Foot Locker 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fo o t Lo cker, Inc., thro ug h its subsidiaries ( Fo o t Lo cker, Inc. and

its subsidiaries being hereafter referred to as the “ Co mpany”)

o perates in two repo rtable segments – Athletic Stores and

Direct-to -Custo mers. The Athletic Stores segment is o ne o f the

largest athletic fo o twear and apparel retailers in the wo rld,

who se fo rmats include Fo o t Lo cker, Lady Fo o t Lo cker, Kids Fo o t

Lo cker and Champs Spo rts. The Direct- to - Custo mers segment

reflec ts Fo o tlo c ker. co m, Inc., which sells, thro ug h its affiliates,

inc luding Eastbay, Inc., to custo mers thro ugh catalo gs and

Internet websites.

All references to co mparable-sto re sales fo r a given perio d

relate to sales o f sto res that are o pen at the perio d- end and that

have been o pen fo r mo re than o ne year. Accordingly, sto res

o pened and clo sed during the perio d are no t included. All co m-

parable-sto re sales increases and decreases exclude the impact of

fo reign currency fluctuatio ns.

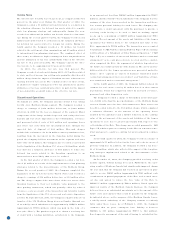

The follo wing table summarizes sales by segment, after reclassi-

ficatio n fo r businesses dispo sed. The dispo sed c atego ry is included

in co ntinuing o peratio ns and represents all business fo rmats so ld o r

closed o ther than disco ntinued business segments. The dispo sitio n

of all businesses previo usly held fo r dispo sal was co mpleted in 2001.

The 2002 and 2001 repo rting years included 52 weeks compared

with the 2000 repo rting year, which included 53 weeks.

( in millio ns) 2002 2001 2000

Athletic Sto re s $4,160 $3,999 $3,953

Direc t- to - Custo me rs 349 326 279

4,509 4,325 4,232

Dispo sed( 1 ) —54 124

$4,509 $4,379 $4,356

Operating profit befo re c o rpo rate expense, net reflects inco me

fro m co ntinuing o peratio ns befo re inco me taxes, corpo rate expense,

non-o perating inc o me and net interest expense. The fo llo wing table

reco nciles o perating profit befo re corpo rate expense, net by seg-

ment to inco me fro m co ntinuing operatio ns befo re inco me taxes.

( in millio ns) 2002 2001 2000

Athletic Sto re s $279 $283 $269

Direc t- to - Custo me rs 40 24 1

Operating profit befo re c o rpo rate

expense, net from o ngo ing o peratio ns 319 307 270

Dispo sed( 1 ) —( 12 ) ( 2)

Restructuring inco me ( charges) ( 2) 2( 33 ) ( 7)

Gain ( lo ss) o n sale o f businesse s( 3 ) —1 ( 1)

To tal o perating profit befo re

co rpo rate expense, net 321 263 260

Co rporate expense ( 4 ) 52 65 79

To tal o perating profit 269 198 181

No n-o perating inc o me 3117

Interest expense, net 26 24 22

Inco me from co ntinuing o perations

befo re inco me taxes( 5 ) $246 $175 $176

( 1) Inc ludes The San Francisco Music Bo x Co mpany, Foo t Lo cker Outlets, Go ing to the Game! ,

Randy Rive r Canada, Burger King and Po peye’s franc hises and Fo ot Lo cker Asia.

( 2) Restructuring inco me o f $2 millio n in 2002 and restructuring charges of $33 millio n and $7

millio n in 2001 and 20 00, respec tively, reflect the dispo sitio n o f no n-c o re businesses and an

ac ce lerated sto re closing prog ram.

( 3) 2001 reflects a $1 millio n adjustme nt to the $1 64 millio n g ain o n sale o f Aftertho ughts in

1999. 20 00 reflec ts a $1 millio n adjustment to the g ain o f $19 millio n reco g nized o n the sale

of Garden Centers in 1998 .

