingnetearningsbyaveragemonthlyshareholders’equity.

(8)

Returnonaveragetangibleshareholders’equityiscomputedbydividingnetearningsbyaveragemonthlytangibleshareholders’equity.Webelievethatreturn

onaveragetangibleshareholders’equityisameaningfulmeasureofperformancebecauseitexcludestheportionofourshareholders’equityattributable

togoodwillandidentifiableintangibleassets.Asaresult,thiscalculationmeasurescorporateperformanceinamannerthat treatsunderlyingbusinesses

consistently,whethertheywereacquiredordevelopedinternally.See“FinancialInformation—Management’sDiscussionandAnalysis—ResultsofOperations”

forfurtherinformationregardingourreturnonaveragetangibleshareholders’equitycalculation.