Foot Locker 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

All Other Businesses

The dispo sitio n of all business fo rmats captured in the “All Other”

catego ry was co mpleted during 2001. They include

Afterthoughts, The San Francisco Music Bo x Co mpany, Burger

King and Po peye’s franchises, Randy River Canada, Weekend

Editio n and Garden Centers.

( in millio ns) 2002 2001 2000

Sales $— $54 $123

Operating profi t ( loss) before

corporate expense, net

Dispo se d $— $( 1 2) $ —

Restructuring inco me ( charges) 1 ( 33) ( 11)

Gain ( lo ss) o n sale o f businesse s — 1 ( 1)

To tal o perating profit ( lo ss) befo re

co rpo rate expense, net $ 1 $( 44) $( 12)

Sales as a pe rcentage o f

co nso lidated to tal — % 1% 3%

Number o f sto res at year end — — 170

Selling square fo o tage ( in millio ns) — — 0. 18

Gross square fo o tage ( in millio ns) — — 0.24

In co nnectio n with the 1999 restructuring pro gram, restruc-

turing inco me of $1 millio n was reco rded in 2002 as a reduc tio n

in the previo us charges related to the dispo sitio n o f the no n-c o re

businesses. Restructuring charges o f $33 millio n and $11 millio n

were recorded in 2001 and 2000, respectively, fo r the dispo sitio n

of The San Francisco Music Box Co mpany and the Burger King and

Po peye’s franchises.

The sale of The San Franc isco Music Box Co mpany was co m-

pleted o n No vember 13, 2001, fo r cash pro ceeds of approximately

$14 millio n. In additio n, o n Octo ber 10, 2001, the Co mpany c o m-

pleted the sale o f assets related to its Burger King and Po peye’s

franc hises fo r cash pro ceeds of approximately $5 millio n.

In 2001, a $1 millio n adjustment was reco rded to the g ain o n

the 1999 sale of Aftertho ug hts. In 2000, the Co mpany recorded

a $1 millio n adjustment to the $19 millio n gain reco gnized o n

the 1998 sale of the Garden Centers nursery business.

Liquidit y and Capit al Resources

Cash Flow and Liquidit y

Generally, the Co mpany’s primary so urce o f c ash has been fro m

o peratio ns. The Co mpany has a $190 millio n revolving c redit facil-

ity available through June 2004. In 2001, the Co mpany raised

$150 millio n in cash thro ugh the issuance o f subo rdinated co n-

vertible no tes. The Co mpany generally finances real estate with

o perating leases. The principal uses of cash have been to finance

invento ry requirements, capital expenditures related to sto re o pen-

ing s, sto re remo delings and management info rmatio n systems, and

to fund o ther general wo rking capital requirements.

Management believes o perating cash flows and c urrent credit

facilities will be adequate to finance its wo rking capital require-

ments, to make scheduled pensio n c o ntributions fo r the Co mpany’s

retirement plans, to fund quarterly dividend payments, which are

part of the approved dividend payment pro gram, and suppo rt the

develo pment of its sho rt-term and lo ng-term o perating strategies.

Planned capital expenditures fo r 2003 are $148 millio n, o f which

$114 millio n relates to new sto re o penings and mo dernizatio ns o f

existing sto res and $34 millio n reflects the develo pment of info r-

matio n systems and o ther suppo rt facilities. In additio n, planned

lease acquisitio n costs are $17 millio n and primarily relate to the

Co mpany’s o peratio ns in Euro pe. The Co mpany has the ability to

revise and reschedule the anticipated capital expenditure program

sho uld the Co mpany’s financ ial po sitio n require it.

Any materially adverse reaction to custo mer demand, fashio n

trends, c o mpetitive market fo rces, uncertainties related to the

effect of competitive pro ducts and pricing, c usto mer acc eptance

of the Co mpany’s merchandise mix and retail lo catio ns, the

Co mpany’s reliance on a few key vendo rs fo r a significant po rtio n

of its merchandise purchases ( and o n o ne key vendo r fo r approx-

imately 44 percent o f its merchandise purchases) , risks asso ci-

ated with fo reign glo bal so urcing o r econo mic co nditio ns

worldwide c o uld affec t the ability of the Co mpany to continue to

fund its needs from business o peratio ns.

