Goldman Sachs 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Goldman Sachs

2004annualreport

Table of contents

-

Page 1

Goldman Sachs 2004฀annual฀report -

Page 2

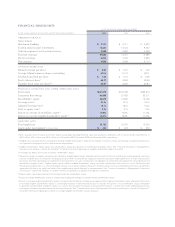

... Trading and principal investments Asset management and securities services Total net revenues Pre-tax earnings Net earnings common฀share฀data Diluted earnings per share Average diluted common shares outstanding Dividends declared per share Book value per share(1) Tangible book value per share... -

Page 3

in฀the฀financial฀markets , Goldman Sachs plays a vital role in accessing, allocating and managing capital across a broad spectrum of markets and businesses. In doing so, we bring together people, capital and ideas. These three ingredients propel innovation and economic growth, create jobs and... -

Page 4

henry฀m.฀paulson,฀jr.฀ Chairman and Chief Executive Ofï¬cer lloyd฀c.฀blankfein฀ President and Chief Operating Ofï¬cer 2 ฀฀ ฀GOL DM A N฀S A C HS ฀ 2 004 ฀A NNUA L ฀R E P ORT -

Page 5

... doubled. Our net revenues in Investment Banking increased 24% to $3.37 billion and pre-tax earnings almost doubled to $401 million. In 2004, we maintained leadership positions in our most important high-margin businesses. In mergers and acquisitions, we ranked number one globally in announced and... -

Page 6

... to our other major trading business, Equities net revenues grew 9% in 2004 to $4.67 billion. Our equities products group net revenues increased as a result of higher customer activity in shares and derivatives globally. The principal strategies group also recorded higher net revenues compared with... -

Page 7

... commitment to high-quality service for our clients has made us an industry leader. Asset Management and Securities Services continue to offer some of our most attractive opportunities for future growth. Expenses Our total operating expenses increased 20% in 2004, against a net revenues increase of... -

Page 8

... places risk management at the center of our core competencies. One measure of our market risk-taking is Value-at-Risk (VaR), a statistical measure of potential loss in the value of our trading positions over a deï¬ned time horizon with a speciï¬ed level of conï¬dence. In 2004, our average daily... -

Page 9

... a leader in providing advisory services to some of China's most important companies and bringing them to the international capital markets. Goldman Sachs Gao Hua Securities Company Limited will enable us for the ï¬rst time to offer a wide range of investment banking and securities trading services... -

Page 10

IDEAS ฀ Generating฀ideas฀that฀ create฀progress. Texas฀Genco฀supplies฀power฀฀ to฀the฀Houston,฀Texas฀market. 8 ฀฀ ฀GOL DM A N฀S A C HS ฀ 2 004 ฀A NNUA L ฀R E P ORT -

Page 11

...'s฀earnings฀to฀volatile฀commodity฀prices฀in฀the฀gas-driven฀฀ Texas฀energy฀market.฀Goldman฀Sachs฀combined฀its฀merger฀฀ advisory,฀industry,฀ï¬nancing฀and฀risk฀management฀expertise฀฀ to฀help฀the฀investor฀group฀leverage฀Texas฀Genco... -

Page 12

...foundation฀of฀Goldman฀Sachs'฀long-฀ term฀commitment฀to฀China. PEOPLE฀ The฀creation฀of฀Goldman฀Sachs฀Gao฀Hua฀Securities฀Company฀ Limited฀brought฀together฀a฀diverse฀team฀across฀business฀฀ disciplines฀and฀regions฀to฀develop฀this฀unique... -

Page 13

Beijing฀will฀be฀the฀headquarters฀of฀ ฀ Goldman฀Sachs฀Gao฀Hua฀Securities. GOL DM A N฀S A C HS ฀ 2004 ฀A NNUA L ฀R E P ORT ฀฀฀ 11 -

Page 14

Goldman฀Sachs฀has฀established฀itself฀as฀one฀฀ of฀the฀leading฀investment฀banks฀in฀Germany. 12 ฀฀฀GOL DM A N฀S A C HS ฀ 2 004 ฀A NNUA L ฀R E P ORT -

Page 15

...Club฀debt฀to฀the฀capital฀markets.฀The฀successful฀structuring฀฀ and฀placement฀of฀this฀transaction฀is฀a฀reï¬,ection฀of฀Goldman฀ Sachs'฀established฀presence฀in฀Germany,฀and฀another฀example฀ of฀our฀long-standing฀ï¬nancing฀work฀for฀the... -

