Foot Locker 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

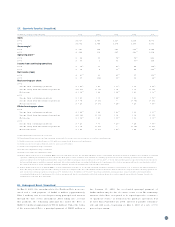

28 . Subsequent Event ( Unaudited)

On May 6, 2003, the amendments to the No rthern No te were exe-

cuted and a c ash payment o f CAD$5.2 millio n ( approximately

US$3.5 millio n) was received representing principal and interest

thro ugh the date o f the amendment. After taking into acco unt

this payment, the remaining principal due under the No te is

CAD$17.5 millio n ( appro ximately US$12 millio n) . Under the terms

of the renego tiated No te, a principal payment o f CAD$1 millio n is

due January 15, 2004. An ac celerated princ ipal payment o f

CAD$1 millio n may be due if certain events o ccur. The remaining

amo unt of the No te is required to be repaid upo n the o ccurrence

of “ payment events,” as defined in the purchase agreement, but

no later than September 28, 2008. Interest is payable semiannu-

ally and will accrue beg inning o n May 1, 2003 at a rate o f 7. 0

percent per annum.

27 . Quart erly Results ( Unaudited)

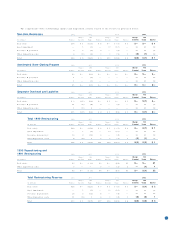

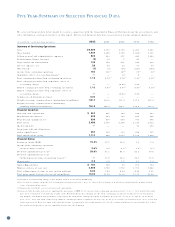

( in millio ns, exc ept per share amo unts) 1st Q 2nd Q 3 rd Q 4th Q Ye ar

Sales

2002 $1,090 1,085 1,120 1,214 4,509

2001 $1,072 1,048 1,104 1,155 4,379

Gross margin( a)

2002 $ 320 312 343 369( c ) 1,344

2001 $ 326 306 327 349( d) 1,308

Operating profi t ( b)

2002 $ 64 55 72( e ) 78( f ) 269

2001 $ 57 9 59 73( g ) 198

I ncome f rom continuing operations

2002 $ 38( h) 33 43( h ) 48 162(h )

2001 $ 32 4 33( i) 42 111( i )

Net income ( loss)

2002 $ 20( h) 31 45( h ) 57 153(h )

2001 $ 37 (14) 33( i ) 36 92( i)

Basic earnings per share:

2002

Inco me from co ntinuing o perations $ 0.27( h ) 0.23 0.30( h) 0.35 1.15( h)

Inco me ( lo ss) from disc ontinued o peratio ns $ ( 0.13) (0.01) 0.02 0.06 ( 0.06)

Net inc ome $ 0.14( h) 0.22 0.32( h) 0.41 1.09( h)

2001

Inco me from co ntinuing o perations $ 0.23 0.03 0.24( i ) 0.29 0. 79( i)

Inco me ( lo ss) from disc ontinued o peratio ns $ 0.04 ( 0. 13) — (0.04) (0.13)

Net inc ome ( lo ss) $ 0.27 ( 0.10) 0.24( i ) 0.25 0. 66( i)

Dilut ed earnings per share:

2002

Inco me from co ntinuing o perations $ 0.26( h ) 0.22 0.29( h) 0.33 1.10( h)

Inco me ( lo ss) from disc ontinued o peratio ns $ ( 0.12) (0.01) 0.02 0.06 ( 0.05)

Net inc ome $ 0.14( h) 0.21 0.31( h) 0.39 1.05( h)

2001

Inco me from co ntinuing o perations $ 0.23 0.03 0.23( i ) 0.28 0. 77( i)

Inco me ( lo ss) from disc ontinued o peratio ns $ 0.04 ( 0. 13) — (0.04) (0.13)

Net inc ome ( lo ss) $ 0.27 ( 0.10) 0.23( i ) 0.24 0. 64( i)

( a) Gross margin represe nts sale s less co st o f sale s.

( b) Operating profit represe nts inco me from co ntinuing o peratio ns befo re inco me taxes, interest expense, net and no n-o perating inc o me.

( c) Includes an increase in ve ndo r allo wances o f $1 0 millio n as co mpared with the prio r ye ar fo urth quarter.

( d) Includes inco me from ve ndo r settleme nts related to prio r ye ars of $7 millio n.

( e) Inc ludes asset impairment charg e o f $ 1 millio n.

( f) Includes asset impairment charge o f $6 millio n.

( g) Include s a $2 millio n asset impairment charge.

( h) As mo re fully de scribed in no te 2, in applying EITF 90-16 to the first quarter o f 200 2, the $18 millio n No rthern charge reco rded within disco ntinued o peratio ns wo uld have been classified as co ntinuing

o peratio ns. Similarly, the $1 millio n bene fit reco rded in the third quarter of 2002 would have bee n classified as co ntinuing o peratio ns. Inc o me from co ntinuing o pe ratio ns for the first and third

quarters wo uld have be en $2 0 millio n and $44 millio n, respe ctively. Diluted e arnings per share would have bee n $0.14 and $0. 30 fo r the first and third quarters, respe ctively. Repo rte d net inco me fo r

the first and third quarters wo uld have remained unchanged. After achieving dive stiture ac co unting fo r No rthern in the fourth quarter o f 2002, these amo unts would have bee n rec lassified to reflec t

the results as sho wn above and as o riginally reported by the Co mpany. As such, the Co mpany has not ame nded these prio r filings.

( i) As mo re fully desc ribe d in no te 2, applying EITF 9 0- 16 in the third quarter of fiscal 2 001, inc o me from co ntinuing o peratio ns wo uld have been $13 millio n o r $0. 10 pe r basic and dilute d earning s per

share. This change wo uld have represe nted the remaining ac crue d lo ss o n dispo sal at the date of the Northe rn Canada sto ck transfer, which would have bee n repo rte d within c o ntinuing o peratio ns. As

such, inc o me from co ntinuing o peratio ns of fiscal year 2001 wo uld have be en $9 1 millio n o r $0. 65 and $0. 64 per basic and diluted earnings per share, respectively. After achieving dive stiture

ac co unting fo r No rthern in the fo urth quarter of 2002 , these amo unts wo uld have bee n rec lassified to reflec t the results as sho wn ab o ve and as o rig inally repo rte d by the Company. As such, the

Co mpany has no t amended the se prio r filings.