Foot Locker 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FOOT LOCKER, INC.

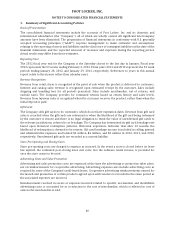

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies − (continued)

Merchandise Inventories and Cost of Sales

Merchandise inventories for the Company’s Athletic Stores are valued at the lower of cost or market using

the retail inventory method. Cost for retail stores is determined on the last-in, first-out (‘‘LIFO’’) basis for

domestic inventories and on the first-in, first-out (‘‘FIFO’’) basis for international inventories. The retail

inventory method is commonly used by retail companies to value inventories at cost and calculate gross

margins due to its practicality. Under the retail inventory method, cost is determined by applying a

cost-to-retail percentage across groupings of similar items, known as departments. The cost-to-retail

percentage is applied to ending inventory at its current owned retail valuation to determine the cost of

ending inventory on a department basis. The Company provides reserves based on current selling prices

when the inventory has not been marked down to market. Merchandise inventories of the

Direct-to-Customers business are valued at the lower of cost or market using weighted-average cost, which

approximates FIFO. Transportation, distribution center, and sourcing costs are capitalized in merchandise

inventories. The Company expenses the freight associated with transfers between its store locations in the

period incurred. The Company maintains an accrual for shrinkage based on historical rates.

Cost of sales is comprised of the cost of merchandise, occupancy, buyers’ compensation, and shipping and

handling costs. The cost of merchandise is recorded net of amounts received from vendors for damaged

product returns, markdown allowances, and volume rebates, as well as cooperative advertising

reimbursements received in excess of specific, incremental advertising expenses. Occupancy includes the

amortization of amounts received from landlords for tenant improvements.

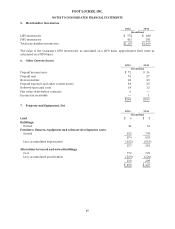

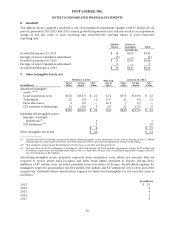

Property and Equipment

Property and equipment are recorded at cost, less accumulated depreciation and amortization. Significant

additions and improvements to property and equipment are capitalized. Depreciation and amortization

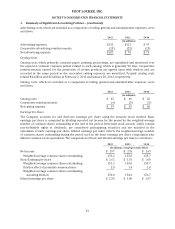

are computed on a straight-line basis over the following estimated useful lives:

Buildings Maximum of 50 years

Leasehold improvements 10 years or term of lease, if shorter

Furniture, fixtures, and equipment 3 − 10 years

Software 2 − 7 years

Maintenance and repairs are charged to current operations as incurred. Major renewals or replacements

that substantially extend the useful life of an asset are capitalized and depreciated.

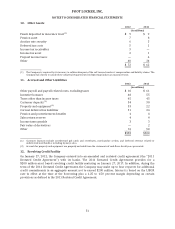

Internal-Use Software Development Costs

The Company capitalizes certain external and internal computer software and software development costs

incurred during the application development stage. The application development stage generally includes

software design and configuration, coding, testing, and installation activities. Capitalized costs include only

external direct cost of materials and services consumed in developing or obtaining internal-use software, and

payroll and payroll-related costs for employees who are directly associated with and devote time to the

internal-use software project. Capitalization of such costs ceases no later than the point at which the project is

substantially complete and ready for its intended use. Training and maintenance costs are expensed as

incurred, while upgrades and enhancements are capitalized if it is probable that such expenditures will result

in additional functionality. Capitalized software, net of accumulated amortization, is included as a component

of property and equipment and was $29 million and $27 million at February 2, 2013 and January 28, 2012,

respectively.

43