Page 16

...฀fund฀-฀the฀Goldman฀Sachs฀US฀REIT฀ Fund฀-฀to฀Japan's฀retail฀market.฀A฀change฀in฀rules฀by฀The฀฀ Investment฀Trusts฀Association฀of฀Japan฀now฀enables฀management฀companies฀to฀launch฀funds฀that฀invest฀in฀Real฀Estate฀฀ Investment... -

Page 17

Goldman฀Sachs฀Asset฀Management฀ ฀ has฀established฀itself฀as฀one฀ ฀ of฀the฀leading฀investment฀advisors฀ ฀ and฀fund฀managers฀in฀Japan. GOL DM A N฀S A C HS ฀ 2004 ฀A NNUA L ฀R E P ORT ฀฀฀ 15 -

Page 18

.... IDEAS฀ In฀September฀2004,฀Goldman฀Sachs฀ï¬nalized฀the฀framework฀฀ of฀an฀extraordinary฀venture,฀the฀result฀of฀a฀creative฀approach฀฀ to฀what฀initially฀appeared฀to฀be฀a฀routine฀transaction฀for฀the฀฀ Principal฀Finance฀Group฀in... -

Page 19

Tierra฀del฀Fuego฀is฀home฀to฀ ฀ huge฀tracts฀of฀old฀growth฀forests. GOL DM A N฀S A C HS ฀ 2004 ฀A NNUA L ฀R E P ORT ฀฀฀ 17 -

Page 20

PEOPLE ฀ Fostering฀our฀ culture. "I remember very clearly one of the ï¬rst memos I wrote. Wherever I had written 'I,' Jim had crossed it out and written 'We.' He didn't have to say ... -

Page 21

..., with younger generations offering new skills and perspectives to even the most senior of our leaders. What remains unchanged is that the most successful people at Goldman Sachs - young and old - view themselves as stewards of our ï¬rm, its values and its culture. Stewardship is a concept... -

Page 22

... teammates helped me navigate the interview process and see the value my unique perspective could add to the ï¬rm. Now I am personally involved in recruiting as a member of the MIT recruiting team." naz฀majidi,฀ Fixed Income, Currency and Commodities, New York 20 ฀฀฀GOL DM A N฀S A C HS... -

Page 23

...and Commodities , New York recruiting฀top฀talent The people of Goldman Sachs share a passion for achieving results and recognize that success without integrity is failure. Their unique backgrounds, individual perspectives and diverse skills are put to the test as they participate in events that... -

Page 24

... London "Senior people here make the time to teach many of our Pine Street programs. I've personally beneï¬ted from participating both as a student and as a faculty member." caroline฀taylor,฀ ฀Investment Management, London 22 ฀฀฀GOL DM A N฀S A C HS ฀ 2 004 ฀A NNUA L ฀R E P ORT -

Page 25

... development of high-performing leaders. Pine Street also helps business leadership teams articulate their strategies and improve their business results. Many of Pine Street's programs and initiatives are available to key clients. Leaders from client ï¬rms attend courses jointly with Goldman Sachs... -

Page 26

... around me - the economy, politics, markets - and our business has been at the center of that change." mark฀machin,฀ Investment Banking, Hong Kong "Our team serves clients in more than a dozen countries and regions across Asia. This requires a huge personal and professional commitment to focus... -

Page 27

... new array of sophisticated approaches to ï¬nancing transactions and mitigating risk. Goldman Sachs applies its expertise to help meet the increasingly diverse and complex objectives of our clients. Now an important part of our Investment Banking capabilities, the ï¬rm's Financing Group... -

Page 28

... people of Goldman Sachs are at the very center of the change that constantly buffets the global markets. A career at Goldman Sachs can lead to a range of assignments across industries, markets and professional disciplines. This environment helps attract the very best people, and the broad power of... -

Page 29

... at the ï¬rm, I've always found new ways to be challenged, whether I'm working in a new function, a new division or a new country. The breadth of the Goldman Sachs franchise has made that possible." valentino฀carlotti,฀ Equities, New York GOL DM A N฀S A C HS ฀ 2004 ฀A NNUA L ฀R E P ORT... -

Page 30

...contribute greatly to our success. 7.฀We offer our people the opportunity to 11.฀We constantly strive to anticipate the move ahead more rapidly than is possible rapidly changing needs of our clients and at most other places. Advancement depends to develop new services to meet those on merit and... -

Page 31

...at฀a฀฀ New฀York฀City฀soup฀kitchen. A฀team฀of฀CTW฀volunteers฀helps฀build฀a฀Goldman฀Sachs-sponsored฀home. Community We฀recognize฀the฀demands฀our฀business฀places฀on฀our฀people.฀ We฀give฀them฀extensive฀opportunities฀to฀grow฀personally... -

