Foot Locker 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOOT LOCKER, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

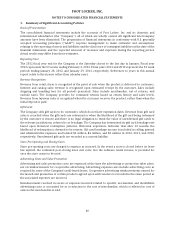

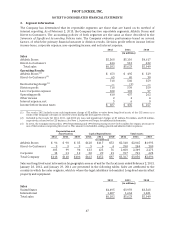

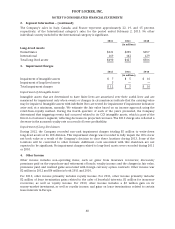

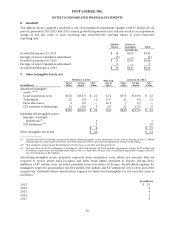

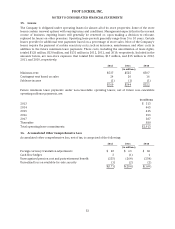

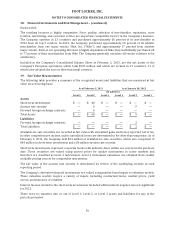

8. Goodwill

The Athletic Stores segment’s goodwill is net of accumulated impairment charges of $167 million for all

periods presented. The 2012 and 2011 annual goodwill impairment tests did not result in an impairment

charge as the fair value of each reporting unit exceeded the carrying values of each respective

reporting unit.

Athletic

Stores

Direct-to-

Customers Total

(in millions)

Goodwill at January 29, 2011 $ 18 $127 $145

Foreign currency translation adjustment (1) — (1)

Goodwill at January 28, 2012 $ 17 $127 $144

Foreign currency translation adjustment 1 — 1

Goodwill at February 2, 2013 $ 18 $127 $145

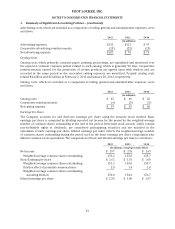

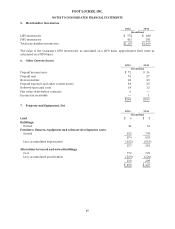

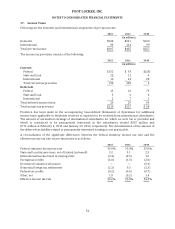

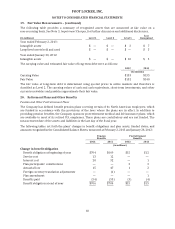

9. Other Intangible Assets, net

February 2, 2013 Wtd. Avg.

Life in

Years

January 28, 2012

(in millions)

Gross

value

Accum.

amort.

Net

Value

Gross

value

Accum.

amort.

Net

Value

Amortized intangible

assets:

(1),(2)

Lease acquisition costs $158 $(137) $ 21 12.4 $171 $(149) $ 22

Trademarks 21 (9) 12 19.7 21 (8) 13

Favorable leases 5 (5) — 10.1 7 (7) —

CCS customer relationships 21 (18) 3 5.0 21 (13) 8

$205 $(169) $ 36 12.4 $220 $(177) $ 43

Indefinite life intangible assets:

Republic of Ireland

trademark

(1)

11

CCS tradename

(3)

310

$4 $11

Other intangible assets, net $ 40 $ 54

(1) Includes the effect of foreign currency translation related primarily to the movements of the euro in relation to the U.S. dollar.

Additionally, the amounts presented for each of the periods reflects accumulated impairment charges of $2 million.

(2) The weighted-average useful life disclosed excludes those assets that are fully amortized.

(3) The net value of the CCS tradename at February 2, 2013 and January 28, 2012 includes impairment charges of $7 million and

$5 million, respectively, as described more fully in Note 3, Impairment Charges. The accumulated impairment charge related to

the CCS tradename is $22 million.

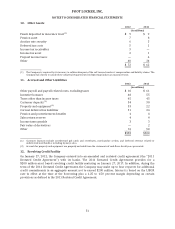

Amortizing intangible assets primarily represent lease acquisition costs, which are amounts that are

required to secure prime lease locations and other lease rights, primarily in Europe. During 2012,

additions of $7 million were recorded primarily from new leases in Europe. Amortization expense for

intangibles subject to amortization was $14 million, $16 million, and $17 million for 2012, 2011, and 2010,

respectively. Estimated future amortization expense for finite lived intangibles for the next five years is

as follows:

(in millions)

2013 $11

2014 5

2015 4

2016 3

2017 3

50