Goldman Sachs 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.believe it is firmly in the interests of our clients and share-

holders that we concentrate our resources where they will

have the most impact.

Principal Investments had strong results in 2004, with

net revenues more than doubling to $1.33 billion. This

included a $771 million unrealized gain on our investment in

convertible preferred stock of Sumitomo Mitsui Financial

Group (SMFG), reflecting a continued economic recovery in

Japan. Almost two years after we invested $1.25 billion,

our convertible preferred is now carried at $2.56 billion.

We are very pleased with this investment, which was made

possible by our strong relationship with SMFG, developed

over many years. It is a prime example of our willingness to

commit capital to the mutual benefit of our clients and

our shareholders.

Our traditional corporate and real estate investing

business also performed very well in 2004, generating gains

and overrides of $561 million. After the technology and

telecom boom of the late 1990s, we returned this business to

its traditional merchant banking model of investing larger

amounts in mature companies. This strategy paid off in 2004,

as we were able to take advantage of the credit and equity

markets recoveries and harvest some of these investments.

And we continue to identify attractive opportunities to invest

our capital in this business.

We view principal investing as a vital part of an integrated

investment bank. Our success in this area stems partly from

our role as an innovator. We helped lead the way in partnering

with other private equity investors, many of whom are also our

clients, to supply the capital required for larger deals and to

spread risk among a wider investor base. We continue to see

this strategy as important to our future success and another

example of how multiple relationships can be managed for

the benefit of our clients.

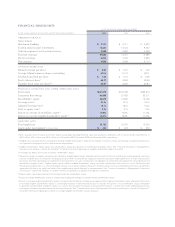

AssetManagementandSecuritiesServices

Our Asset Management and Securities Services businesses

had an excellent year. Net revenues were up 35% to a record

$3.85 billion, and pre-tax earnings rose 47% to a record

$1.42 billion.

In Asset Management, net revenues grew 38% to a

record $2.55 billion, as assets under management grew and

incentive fees for exceeding performance benchmarks set a

new record. Net inflows during 2004 were very strong,

totaling $52 billion across all asset classes, while market

appreciation added $27 billion. As a result, year-end assets

under management reached a record $452 billion. There

is no more direct testament to the performance of our

investment strategies than our success in attracting new assets.

This was an exceptional year overall for Asset Management,

with strong asset growth and expanding margins.

Securities Services posted record net revenues of $1.30

billion, up 29% from 2003. We continue to benefit from

trends in hedge fund formation, activity levels and asset

flows. We have also had success in winning new mandates

despite ever-increasing competition. Securities Services is

an excellent business, which we have built over many years.

Our consistent commitment to high-quality service for our

clients has made us an industry leader.

Asset Management and Securities Services continue to offer

some of our most attractive opportunities for future growth.

Expenses

Our total operating expenses increased 20% in 2004, against

a net revenues increase of 28%. Most of our expenses related

to compensation and benefits, and a majority of that was

discretionary year-end compensation based on the performance

of the firm and our people. Compensation and benefits were

46.7% of net revenues in 2004, against 46.2% in 2003. This

reflects our strong performance as well as an increasingly

competitive environment for talented people. Keeping our

team together is critically important and, more than ever,

we have worked hard to be fair and appropriate in our

compensation decisions.

We have always approached compensation decisions

from the bottom up. Rather than allocating dollars based on

a rigid share of net revenues, we try to determine the right

amount of compensation for each individual’s contribution to

the firm’s performance. This takes time and effort, but we

believe it is repaid in our ability to attract and retain people

for the long term, without relying on multiyear bonus

guarantees. Headcount grew for the first time in several

years during 2004, up 6% to 20,722.

Non-compensation expenses were $4.22 billion, up 4%

compared with 2003. Most of the year-over-year increase came

from higher levels of business activity and higher professional

fees. Looking forward, we want to emphasize that while

expenses will inevitably increase in a stronger business

and economic environment, we continue to focus hard on

controlling discretionary costs. That said, we have little

control over the escalating costs related to increased regulation

and regulatory scrutiny of our industry, as well as litigation.

In addition to provisions for legal and regulatory proceedings,

which amounted to $103 million in 2004, we continue to

incur legal fees associated with such matters as well as expenses

related to compliance with new legislative and regulatory

requirements and investigations. These costs include not only

the direct expense of new internal processes and additional

people, but also a significant investment of senior management

time and focus.

StrategicandCompetitiveIssues

We touched earlier on the importance of combining a strong

customer franchise with a willingness to commit capital on

behalf of our clients. We believe that this has been — and

will continue to be — critical to our success. Across our

many businesses, our client franchise is second to none. At

the same time, our trading and risk management is best in

class. Critically, we believe that we combine these attributes

as well as or better than any other firm.

GOLDMANSAC H S 2 0 0 4 ANNUAL R E P O RT5

GOLDMANSAC H S 2 0 0 4 ANNUAL R E P O RT5