Page 32

...Inc. Asset Management and Securities Services HELPING฀INVESTORS฀GROW฀THEIR฀CAPITAL฀฀ AND฀ACCESS฀MARKETS Trading and Principal Investments FINDING฀WAYS฀TO฀CONNECT฀IDEAS฀AND฀CAPITAL Our outstanding client franchise has helped us establish a leading position in the global... -

Page 33

... Risk Management Structure . ... 101 102 103 ... ... ... Liquidity Risk supplemental฀financial฀information Operational Risk . Quarterly Results . ... 106 106 107 Recent Accounting Developments . Common Stock Price Range . Selected Financial Data . management's฀report฀on฀internal... -

Page 34

...฀analysis Introduction Goldman Sachs is a leading global investment banking, securities and investment management ï¬rm that provides a wide range of services worldwide to a substantial and diversiï¬ed client base that includes corporations, ï¬nancial institutions, governments and high-net-worth... -

Page 35

...ation, the U.S. Federal Reserve raised the federal funds rate target by 25 basis points in June, and subsequently raised rates a further 75 basis points by the end of our ï¬scal year to 2.0%. Despite rising short-term interest rates, long-term yields moved higher only brieï¬,y, for several months... -

Page 36

... large trading, specialist and investment positions. Market ï¬,uctuations and volatility may adversely affect the value of those positions or may reduce our willingness to enter into new transactions. Conversely, our trading businesses depend on market volatility to provide trading and arbitrage... -

Page 37

...than on a marketed basis, which increases the risk Goldman Sachs may be unable to resell the purchased securities at favorable prices. Moreover, because of concentration of risk, we may suffer losses even when economic and market conditions are generally favorable for others in the industry. We also... -

Page 38

...corporate bonds, listed equities, money market securities, state, municipal and provincial obligations, and physical commodities. Certain cash trading instruments trade infrequently and, therefore, have little or no price transparency. Such instruments may include certain high-yield debt, corporate... -

Page 39

...813 Cash trading instruments we own (long positions) are marked to bid prices and instruments we have sold but not yet purchased (short positions) are marked to offer prices. If liquidating a position is reasonably expected to affect its prevailing market price, our valuation is adjusted generally... -

Page 40

... Contracts Held for Trading Purposes and Contracts Involved in Energy Trading and Risk Management Activities." Following day one, we adjust the inputs to our valuation models only to the extent that changes in such inputs can be veriï¬ed by similar market transactions, third-party pricing services... -

Page 41

... initial public offerings or other corporate transactions, are valued using quoted market prices discounted for restrictions on sale. If liquidating a position is reasonably expected to affect market prices, valuations are adjusted accordingly based on predetermined written policies. Our investment... -

Page 42

... Board Options Exchange and the Philadelphia Stock Exchange all announced proposed restructuring plans and continued to experience loss of market share to the International Securities Exchange, which became the leading U.S. options exchange during 2003. Consequently, we tested our related option... -

Page 43

... by major asset class: identifiable฀intangible฀assets฀by฀asset฀class CARRYING฀ VALUE฀ 2004฀ RANGE฀OF฀REMAINING฀ USEFUL฀LIVES฀ (IN฀YEARS)฀ AS฀OF฀NOVEMBER 2003 ฀ CARRYING฀ VALUE IN฀MILLIONS)฀ Customer lists(1) New York Stock Exchange (NYSE) specialist... -

Page 44

... with 2003, reï¬,ecting strong growth in Trading and Principal Investments, Asset Management and Securities Services, and Investment Banking. The increase in Trading and Principal Investments reï¬,ected signiï¬cantly higher net revenues in FICC, as all major businesses and regions performed well in... -

Page 45

...฀to฀Goldman฀Sachs฀by฀the฀investment฀ funds฀for฀which฀these฀companies฀manage฀properties฀and฀perform฀loan฀servicing.฀Such฀reimbursements฀are฀recorded฀in฀net฀revenues.฀All฀three฀years฀exclude฀ employees฀of฀certain฀consolidated฀entities... -

Page 46

... Investments ฀ ฀ ฀ Asset Management and Securities Services ฀ ฀ ฀ Total ฀ ฀ ฀ ฀ (1) ฀฀ Includes฀the฀following฀expenses฀that฀have฀not฀been฀allocated฀to฀our฀segments:฀(i)฀the฀amortization฀of฀employee฀initial฀public฀offering฀awards... -

