Goldman Sachs 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our success in 2004 can be attributed to many factors and

demonstrates the remarkable potential of our firm. Most

importantly, our results reflect the strength of our franchise,

the depth of our client relationships across all of our

businesses and our leading positions in the most important

financial markets around the world. We also benefited

from steps taken in earlier, more difficult years to restructure

certain of our businesses and build for the future.

This year, like many before it, was marked by a number

of rapidly shifting markets. Our ability to navigate these

changes and effectively manage our risks strengthened our

results. As we have remarked before, we cannot control the

environment, but we strive to outperform our peers in all

market environments. We are particularly pleased that our

relative performance was very strong.

It is worth noting that we won’t always be as fortunate

as we were in 2004. But we are energized by the challenge

and optimistic about the future. Our long-term success has

deep roots — in our client relationships, our willingness to

commit capital and to manage risk, our global reach, our

nimbleness and, above all, our people and reputation. It

is the combination of these attributes that enabled us to

serve our clients and to generate attractive returns for our

shareholders in 2004.

Along with people around the world, Goldman Sachs was

stunned by the devastation caused by the earthquake and

subsequent tsunamis in South Asia in late December 2004.

Our response was immediate and focused. Within hours of

the disaster, the firm was working to ensure that our people in

the area were safe. Within days, we had partnered with our

contacts in the non-profit community— including CARE,

Japan Red Cross Society, the International Rescue Committee

and AmeriCares — to identify the most urgent needs in the

regions and to provide assistance to those impacted by the

disaster. Beyond our immediate response, Goldman Sachs

remains committed to assisting over the long term through

supporting initiatives to rebuild the physical and economic

infrastructures of the impacted countries. We believe that our

business success is accompanied by a responsibility to act,

and the response of our people to this tragedy underscores the

strength of this belief throughout the firm.

InvestmentBanking

Investment banking activity began to recover during 2004.

Global completed mergers and acquisitions increased 33%

compared with 2003 and worldwide common stock issuance

nearly doubled. Our net revenues in Investment Banking

increased 24% to $3.37 billion and pre-tax earnings almost

doubled to $401 million.

In 2004, we maintained leadership positions in our most

important high-margin businesses. In mergers and acquisitions,

we ranked number one globally in announced and completed

activity for the seventh consecutive year and advised on seven

of the ten largest completed transactions. We also demonstrated

the strength of our equity underwriting franchise, ranking

second in worldwide common stock and initial public

offerings with leadership positions in every major region.

In leveraged finance, we continued to strengthen our global

business and we have been at the forefront of the growth of

the hybrid loan market, particularly working with financial

sponsor clients.

In a period in which trading results are more significant

than ever to the industry’s performance, some may under-

estimate the importance of Investment Banking. We believe it

is difficult to overstate the importance of Investment Banking

to our firm. Our traditional role as an advisor and underwriter

will always be a critical part of our business. In addition, in

today’s rapidly changing markets, corporate clients are

increasingly asking us to help them manage their risk by

acting as a principal. These opportunities are an attractive

source of transactions and come from the strength of our

relationships and the depth of our market knowledge.

fellowshareholders:

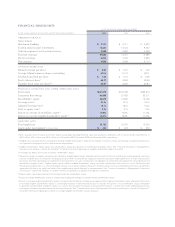

2004 was an outstanding year for Goldman Sachs —

the strongest performance in the firm’s history. Net revenues

increased 28% to a record $20.55 billion and net earnings

rose 52% to a record $4.55 billion. Earnings per diluted

share (EPS) were $8.92, the highest we have ever reported,

and our return on average tangible shareholders’ equity

was 25%, compared with 20% in 2003.

GOLDMANSAC H S 2 0 0 4 ANNUAL R E P O RT3

GOLDMANSAC H S 2 0 0 4 ANNUAL R E P O RT3