Goldman Sachs 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. To better serve our clients, in 2004 we created a global

financing group by combining our traditional equity and debt

capital markets underwriting areas with our financing and

liability hedging businesses. Through this combination,

we are able to offer our clients a full range of customized

financing and hedging alternatives to meet their needs more

effectively. Early in 2005, the financing group was combined

with Investment Banking, bringing together our strategic,

corporate-facing businesses.

Delivering the resources of the entire firm to our clients in

a seamless fashion, with Investment Banking as “front of the

house,” is one of the most challenging things we do. It is also

one of the most rewarding. Our ability to serve our clients

with firmwide resources is a critical competitive advantage

and stems directly from our culture of teamwork.

Barring unforeseen shocks, we expect a continued gradual

recovery in the level of investment banking activity. Capital

raising and strategic activity are directly linked to economic

growth as well as to CEO and investor confidence. While

confidence has certainly increased from the lows of a few years

ago, further increases are needed to produce more robust

Investment Banking results.

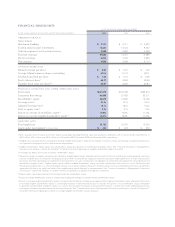

TradingandPrincipalInvestments

Trading and Principal Investments once again produced

a record performance in 2004. Net revenues increased 28%

to $13.33 billion and pre-tax earnings were up 44% to

$5.04 billion.

Fixed Income, Currency and Commodities (FICC)

produced a remarkable performance, with net revenues of

$7.32 billion up 31% from 2003’s record. Throughout 2004,

the environment for our FICC businesses changed continually.

While absolute interest rates remained low, the yield curve

flattened during the year as the U.S. Federal Reserve raised

short-term interest rates four times. Credit spreads ended the

year at very tight levels. Currency markets, dormant for much

of the year, moved dramatically in the fourth quarter as the

U.S. dollar declined markedly. Commodities prices were

exceptionally volatile throughout the year, prompting record

levels of activity by producers and consumers of energy and

raw materials.

Against this backdrop, our strong performance under-

scores the breadth of our customer franchise across FICC.

Each of our major FICC businesses — interest rate products,

credit products, mortgages, currencies and commodities — is

large enough to have a meaningful impact on FICC’s overall

results in any quarter. At the same time, it is rare for any one

of these businesses to be a dominant portion of our total FICC

net revenues in a given period. Coupled with our culture of

outstanding client service, we believe this “strength in breadth”

has been a critical advantage in recent years and positions

us well for the future.

As we enter a period of rising interest rates, many wonder

about the potential effect on our FICC performance. Our

experience is that customer activity is the key driver of FICC.

Clients are drawn to the market by the desire to hedge, to

reallocate investments, to capture upside or to limit downside.

Today, with deep and liquid derivatives markets and a

broader client base than ever before, the existence of a trend

in prices and activity has become as important as the direction

of prices. These developments, coupled with the diversity of

our FICC businesses, helps to explain why the increase in

interest rates in 2004 did not lead to dramatic declines in FICC

revenues. To be clear, this does not mean that risk has been

reduced. On the contrary, our willingness to take and manage

risk is more critical than ever to our clients, who are the core

of our trading franchise.

Turning to our other major trading business, Equities net

revenues grew 9% in 2004 to $4.67 billion. Our equities

products group net revenues increased as a result of higher

customer activity in shares and derivatives globally. The

principal strategies group also recorded higher net revenues

compared with 2003. While equity markets increased in the

early part of 2004, much of the year was characterized by

directionless markets, with lower volumes and declining

volatility, before a pickup in the last weeks of our fiscal year.

The equities business continues to face significant

challenges, including declining commission rates driven by

intense competition and our clients’ focus on managing trans-

action costs. These challenges in turn create new requirements

for us. For example, our clients more frequently ask us to

trade for them in a way that guarantees their execution price

rather than by having us act as a pure intermediary. This

can still be excellent business for us, but it places demands

on our capital and requires us to accept greater risk than

we did in the past.

In addition, the structure of equity markets continues to

be in a state of flux, with trading rule changes and market

reforms being contemplated by a range of regulatory bodies.

While our success is not tied to any particular equity market

structure, we will try to determine the optimal outcome for

our clients and our shareholders as alternatives are reviewed.

Regardless of the structure of markets, our primary goal is to

continue to serve our clients and thereby retain our leadership

in global equities.

While some of these developments are challenging, we

have been pleased with our performance in Equities. We

believe our strength across the trading business equips us

very well to adapt to changes in the way equities are traded.

As with FICC, the size and breadth of our Equities franchise

is key. It includes our sales and trading operation, a leading

direct market access capability, a dominant prime broker, our

long-standing proprietary trading business and a commitment

to providing world class research.

In Equities, we reduced costs during the downturn of

2001-2003 and, more importantly, restructured our business

to address the challenges outlined above. We have also

worked to match service levels to our clients’ needs and

our own revenue potential. This effort has involved some

difficult decisions about where we should focus, but we

4GOLDMAN S A C H S 2 0 0 4ANNU A L R E P O RT

4GOLDMAN S A C H S 2 0 0 4ANNU A L R E P O RT