Page 47

... ï¬nancial advisory and underwriting transaction volumes: goldman฀sachs฀global฀investment฀banking฀volumes (1) ฀ ฀ 2004฀ YEAR฀ENDED฀NOVEMBER 2003฀ 2002 (IN฀BILLIONS)฀ Announced mergers and acquisitions Completed mergers and acquisitions Equity and equity-related offerings... -

Page 48

.... make markets in, act as a specialist for, and trade equities and equity-related products, structure and enter into equity derivative transactions, and engage in proprietary trading. We also execute and clear customer transactions on major stock, options and futures exchanges worldwide. Investments... -

Page 49

... energy prices, narrow corporate credit spreads and low, although rising, interest rates. The yield curve remained steep in 2004, but ï¬,attened in the second half of the year. Net revenues in Equities of $4.67 billion increased 9% compared with 2003, reï¬,ecting higher net revenues in our global... -

Page 50

... securities lending services to mutual funds, pension funds, hedge funds, foundations and high-net-worth individuals worldwide, and generates revenues primarily in the form of interest rate spreads or fees. The following table sets forth the operating results of our Asset Management and Securities... -

Page 51

... income and alternative investment assets. Net asset outï¬,ows for 2003 included $16 billion in net outï¬,ows related to British Coal Pension Schemes' planned program of diversiï¬cation among its asset managers and $4 billion in inï¬,ows acquired from Ayco. Securities Services net revenues of $1.01... -

Page 52

...size and composition of our trading and investment positions. Goldman Sachs' total capital (shareholders' equity and long-term borrowings) increased 34% to $105.78 billion as of November 2004 compared with $79.11 billion as of November 2003. See "-Risk Management-Liquidity Risk- Cash Flows" included... -

Page 53

... program, see "Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" in Part II, Item 5 of the Annual Report on Form 10-K. The following table sets forth information on our assets, shareholders' equity, leverage ratios and book value per share... -

Page 54

...)฀ Our secured short-term borrowings provide Goldman Sachs with a more stable source of liquidity, as these borrowings are less sensitive to changes in our credit ratings than our unsecured short-term borrowings, due to the underlying collateral. See "-Risk Management-Liquidity Risk" included... -

Page 55

..."-Risk Management-Liquidity Risk- Excess Liquidity-Maintenance of a Pool of Highly Liquid Securities" included below. CONTRACTUAL฀ OBLIGATIONS฀ AND฀ ฀ CONTINGENT฀ COMMITMENTS Goldman Sachs has contractual obligations to make future payments under long-term debt and long-term noncancelable... -

Page 56

... in secured long-term borrowings and $68.61 billion in unsecured long-term borrowings. As of November 2004, long-term borrowings included nonrecourse debt of $12.05 billion, consisting of $5.14 billion issued by William Street Funding Corporation (a wholly owned subsidiary of Group Inc. formed to... -

Page 57

...by the Financial Services Agency, the Tokyo Stock Exchange, the Osaka Securities Exchange, The Tokyo International Financial Futures Exchange and the Japan Securities Dealers Association. Several other subsidiaries of Goldman Sachs are regulated by securities, investment advisory, banking, and other... -

Page 58

... for changes in the market value of our trading and investing positions is referred to as market risk. Such positions result from market-making, specialist and proprietary trading, investing and underwriting activities. Categories of market risk include exposures to interest rates, equity prices... -

Page 59

...product positions and related hedges that may include positions in other product areas. For example, the hedge of a foreign exchange forward may include an interest rate futures position, and the hedge of a long corporate bond position may include a short position in the related equity. The modeling... -

Page 60

management's฀discussion฀and฀analysis The following tables set forth the daily trading VaR: average฀daily฀va r (1)(2) (IN฀MILLIONS)฀ RISK฀CATEGORIES฀ 2004฀ YEAR฀ENDED฀NOVEMBER 2003฀ 2002 Interest rates Equity prices Currency rates Commodity prices Diversiï¬cation effect... -

Page 61

...-to-market on a daily basis and changes are recorded in net revenues. The following chart sets forth the frequency distribution of our daily trading net revenues for substantially all inventory positions included in VaR for the year ended November 2004: daily฀trading฀net฀revenues ($฀IN... -

Page 62

...and฀analysis As part of our overall risk control process, daily trading net revenues are compared with VaR calculated as of the end of the prior business day. Trading losses incurred on a single day exceeded our 95% one-day VaR on one occasion during 2004. Distressed฀Asset฀Portfolios CREDIT... -

