Foot Locker 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

18. Financial Instruments and Risk Management − (continued)

Business Risk

The retailing business is highly competitive. Price, quality, selection of merchandise, reputation, store

location, advertising, and customer service are important competitive factors in the Company’s business.

The Company operates in 23 countries and purchased approximately 86 percent of its merchandise in

2012 from its top 5 vendors. In 2012, the Company purchased approximately 65 percent of its athletic

merchandise from one major vendor, Nike, Inc. (‘‘Nike’’), and approximately 17 percent from another

major vendor. Each of our operating divisions is highly dependent on Nike; they individually purchased 48

to 77 percent of their merchandise from Nike. The Company generally considers all vendor relations to be

satisfactory.

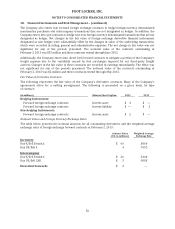

Included in the Company’s Consolidated Balance Sheet at February 2, 2013, are the net assets of the

Company’s European operations, which total $909 million and which are located in 19 countries, 11 of

which have adopted the euro as their functional currency.

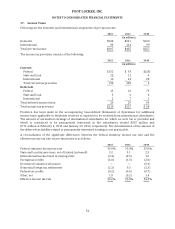

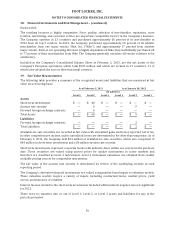

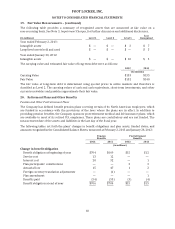

19. Fair Value Measurements

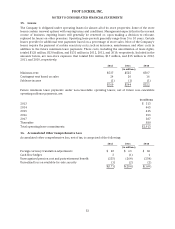

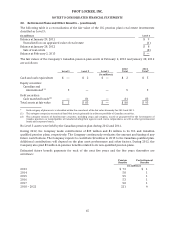

The following table provides a summary of the recognized assets and liabilities that are measured at fair

value on a recurring basis:

As of February 2, 2013 As of January 28, 2012

(in millions)

Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Assets

Short-term investments $ — $ 48 $ — $ — $ — $ —

Auction rate security — 6 — — 5 —

Forward foreign exchange contracts — 6 — — — —

Total Assets $ — $ 60 $ — $ — $ 5 $ —

Liabilities

Forward foreign exchange contracts — — — — 2 —

Total Liabilities $ — $ — $ — $ — $ 2 $ —

Available-for-sale securities are recorded at fair value with unrealized gains and losses reported, net of tax,

in other comprehensive income, unless unrealized losses are determined to be other than temporary. As of

February 2, 2013, the Company held $54 million of available-for-sale securities, which was comprised of

$48 million in short-term investments and a $6 million auction rate security.

Short-term investments represent corporate bonds with maturity dates within one year from the purchase

date. These securities are valued using quoted prices for similar instruments in active markets and

therefore are classified as Level 2 instruments. Level 2 instrument valuations are obtained from readily

available pricing sources for comparable instruments.

The fair value of the auction rate security is determined by review of the underlying security at each

reporting period.

The Company’s derivative financial instruments are valued using market-based inputs to valuation models.

These valuation models require a variety of inputs, including contractual terms, market prices, yield

curves, and measures of volatility.

Interest income related to the short-term investments included within interest expense was not significant

for 2012.

There were no transfers into or out of Level 1, Level 2, or Level 3 assets and liabilities for any of the

periods presented.

59