Foot Locker 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

As o f February 1, 2003, the Co mpany had a valuatio n

allo wance o f $117 millio n to reduc e its deferred tax assets to

an amo unt that is more likely than no t to be realized. The val-

uation allowance primarily relates to the deferred tax assets

arising fro m state tax lo ss carryfo rwards, tax lo ss carryfo rwards

of c ertain fo reig n o perations and capital lo ss carryforwards and

unclaimed tax depreciatio n o f the Canadian operatio ns. The net

change in the to tal valuatio n allo wance fo r the year ended

February 1, 2003, was principally due to current utilizatio n and

future benefit relating to state net o perating losses and fo reign

tax credits, fo r which a valuatio n allo wance is no lo nger neces-

sary, and the expiratio n o f certain state net o perating losses fo r

which there was a full valuatio n allo wance, offset by an

inc rease in the Canadian valuatio n allo wance relating to a cur-

rent year increase in deferred tax assets fo r which the Co mpany

do es no t expect to rec eive future benefit.

Based upo n the level of histo rical taxable inco me and pro jec-

tio ns fo r future taxable inco me o ver the perio ds in which the

tempo rary differences are anticipated to reverse, management

believes it is mo re likely than no t that the Co mpany will realize

the benefits of these deductible differences, net o f the valuatio n

allo wances at February 1, 2003. Ho wever, the amo unt o f the

deferred tax asset considered realizable co uld be adjusted in the

future if estimates of taxable inco me are revised.

At February 1, 2003, the Co mpany’s tax lo ss/ credit carryfo r-

wards included internatio nal o perating lo ss carryforwards with

a po tential tax benefit of $24 millio n. Those expiring between

2003 and 2009 are $23 millio n and those that do no t expire are

$1 millio n. The Co mpany also had state net o perating lo ss car-

ryfo rwards with a po tential tax benefit o f $35 millio n, which

principally related to the 16 states where the Co mpany do es no t

file a co mbined return. These loss carryfo rwards expire between

2003 and 2020 as well as wo rk o ppo rtunity tax credits to taling

$2 millio n, which expire between 2013 and 2018. The Co mpany

had U.S. Federal alternative minimum tax credits and Canadian

capital lo ss carryfo rwards o f approximately $21 millio n and

$9 millio n, respectively, which do no t expire.

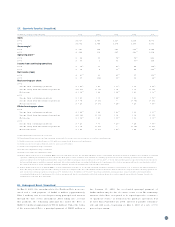

20 . Reti rement Plans and Ot her Benefits

Pensi on and Ot her Postreti rement Plans

The Co mpany has defined benefit pensio n plans co vering mo st o f

its No rth American emplo yees, which are funded in acco rdance

with the pro visio ns o f the laws where the plans are in effect. Plan

assets co nsist primarily o f sto cks, bo nds and tempo rary invest-

ments. In additio n to providing pensio n benefits, the Co mpany

spo nso rs po stretirement medical and life insurance plans, which

are available to mo st o f its retired U.S. emplo yees. These plans

are co ntributo ry and are no t funded.

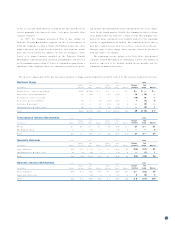

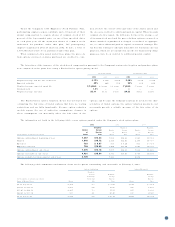

The follo wing tables set fo rth the plans’ changes in benefit

o bligatio ns and plan assets, funded status and amounts reco g-

nized in the Co nso lidated Balance Sheets:

Po st re ti re me nt

Pensio n Be ne fits Benefits

( in millio ns) 2002 2001 2002 2001

Change in benefi t obligat i on

Benefit o bligatio n at

beg inning o f year $ 655 $ 647 $ 37 $57

Servic e c ost 88——

Interest co st 44 45 23

Plan participants’ co ntributio ns ——54

Actuarial ( gain) loss 4 3 27 ( 3 ) ( 1)

Fo reign curre ncy translatio n

adjustments 3( 5) ——

Benefits paid ( 68) ( 67 ) ( 1 1 ) ( 1 1)

Plan ame ndment ———( 15 )

Curtailment —( 1) ——

Settlement —1——

Benefit o bligatio n at

end o f year $ 685 $ 655 $ 30 $37

Change in plan asset s

Fair value o f plan assets at

beg inning o f year $ 500 $ 612

Actual return o n plan asse ts ( 57 ) ( 48 )

Employer co ntribution 27

Fo reign curre ncy translatio n

adjustments 3( 4)

Benefits paid ( 68) ( 67 )

Fair value o f plan assets at

end o f year $ 380 $ 500

Funded stat us

Funded status $ ( 30 5) $( 15 5) $ ( 30) $ ( 37 )

Unreco gnized prio r service c o st 55( 1 2) ( 13 )

Unreco gnized net ( gain) lo ss 3 37 190 ( 9 6) ( 10 5)

Prepaid asset

( accrued liability) $37 $40 $ ( 13 8) $( 1 55)

Balance Sheet capt ion report ed in:

Intangible assets $ 2 $— $ — $—

Accrued liabilities ( 53) ( 2 ) ( 6 ) ( 7)

Other liabilities ( 237 ) ( 1 44) ( 132) ( 14 8)

Accumulated o ther

co mprehensive inco me,

pre- tax 325 186 ——

$37 $40 $( 13 8) $( 15 5)

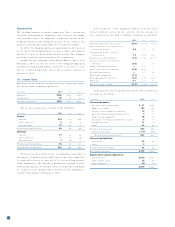

As o f February 1, 2003 and February 2, 2002, the accumulated

benefit obligatio n fo r all pensio n plans, to taling $664 million and

$642 millio n, respectively, exc eeded plan assets.

In 2001, the Co mpany rec o rded a c urtailment and settlement

lo ss fo r its Canadian pensio n plan, in co nnectio n with the disco n-

tinuanc e o f the No rthern Group. The net charge o f approximately

$1 millio n was charged to the reserve fo r disco ntinued o peratio ns.