Page 63

... of risk management. In addition to derivative transactions entered into for trading purposes, we enter into derivative contracts to hedge our net investment in non-U.S. operations and to manage the interest rate and currency exposure on our long-term borrowings and certain short-term borrowings... -

Page 64

... industry or market liquidity events. Our principal objective is to be able to fund Goldman Sachs and to enable our core businesses to continue to generate revenue even under adverse circumstances. Management has implemented a number of policies according to the following liquidity risk management... -

Page 65

... to this narrowly deï¬ned list of securities and cash which we believe are highly liquid, even in a difï¬cult funding environment. The majority of our Global Core Excess is structured such that it is available to meet the liquidity requirements of our parent company, Group Inc., and all of its... -

Page 66

... resulted in material changes to our credit risk, market risk or liquidity position because they are generally in highly liquid assets that are typically ï¬nanced on a secured basis. Certain ï¬nancial instruments may be more difï¬cult to fund on a secured basis during times of market stress and... -

Page 67

...07 billion invested in Goldman Sachs (Japan) Ltd., a Tokyo-based broker-dealer. Group Inc. also had $46.84 billion of unsubordinated loans to these entities as of November 2004, as well as signiï¬cant amounts of capital invested in and loans to its other regulated subsidiaries. We also manage our... -

Page 68

...(net of repayments of long-term debt). We used net cash of $11.18 billion in our operating and investing activities, primarily to capitalize on opportunities in our trading and principal investing businesses, including the purchase of investments that could be difï¬cult to fund in periods of market... -

Page 69

... of the types of plan assets, investment strategies, measurement dates, plan obligations, cash ï¬,ows and components of net periodic pension costs recognized during interim periods. The statement does not change the measurement or recognition of plan assets and obligations. We adopted the... -

Page 70

...฀reporting Management of The Goldman Sachs Group, Inc., together with its consolidated subsidiaries (the ï¬rm), is responsible for establishing and maintaining adequate internal control over ï¬nancial reporting. The ï¬rm's internal control over ï¬nancial reporting is a process designed... -

Page 71

... The Goldman Sachs Group, Inc.'s 2004 consolidated ï¬nancial statements and of its internal control over ï¬nancial reporting as of November 26, 2004 and audits of its 2003 and 2002 consolidated ï¬nancial statements in accordance with the standards of the Public Company Accounting Oversight Board... -

Page 72

... Asset management and securities services Interest income Total revenues Interest expense Cost of power generation Revenues, net of interest expense and cost of power generation Operating expenses Compensation and beneï¬ts Amortization of employee initial public offering and acquisition awards... -

Page 73

... owned, at fair value Other assets Total assets Liabilities and shareholders' equity Secured short-term borrowings Unsecured short-term borrowings Total short-term borrowings, including the current portion of long-term borrowings Payables to brokers, dealers and clearing organizations Payables... -

Page 74

...-in capital Balance, beginning of year Issuance of common stock Excess net tax beneï¬t related to delivery of stock-based awards Balance, end of year Retained earnings Balance, beginning of year฀ Net earnings Dividends declared Balance, end of year Unearned compensation Balance, beginning of year... -

Page 75

... equipment Business combinations, net of cash acquired Purchase of other investments Net cash used for investing activities Cash ï¬,ows from ï¬nancing activities Short-term borrowings, net Issuance of long-term borrowings Repayment of long-term borrowings, including the current portion of long-term... -

Page 76

...฀ 2002 (IN฀MILLIONS)฀ Net earnings Currency translation adjustment, net of tax Comprehensive income $4,553 5 $4,558 $3,005฀ 128฀ $3,133฀ $2,114 46 $2,160 The฀accompanying฀notes฀are฀an฀integral฀part฀of฀these฀consolidated฀ï¬nancial฀statements. 74 ฀฀฀GOL... -

Page 77

... entities are Description of Business The Goldman Sachs Group, Inc. (Group Inc.), a Delaware corporation, together with its consolidated subsidiaries (collectively, the ï¬rm), is a leading global investment banking, securities and investment management ï¬rm that provides a wide range of services... -

Page 78

... categories - cash (i.e., nonderivative) trading instruments, derivative contracts and principal investments. Investment฀Banking Underwriting revenues and fees from mergers and acquisitions and other corporate ï¬nance advisory assignments are recorded when the services related to the underlying... -

Page 79

... Held for Trading Purposes and Contracts Involved in Energy Trading and Risk Management Activities." Following day one, the ï¬rm adjusts the inputs to valuation models only to the extent that changes in such inputs can be veriï¬ed by similar market transactions, third-party pricing services and/or... -