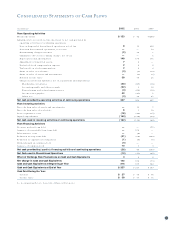

Operating activities of continuing o peratio ns pro vided cash o f

$347 millio n in 2002 co mpared with $204 million in 2001. These

amo unts reflec t inco me fro m c o ntinuing o peratio ns, adjusted fo r

non-cash items and wo rking c apital changes. The increase in cash-

flow from o peratio ns of $143 millio n in 2002 is primarily due to

improved o perating perfo rmance and is also related to wo rking

capital changes primarily related to merchandise invento ries, off-

set by the related payables and inco me taxes payable. During the

third quarter of 2002, the Co mpany rec o rded a current receivable

of approximately $45 millio n related to a Federal inco me tax refund

and subsequently received the cash during the fo urth quarter.

Payments c harged to the repo sitioning and restructuring reserves

were $3 million in 2002 c o mpared with $62 millio n in 2001.

Operating activities of continuing o peratio ns pro vided cash of

$204 millio n in 2001 co mpared with $265 million in 2000. The

decline in cash flo w fro m o peratio ns in 2001 reflected increased

cash o utflo ws for merchandise invento ries and inco me taxes

payable and repo sitio ning and restructuring reserves. Payments

charged to repo sitio ning reserves were $62 millio n in 2001 co m-

pared with $38 millio n in 2000.

Net cash used in investing activities o f co ntinuing o peratio ns

was $162 millio n in 2002 co mpared with $116 millio n in 2001.

Capital expenditures o f $150 millio n in 2002 and $116 millio n in

2001 primarily related to sto re remo deling s and new sto res. Lease

acquisitio n co sts, primarily related to the process of securing and

extending prime lease locatio ns fo r real estate in Euro pe, were $18

millio n and $20 millio n in 2002 and 2001, respectively. Pro ceeds

fro m sales o f real estate and o ther assets and investments were

$6 millio n in 2002 co mpared with $20 million in 2001. Pro ceeds

fro m the condemnation of the Co mpany’s part-o wned and part-

leased pro perty c o ntributed $6 millio n of cash received in 2002.

Pro ceeds from the sales of The San Francisco Music Box Co mpany

and the Burger King and Po peye’s franchises co ntributed $14 mil-

lio n and $5 millio n in cash, respectively, in 2001.

Net cash used in investing activities o f co ntinuing o peratio ns

was $116 millio n in 2001 co mpared with $86 millio n in 2000. The

change was due to pro c eeds fro m sales of real estate and other

assets and investments of $20 millio n in 2001 co mpared with $25

millio n in 2000, in additio n to the $22 millio n increase in capi-

tal expenditures in 2001. Capital expenditures o f $116 millio n in

2001 primarily related to sto re remo deling s and new sto res co m-

pared with $94 millio n in 2000.

Cash used in financing ac tivities o f the Co mpany’s co ntinuing

o peratio ns was $36 millio n in 2002 as co mpared with $89 million

of c ash provided by financing ac tivities o f co ntinuing o peratio ns

in 2001. The change in 2002 compared with 2001 was primarily

due to the issuance of $150 millio n of co nvertible no tes o n June

8, 2001, which was partially o ffset by the repayment o f the $50

millio n 6.98 percent medium-term no tes that matured in Octo ber

2001 and the purchase and retirement o f $8 million of the $40

millio n 7.00 percent medium-term no tes payable in Octo ber

2002. During 2002, the repayment o f debt co ntinued as the

Co mpany repaid the balance of the $40 millio n 7.00 percent

medium- term notes that were due in Octo ber 2002 and $9 mil-

24