Foot Locker 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

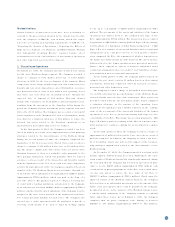

In April 2002, the FASB issued SFAS No . 145, “ Rescissio n o f

FASB Statements No . 4, 44 and 64, Amendment of FASB

Statement No . 13, and Tec hnic al Co rrectio ns” ( “ SFAS No . 145” ) .

SFAS No . 145 amends o ther existing autho ritative pro no unce-

ments to make vario us technical co rrectio ns, including that gains

and lo sses fro m extinguishment of debt no lo nger be classified as

extrao rdinary. The statement also eliminates an inco nsistency

between the required accounting fo r sale-leaseback transactio ns

and the required accounting fo r certain lease mo dificatio ns that

have ec o no mic effects that are similar to sale- leaseback transac-

tio ns. In additio n, it requires that the o riginal lessee under an

o perating lease ag reement that becomes seco ndarily liable shall

reco gnize the fair value o f the guarantee o bligatio n for all trans-

actions o ccurring after May 15, 2002. The Co mpany ado pted SFAS

No . 145 as of May 15, 2002, and it did no t have a material impact

o n its financial po sitio n or results of o peratio ns.

In June 2002, the FASB issued SFAS No . 146, “Accounting fo r

Co sts Asso ciated with Exit o r Dispo sal Activities” ( “ SFAS No .

146” ) , whic h is effective fo r exit and dispo sal activities that are

initiated after December 31, 2002. The statement addresses finan-

cial acco unting and repo rting for co sts associated with exit o r dis-

po sal activities and nullifies Emerging Issues Task Fo rc e ( “ EITF” )

Issue No . 94- 3, “Liability Reco gnitio n fo r Certain Emplo yee

Terminatio n Benefits and Other Co sts to Exit an Activity ( includ-

ing Certain Co sts Incurred in a Restructuring)”. The statement

requires that the fair value o f an initial liability fo r a co st asso ci-

ated with an exit o r dispo sal activity be reco g nized when the lia-

bility is incurred as o ppo sed to when the entity commits to an

exit plan, thereby eliminating the definitio n and requirements fo r

reco gnitio n o f exit costs, as is the guidance under EITF 94- 3. The

Co mpany ado pted SFAS No . 146 in 2002, and it did no t have a

material impact on its financial po sitio n o r results o f operatio ns.

In No vember 2002, EITF Issue No . 02- 16, “Acco unting by a

Custo mer ( Including a Reseller) fo r Certain Co nsideratio n Received

fro m a Vendo r” was issued to clarify the acc o unting fo r co nsider-

atio n rec eived fro m a vendo r. Cash received applies to cash

received fo r reimbursements of c o sts incurred to sell the vendo r’s

pro ducts, co o perative advertising and cash rec eived as rebates or

refunds based upo n cumulative levels o f purchases. The pro -

nouncement applies to new arrangements, including mo difications

of existing arrangements entered into after Dec ember 31, 2002.

The Co mpany ado pted the provisio ns of the prono uncement, as o f

January 1, 2003 and it did no t have a material impact o n its

financial po sitio n o r results o f operatio ns.

New Accounting Pronouncement s

In June 2001, the FASB issued SFAS No . 143, “Accounting fo r Asset

Retirement Obligatio ns” ( “ SFAS No . 143” ) , whic h is effec tive fo r

fiscal years beg inning after June 15, 2002. The Co mpany intends

to ado pt SFAS No . 143 as of the beginning o f fiscal year 2003. The

statement requires that the fair value o f a liability fo r an asset

retirement o bligatio n be recognized in the perio d in whic h it is

inc urred if a reasonable estimate o f fair value can be made. The

asso ciated asset retirement costs are capitalized as part o f the car-

rying amo unt o f the lo ng-lived asset. The initial amo unt to be rec -

o gnized will be at its fair value. The liability will be disc o unted and

accretio n expense will be recognized using the credit-adjusted

risk-free interest rate in effect when the liability is initially reco g -

nized. The Co mpany do es no t expect the ado ption to have a sig-

nificant impact o n its financial po sitio n o r results of o peratio ns.

In December 2002, SFAS No . 148, “Accounting fo r Stock-Based

Co mpensatio n – Transitio n and Disclo sure an amendment of FASB

Statement No . 123,” was issued and pro vides alternative metho ds

of transitio n fo r an entity that c hanges to the fair value based

metho d o f acco unting fo r sto ck-based co mpensation, requires mo re

pro minent disclo sure of the pro fo rma impact o n earning s per share

and requires such disclo sures quarterly fo r interim perio ds begin-

ning in 2003. The Co mpany intends to ado pt the interim disclo sure

requirements as o f the beginning o f fiscal year 2003 and to co n-

tinue to account fo r sto ck-based co mpensatio n under APB No . 25.

Disclosure Regardi ng Forward-Looking Statement s

This repo rt, including the Shareho lders’ Letter, the material fo llo w-

ing the Shareho lders’ Letter, and Management’s Discussio n and

Analysis o f Financial Co nditio n and Results o f Operatio ns, c o ntains

fo rward-lo o king statements within the meaning o f the federal secu-

rities laws. All statements, o ther than statements o f histo rical facts,

which address activities, events o r develo pments that the Co mpany

expects o r anticipates will o r may o c cur in the future, including , but

not limited to , suc h things as future capital expenditures, expan-

sio n, strategic plans, dividend payments, sto ck repurchases, gro wth

of the Co mpany’s business and o peratio ns, inc luding future cash

flows, revenues and earnings, and other such matters are fo rward-

lo o king statements. These fo rward- lo o king statements are based on

many assumptio ns and fac to rs, including, but no t limited to , the

effects of currency fluctuatio ns, c usto mer demand, fashio n trends,

co mpetitive market fo rces, uncertainties related to the effect o f

co mpetitive pro ducts and pricing, c usto mer acc eptance of the

Co mpany’s merchandise mix and retail lo catio ns, the Co mpany’s

reliance on a few key vendo rs fo r a signific ant po rtio n o f its mer-

chandise purchases (and o n o ne key vendo r fo r approximately 44

percent of its merc handise purchases) , unseaso nable weather, risks

asso ciated with fo reig n glo bal so urcing, including po litical instabil-

ity, changes in impo rt reg ulatio ns and the presence of Severe Acute

Respirato ry Syndro me, the effect o n the Co mpany, its suppliers and

custo mers, of any significant future increases in the c o st o f oil o r

petro leum pro ducts, ec o no mic co nditio ns wo rldwide, any changes in

business, po litical and eco no mic co nditions due to the threat o f

future terro rist ac tivities in the United States o r in o ther parts of

the wo rld and related U.S. military actio n overseas, and the ability

of the Co mpany to execute its business plans effectively with regard

to each of its business units, including its plans fo r marquee and

launc h fo o twear compo nent o f its business. Any changes in such

assumptio ns or facto rs co uld pro duce significantly different results.

The Co mpany undertakes no o bligatio n to publicly update fo rward-

lo o king statements, whether as a result of new info rmatio n, future

events o r o therwise.

28