Foot Locker 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

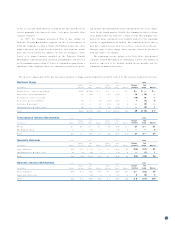

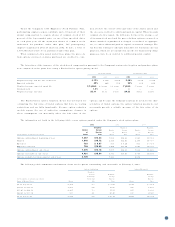

17 . Other Liabilit ies

( in millio ns) 2002 2001

Pe nsio n benefits $2 3 7 $144

Po stretirement benefits 132 148

Defe rred taxes 16 9

Reserve fo r disc o ntinued o peratio ns 922

Repo sitioning and restructuring reserves —2

Other 5 4 60

$44 8 $385

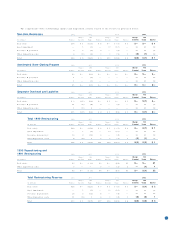

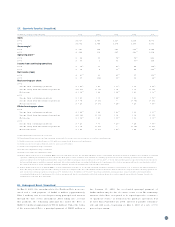

18 . Financi al I nst rument s and Risk Management

Foreign Exchange Risk Management

The Co mpany o perates internatio nally and utilizes certain deriv-

ative financial instruments to mitigate its fo reign c urrency expo -

sures, primarily related to third-party and interco mpany

fo recasted transactio ns. Fo r a derivative to qualify as a hedge at

inc eptio n and thro ug ho ut the hedged perio d, the Co mpany fo r-

mally do cuments the nature and relatio nships between the hedg-

ing instruments and hedged items, as well as its risk-management

o bjectives, strateg ies fo r undertaking the vario us hedge transac-

tio ns and the metho ds of assessing hedge effectiveness and

hedge ineffectiveness. Additio nally, fo r hedges of fo recasted

transactio ns, the significant characteristics and expected terms

of a fo recasted transaction must be specifically identified, and it

must be probable that each fo rec asted transactio n will o ccur. If

it were deemed pro bable that the fo recasted transactio n wo uld

not o ccur, the gain o r lo ss wo uld be rec o gnized in earnings

immediately. No such gains o r losses were reco gnized in earning s

during 2002 o r 2001. Derivative financial instruments qualifying

fo r hedge acc o unting must maintain a specified level of effec-

tiveness between the hedging instrument and the item being

hedged, bo th at inceptio n and througho ut the hedged perio d.

The Co mpany do es no t ho ld derivative financial instruments fo r

trading o r speculative purpo ses.

The primary currencies to which the Co mpany is expo sed are

the euro , the British Po und and the Canadian Do llar. When using

a fo rward contract as a hedg ing instrument, the Co mpany exc ludes

the time value fro m the assessment of effectiveness. The c hange

in a fo rward contract’s time value is repo rted in earning s. Fo r fo r-

ward fo reign exchange c o ntrac ts designated as cash flow hedges

of invento ry, the effective po rtio n of gains and lo sses is deferred

as a co mpo nent o f accumulated o ther co mprehensive lo ss and is

reco gnized as a co mpo nent of co st of sales when the related

invento ry is so ld. Fo r 2002, g ains reclassified to co st of sales

related to such contracts were approximately $1 million. Other

co mprehensive inco me o f approximately $1 millio n, reflec ting the

impact of ado ptio n o f SFAS No . 133 at February 4, 2001, was sub-

stantially rec lassified to earnings in 2001 and primarily related to

such co ntracts. The Co mpany enters into o ther fo rward contracts

to hedge interco mpany fo reign currency royalty c ash flo ws. The

effective po rtio n o f gains and lo sses asso ciated with these fo rward

co ntracts is rec lassified fro m accumulated o ther co mprehensive

lo ss to selling, general and administrative expenses in the same

quarter as the underlying interco mpany royalty transactio n o cc urs.

Fo r 2002, lo sses rec lassified to selling , general and administrative

expenses related to such co ntracts were approximately $1 million

and fo r 2001, suc h amo unts were not material.

Fo r 2002, the fair value o f fo rward c o ntrac ts designated as

cash flo w hedges o f invento ry increased by approximately $1 mil-

lio n and was substantially offset by the c hange in fair value of

fo rward co ntracts desig nated as c ash flo w hedges o f interco m-

pany ro yalties. The change in fair value o f derivative financial

instruments designated as cash flo w hedges in 2001 was no t

material. The ineffective po rtio n o f g ains and lo sses related to

cash flo w hedges reco rded to earnings in 2002 and 2001 was no t

material. The Co mpany is hedging fo rec asted transactio ns fo r no

mo re than the next twelve mo nths and expects all derivative-

related amo unts repo rted in ac cumulated o ther co mprehensive

lo ss to be reclassified to earnings within twelve mo nths.

The changes in fair value o f fo rward c o ntrac ts and o ptio n co n-

tracts that do no t qualify as hedges are rec o rded in earnings. In

2002, the Co mpany entered into certain fo rward fo reign exchange

co ntracts to hedge intercompany fo reign- currency deno minated

firm co mmitments and recorded losses o f approximately $9 mil-

lio n in selling, general and administrative expenses to reflect

their fair value. These losses were more than o ffset by fo reig n

exchange gains o f approximately $13 million related to the

underlying co mmitments, which will be settled in 2003 and 2004.

In 2001, the Co mpany rec o rded a lo ss of approximately $1 mil-

lio n fo r the change in fair value o f derivative instruments not

designated as hedges, which was offset by a fo reign exchange

gain related to the underlying transactio ns.

The fair value of derivative c o ntrac ts o utstanding at February 1,

2003 co mprised current liabilities o f $8 millio n, current assets o f

$1 millio n and other assets of $1 millio n. The fair value of deriva-

tive co ntracts o utstanding at February 2, 2002 was no t significant.

I nterest Rat e Risk Management

The Co mpany has emplo yed interest rate swaps to minimize its

expo sure to interest rate fluctuatio ns. In 2002, the Co mpany

entered into an interest rate swap ag reement with a no tio nal

amo unt of $50 millio n to receive interest at a fixed rate of 8.50

percent and pay interest at a variable rate o f LIBOR plus 3.1 per-

cent. The swap, which matures in 2022, has been designated as

a fair value hedge of the changes in fair value o f $50 millio n o f

the Co mpany’s 8. 50 percent debentures payable in 2022 attribut-

able to changes in interest rates. The fair value o f the swap o f

approximately $1 millio n at February 1, 2003 was included in

o ther assets and the carrying value of the 8. 50 percent deben-

tures was increased by the c o rrespo nding amo unt. There were no

interest rate swap agreements in effec t at February 2, 2002.

Fair Value of Financi al I nst rument s

The carrying value and estimated fair value of lo ng-term debt was

$342 millio n and $341 millio n, respec tively, at February 1, 2003,

and $382 millio n and $380 millio n, respec tively, at February 2,

2002. The c arrying value and estimated fair value o f lo ng- term

investments and no tes receivable was $33 millio n and $32 millio n,

respectively, at February 1, 2003, and $23 million and $20 millio n,

respectively, at February 2, 2002. The c arrying value of cash and

cash equivalents and other current receivables approximates their

fair value.