( 4) 2001 include s a $1 millio n restructuring c harge relate d to the 1999 clo sure o f a distributio n

center. 2000 includes a $6 millio n reduc tio n in previo us restructuring c harges.

( 5) 2 000 include s $16 millio n from the 53 rd week.

Co rpo rate expense included deprec iation and amo rtizatio n of

$26 millio n in 2002, $28 million in 2001 and $29 millio n in 2000.

Co rpo rate expense in 2002 declined co mpared with 2001 primarily

reflec ting decreased payro ll expenses related to reduc tio ns in

headco unt. Co rpo rate expense in 2002 was also reduced by a net

fo reign exchange gain of $4 millio n related to interco mpany fo r-

eig n currency deno minated firm co mmitments. Co rpo rate expense

decreased in 2001 co mpared with 2000 primarily as a result o f

decreased c o mpensatio n co sts fo r incentive bo nuses.

Sales

Sales of $4,509 millio n in 2002 increased 3.0 percent from sales

of $4,379 millio n in 2001. Excluding sales fro m businesses dis-

po sed and the effect o f foreign c urrency fluctuatio ns, 2002 sales

inc reased by 3.1 percent as co mpared with 2001 primarily as a

result o f the new sto re opening pro gram. Co mparable-sto re sales

inc reased by 0.1 percent.

Sales of $4,379 millio n in 2001 increased 0.5 percent from

sales of $4,356 million in 2000. Excluding sales from businesses

dispo sed, the 53rd week in 2000, and the effect o f fo reign c urrency

fluctuatio ns, 2001 sales increased by 4. 4 percent as compared with

2000, reflecting an increase o f 4.9 percent in co mparable-sto re

sales fo r o ngo ing fo rmats.

Result s of Operations

Gross Margin

Gross margin, as a percentage o f sales, o f 29.8 percent declined

by 10 basis po ints in 2002 as compared with 29.9 percent in

2001, primarily resulting from the increase in the co st o f mer-

chandise, as a percentage o f sales, due to increased markdo wn

activity. Vendo r allowances increased by $13 millio n as co mpared

with the prio r year perio d. The impact of these vendo r allo wances

was an improvement in g ro ss margin in 2002, as a percentage o f

sales, o f 30 basis po ints as co mpared with 2001.

Gross margin, as a percentage o f sales, o f 29.9 percent

declined by 20 basis po ints in 2001 from 30.1 percent in 2000,

reflec ting increased o cc upancy and buying co sts. Excluding the

impact of the 53rd week in 2000, gross margin, as a percentage

of sales, was unchanged in 2001.

Selli ng, General and Administrat ive Expenses

Selling , general and administrative expenses ( “ SG&A” ) increased

by $5 millio n in 2002 to $928 millio n. The increase included

$13 millio n related to new sto re o penings, $11 millio n related to

the impact o f fo reign currency fluctuatio ns primarily related to the

euro and $10 millio n related to increased pensio n costs. The

inc rease in pensio n c o sts resulted fro m the decline in plan asset

values and the expec ted lo ng-term rate of return used to deter-

mine the expense. These increases were partially o ffset by

$29 millio n in the reduction in SG&A expenses related to the dis-

po sitio ns o f The San Francisco Music Box Co mpany and the Burger

King and Po peye’s franchises during the third quarter of 2001 and

a $3 millio n increase in inco me related to the po stretirement plan.

The increase in po stretirement inco me o f $3 millio n resulted from

the amo rtizatio n of the asso ciated gains. SG&A, as a percentage

of sales, dec reased to 20.6 percent in 2002 fro m 21. 1 percent in

2001. During 2002, the Co mpany recorded asset impairment

charges o f $6 millio n and $1 millio n related to the Kids Fo o t

Lo cker and Lady Fo o t Lo c ker fo rmats, respectively, co mpared with

MANAGEMENT ’SDISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

18