Page 80

... recognized in net revenues over the lives of the transactions. Commissions The ï¬rm generates commissions from executing and clearing client transactions on stock, options and futures markets worldwide. These commissions are recorded on a trade-date basis in "Trading and principal investments" in... -

Page 81

... in "Asset management and securities services" in the consolidated statements of earnings. Merchant฀Banking฀Overrides Disclosure," using the prospective adoption method. Under this method of adoption, compensation expense is recognized over the relevant service period based on the fair value of... -

Page 82

... 3.52 3.32 IDENTIFIABLE฀ INTANGIBLE฀ ASSETS Goodwill is the cost of acquired companies in excess of the fair value of identiï¬able net assets at acquisition date. In accordance with SFAS No. 142, "Goodwill and Other Intangible Assets," goodwill is tested at least annually for impairment. An... -

Page 83

... term of the lease Straight-line over the useful life of the asset Straight-line over the useful life of the asset Property, leasehold improvements and equipment are tested for potential impairment whenever events or changes in circumstances suggest that an asset's or asset group's carrying value... -

Page 84

... of the types of plan assets, investment strategies, measurement dates, plan obligations, cash ï¬,ows and components of net periodic pension costs recognized during interim periods. The statement does not change the measurement or recognition of plan assets and obligations. The ï¬rm adopted... -

Page 85

...interest payment streams. The amounts exchanged are based on the speciï¬c terms of the contract with reference to speciï¬ed rates, securities, commodities, currencies or indices. Certain cash instruments, such as mortgage-backed securities, interest-only and principal-only obligations, and indexed... -

Page 86

... rate (i.e., LIBOR) on its long-term borrowings. Fair values of the ï¬rm's derivative contracts reï¬,ect cash paid or received pursuant to credit support agreements and are reported on a net-by-counterparty basis in the ï¬rm's consolidated statements of ï¬nancial condition when management... -

Page 87

...connection with its market-making activities and makes investments in and loans to VIEs that hold performing and nonperforming debt, real estate and other assets. In addition, the ï¬rm utilizes VIEs to provide investors with credit-linked and asset-repackaged notes designed to meet their objectives... -

Page 88

...NOVEMBER฀2004 MAXIMUM฀EXPOSURE฀TO฀LOSS ฀ GUARANTEES฀ ฀ LOANS฀AND DERIVATIVES฀ INVESTMENTS฀ TOTAL IN฀MILLIONS)฀ Mortgage-backed Asset repackagings and credit linked notes Power-related Other asset-backed Total $฀ 9,921฀ 5,138฀ 5,340฀ $153฀ 16 169฀ $100... -

Page 89

...AS฀OF฀NOVEMBER 2004฀ 2003 The ï¬rm obtains secured short-term ï¬nancing principally through the use of repurchase agreements and securities lending agreements to obtain securities for settlement, ï¬nance inventory positions and meet customers' needs. In these transactions, the ï¬rm either... -

Page 90

...at฀the฀dates฀such฀options฀become฀exercisable. (2)฀ The ï¬rm enters into derivative contracts, such as interest rate futures contracts, interest rate swap agreements, currency swap agreements and equity-linked contracts, to effectively convert a substantial portion of its long-term... -

Page 91

... owned subsidiary of Group Inc. Another consolidated wholly owned subsidiary, William Street Funding Corporation (Funding Corp), was formed to raise funding to support the William Street credit extension program. Commitment Corp and Funding Corp are each separate corporate entities, with assets and... -

Page 92

... obligations under long-term noncancelable lease agreements, principally for ofï¬ce space, expiring on various dates through 2029. Certain agreements are subject to periodic escalation provisions for increases in real estate taxes and other charges. Future minimum rental payments, net of minimum... -

Page 93

... 2007-฀ 2008฀฀ 2009THEREAFTER฀ TOTAL IN฀MILLIONS)฀ Derivatives Securities lending indemniï¬cations(2)฀ Guarantee of the collection of contractual cash ï¬,ows Merchant banking fund-related commitments Letters of credit and other guarantees (1) (2) (3) $7,639฀ -฀ 16฀ -฀ 89... -

Page 94

...unable to develop an estimate of the maximum payout under these guarantees. However, management believes that it is unlikely the ï¬rm will have to make material payments under these arrangements, and no liabilities related to these arrangements have been recognized in the consolidated statements of... -

