Foot Locker 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FOOT LOCKER, INC.

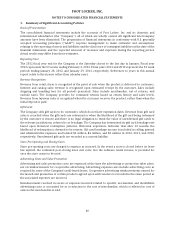

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies − (continued)

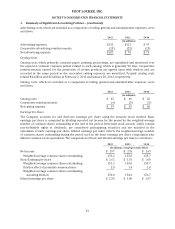

Potential common shares include the dilutive effect of stock options and restricted stock units. Options to

purchase 0.8 million, 3.8 million, and 4.5 million shares of common stock at February 2, 2013,

January 28, 2012, and January 29, 2011, respectively, were not included in the computations because the

exercise price of the options was greater than the average market price of the common shares and,

therefore, the effect of their inclusion would be antidilutive. Contingently issuable shares of 0.1 million

have not been included as the vesting conditions have not been satisfied.

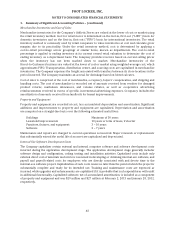

Share-Based Compensation

The Company recognizes compensation expense in the financial statements for share-based awards based

on the grant date fair value of those awards. Additionally, stock-based compensation expense includes an

estimate for pre-vesting forfeitures and is recognized over the requisite service periods of the awards. See

Note 21, Share-Based Compensation, for information on the assumptions the Company used to calculate the

fair value of share-based compensation.

Upon exercise of stock options, issuance of restricted stock or units, or issuance of shares under the

employees stock purchase plan, the Company will issue authorized but unissued common stock or use

common stock held in treasury. The Company may make repurchases of its common stock from time to

time, subject to legal and contractual restrictions, market conditions, and other factors.

Cash and Cash Equivalents

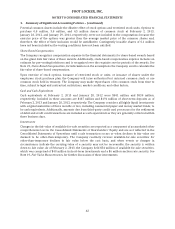

Cash equivalents at February 2, 2013 and January 28, 2012 were $841 million and $830 million,

respectively. Included in these amounts are $187 million and $191 million of short-term deposits as of

February 2, 2013 and January 28, 2012, respectively. The Company considers all highly liquid investments

with original maturities of three months or less, including commercial paper and money market funds, to

be cash equivalents. Additionally, amounts due from third-party credit card processors for the settlement

of debit and credit card transactions are included as cash equivalents as they are generally collected within

three business days.

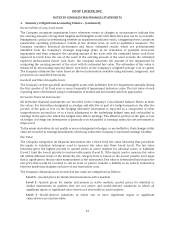

Investments

Changes in the fair value of available-for-sale securities are reported as a component of accumulated other

comprehensive loss in the Consolidated Statements of Shareholders’ Equity and are not reflected in the

Consolidated Statements of Operations until a sale transaction occurs or when declines in fair value are

deemed to be other-than-temporary. The Company routinely reviews available-for-sale securities for

other-than-temporary declines in fair value below the cost basis, and when events or changes in

circumstances indicate the carrying value of a security may not be recoverable, the security is written

down to fair value. As of February 2, 2013, the Company held $54 million of available-for-sale securities,

which was comprised of $48 million in short-term investments and a $6 million auction rate security. See

Note 19, Fair Value Measurements, for further discussion of these investments.

42