Page 95

...174 $2,398 New York Stock Exchange (NYSE) specialist rights Exchange-traded fund (ETF) and option specialist rights Other(2) Total (578)(4) $1,820 (1) ฀฀ Primarily฀includes฀the฀ï¬rm's฀clearance฀and฀execution฀and฀Nasdaq฀customer฀lists฀acquired฀in฀the฀ï¬rm... -

Page 96

...฀ PLANS (IN฀MILLIONS)฀ Goodwill and identiï¬able intangible assets(1) Property, leasehold improvements and equipment Equity-method investments and joint ventures Prepaid assets and deposits Net deferred tax assets(2) Miscellaneous receivables and other Total (1) $฀฀4,871 4,083 2,447... -

Page 97

...)฀ Beneï¬t obligation Balance, beginning of year Business combination Service cost Interest cost Plan amendments Actuarial loss/(gain) Beneï¬ts paid Effect of foreign exchange rates Balance, end of year Fair value of plan assets Balance, beginning of year Business combination Actual return on... -

Page 98

... levels Expected long-term rate of return on plan assets Non-U.S. pension - projected beneï¬t obligation Discount rate Rate of increase in future compensation levels Non-U.S. pension - net periodic beneï¬t cost Discount rate Rate of increase in future compensation levels Expected long-term rate of... -

Page 99

... a mix, which is broadly similar to the actual asset allocation as of November 2004, of equity securities, debt securities and other assets is targeted to maximize the long-term return on assets for a given level of risk. Investment risk is measured and monitored on an ongoing basis by the ï¬rm... -

Page 100

... the second and third anniversaries following the grant date and will not be transferable before the third anniversary of the grant date. Employee Incentive Plans STOCK฀ INCENTIVE฀ PLAN The ï¬rm sponsors a stock incentive plan, The Goldman Sachs Amended and Restated Stock Incentive Plan (the... -

Page 101

... 23.3 million units, respectively, did not require future service. In all cases, delivery of the underlying shares of common stock is conditioned on the grantees satisfying certain other requirements outlined in the award agreements. The activity related to these restricted stock units is set forth... -

Page 102

... initial public offering generally vest as outlined in the applicable stock option agreement and ï¬rst become exercisable on the third anniversary of the grant date. All employee stock option agreements provide that vesting is accelerated in certain circumstances, such as upon The activity related... -

Page 103

... 2003฀ 2002฀ Risk-free interest rate Expected volatility Dividend yield Expected life 3.4%฀ 35.0฀ 1.0฀ 5฀years฀ 3.4%฀ 35.0฀ 1.0฀ 5฀years฀ 3.5% 35.0 0.6 5฀years NOTE฀ 13 Income Taxes The components of the net tax expense reï¬,ected in the consolidated statements of... -

Page 104

...York, Goldman Sachs International (GSI) in London and Goldman Sachs (Japan) Ltd. (GSJL) in Tokyo. GS&Co. and GSEC are registered U.S. broker-dealers and futures commission merchants subject to Rule 15c3-1 of the Securities and Exchange Commission (SEC) and Rule 1.17 of the Commodity Futures Trading... -

Page 105

...Principal Investments, and Asset Management and Securities Services. The ï¬rm made certain changes to its segment reporting structure in 2003. These changes included reclassifying the following from Asset Management and Securities Services to Trading and Principal Investments: • • • Revenues... -

Page 106

...฀Sachs฀Gao฀Hua฀Securities฀Company฀Limited,฀an฀investment฀banking฀and฀securities฀venture฀ in฀China,฀for฀the฀year฀ended฀November฀2004. (4)฀ Includes฀ deferred฀ tax฀ assets฀ relating฀ to฀ the฀ ï¬rm's฀ conversion฀ to฀ corporate฀ form... -

Page 107

... the country of domicile of the legal entity providing the service. The following table sets forth the total net revenues, pre-tax earnings and identiï¬able assets of the ï¬rm and its consolidated subsidiaries by geographic region allocated on the basis described above: ฀ ฀ AS฀OF฀OR฀FOR... -

Page 108

... January 28, 2005, there were approximately 5,660 holders of record of the ï¬rm's common stock. On January 28, 2005, the last reported sales price for the ï¬rm's common stock on the New York Stock Exchange was $106.12 per share. 106 ฀฀฀ GOL DM A N฀S A C HS ฀ 2004 ฀ANNUA L ฀R E P ORT -

Page 109

... per share Book value per share(3) Average common shares outstanding Basic Diluted Selected data (UNAUDITED) Employees United States International Total employees Assets under management (IN฀BILLIONS)(4) Asset class Money markets Fixed income and currency Equity(5) Alternative investments(6) Total... -

Page 110

...-Palmolive฀Company Edward M. Liddy Chairman,฀President฀and฀฀ Chief฀Executive฀Officer฀of฀ The฀Allstate฀Corporation฀ Alan M. Cohen Global฀Head฀฀ of฀Compliance Ruth J. Simmons President฀of฀฀ Brown฀University John F.W. Rogers Secretary฀to฀the฀Board John... -

Page 111

... P. Ransom John F.W. Rogers Michael D. Ryan* J. Michael Sanders Victor R. Simone, Jr. Michael M. Smith Jonathan S. Sobel Judah C. Sommer Mark J. Tracey Michael A. Troy Kaysie P. Uniacke Hugo H. Van Vredenburch Haruko Watanuki Todd A. Williams Zi Wang Xu Paolo Zannoni Yoel Zaoui Joan H. Zief Kendrick... -

Page 112

board฀members,฀officers฀and฀directors David M. Solomon Karen R. Cook* Alberto F. Ades Gregory A. Agran Raanan A. Agus Dean C. Backer Mark E. Bamford Stuart N. Bernstein Alison L. Bott John J. Bu Mark J. Buisseret Mary D. Byron Mark M. Carhart Marc I. Cohen Thomas G. Connolly Michael G. De ... -

Page 113

board฀members,฀officers฀and฀directors Gregory D. Lee Todd W. Leland Remco O. Lenterman Johan H. Leven Richard J. Levy Tobin V. Levy P. Jeremy Lewis George C. Liberopoulos Anthony W. Ling Bonnie S. Litt Joseph... Kasai Remy Klammers Peter Labbat Eric S. Lane Gary R. Lapidus Gregg R. Lemkau ... -

Page 114

board฀members,฀officers฀and฀directors Helen Paleno Massimo Pappone Archie... Giorgio De Santis Bradley S. DeFoor Alvaro del Castano Roger E. Denby-Jones David C. Earling Robert K. Ehudin...Komatsu Joon Kwun Simon M. Lamb Joseph A. LaNasa III Rudolf N. Lang Brian J. Lee George C. Lee Tim Leissner ... -

Page 115

...-Johnson Zubin P. Irani Kevin M. Jordan James P. Kenney Steven E. Kent Masaaki Kimura Jonathan S. King Frederick J. Knecht Yasuro K. Koizumi Robert A. Koort J. Douglas Kramer Tak Sing Kenneth Kwok Brian J. Lahey Jonathan A. Langer Hugh J. Lawson Cham Chung Ken Lee Ronald Lee Deborah R. Leone Roger... -

Page 116

board฀members,฀officers฀and฀directors Elena Ciallie Matthew J. Clark Scott Coleman ... Gray Jason R. Haas Edward G. Hadden Thomas E. Halverson Eric I. Hamou Jan Hatzius Jennifer M. Hill Nigel R. Hill ... G. Smith III Ying Ying Glenda So David Z. Solomon Robert C. Spofford Joseph J. Struzziery... -

Page 117

... Frankfurt Geneva George Town Hong Kong Houston Jersey City Johannesburg London Los Angeles Madrid Melbourne* Mexico City Miami Milan Moscow New York Paris Philadelphia Princeton Salt Lake City San Francisco São Paulo Seattle Seoul Shanghai Singapore Stockholm Sydney* Taipei Tampa Tokyo Toronto... -

Page 118

... Group, Inc. 85 Broad Street New York, New York 10004 1-212-902-1000 www.gs.com Transfer Agent and Registrar for Common Stock Questions from registered shareholders of The Goldman Sachs Group, Inc. regarding lost or stolen stock certiï¬cates, dividends, changes of address and other issues related... -

Page 119

...฀where฀speciï¬cally฀deï¬ned,฀the฀terms฀"Goldman฀Sachs,"฀"ï¬rm,"฀฀ "we,"฀"us"฀and฀"our"฀in฀this฀document฀may฀refer฀to฀The฀Goldman฀Sachs฀ Group,฀Inc.฀and/or฀its฀subsidiaries฀and฀afï¬liates฀worldwide,฀or฀to฀one฀or฀฀ more฀of... -

Page 120

ABOUT฀THE฀COVER In฀September฀2004,฀Goldman฀Sachs฀and฀฀ the฀Wildlife฀Conservation฀Society฀announced฀a฀฀ partnership฀to฀protect฀in฀perpetuity฀a฀vast฀tract฀ of฀wilderness฀in฀Tierra฀del฀Fuego,฀Chile. www.gs.com