Foot Locker 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

1. Summary of Signi ficant Accounting Policies

Basis of Presentation

The co nso lidated financial statements include the ac co unts of Fo o t

Lo cker, Inc. and its do mestic and internatio nal subsidiaries ( the

“ Co mpany” ) , all o f which are who lly- o wned. All significant inter-

co mpany amo unts have been eliminated. The preparatio n o f finan-

cial statements in co nfo rmity with accounting principles generally

accepted in the United States o f America requires management to

make estimates and assumptio ns relating to the repo rting of assets

and liabilities and the disclo sure of contingent liabilities at the

date o f the financial statements, and the repo rted amo unts o f rev-

enue and expense during the repo rting perio d. Actual results may

differ from those estimates.

Reporting Year

The repo rting perio d for the Co mpany is the Saturday closest to the

last day in January. Fiscal years 2002 and 2001 represented the 52

weeks ended February 1, 2003 and February 2, 2002, respectively.

Fiscal 2000 ended February 3, 2001 and included 53 weeks.

References to years in this annual repo rt relate to fiscal years rather

than c alendar years.

Revenue Recogni tion

Revenue fro m retail sto re sales is reco gnized when the pro duct is

delivered to custo mers. Retail sales include merchandise, net o f

returns and exclude all taxes. In the fo urth quarter o f 2000, the

Co mpany changed its metho d of accounting fo r sales under its

layaway prog ram, in ac co rdance with SEC Staff Acco unting

Bulletin No . 101, “ Revenue Reco gnitio n in Financial Statements,”

effective as o f the beginning o f the year. Under the new metho d,

revenue from layaway sales is reco gnized when the c usto mer

receives the product, rather than when the initial depo sit is paid.

The cumulative effect o f the change was a $1 million after-tax

charge, o r $0.01 per diluted share.

Revenue fro m Internet and catalo g sales is reco g nized when

the pro duct is shipped to custo mers. Sales include shipping and

handling fees fo r all perio ds presented.

St ore Pre- Opening and Closing Cost s

Store pre-o pening costs are charged to expense as incurred. In the

event a sto re is clo sed befo re its lease has expired, the estimated

po st- clo sing lease exit co sts, less the fair market value of sublease

rental inco me, is provided fo r o nce the sto re ceases to be used, in

acco rdance with SFAS No . 146, “Accounting fo r Co sts Asso ciated

with Exit o r Dispo sal Activities,” whic h the Co mpany ado pted in

2002.

Adverti sing Costs

Advertising and sales pro mo tion co sts are expensed at the time

the advertising or promo tio n takes plac e, net of reimbursements

fo r co o perative advertising. Co o perative advertising inco me

earned fo r the launch and pro mo tio n o f c ertain pro ducts is ag reed

upo n with vendo rs and is reco rded in the same perio d as the asso -

ciated expense is incurred. Advertising co sts as a co mpo nent of

selling, general and administrative expenses o f $73.8 millio n in

2002, $79.7 millio n in 2001 and $80.9 millio n in 2000 were net

of reimbursements fo r cooperative advertising of $15.4 millio n in

2002, $8.8 millio n in 2001 and $6.9 millio n in 2000.

Catalog Costs

Catalo g c o sts, which primarily co mprise paper, printing, and

po stage, are capitalized and amortized o ver the expected custo mer

respo nse perio d to each catalo g, generally 60 days. Co o perative

inc o me earned fo r the pro mo tion of certain produc ts is agreed upo n

with vendo rs and is reco rded in the same perio d as the asso ciated

catalo g expenses are amo rtized. Catalo g costs as a co mpo nent o f

selling, general and administrative expenses o f $39.0 millio n in

2002, $37.7 millio n in 2001 and $37.4 millio n in 2000 were net o f

co o perative reimbursements of $2.9 millio n in 2002, $2. 3 million in

2001 and $1.3 millio n in 2000. Prepaid c atalo g c o sts to taled $3.5

millio n at February 1, 2003 and February 2, 2002.

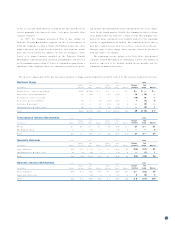

Earnings Per Share

Basic earning s per share is co mputed as net earnings divided by

the weig hted- average number of co mmo n shares o utstanding fo r

the perio d. Diluted earnings per share reflects the po tential dilu-

tio n that co uld o cc ur from co mmo n shares issuable thro ug h

sto ck-based co mpensatio n including sto ck o ptio ns and the co n-

versio n o f co nvertible lo ng- term debt. The fo llo wing table reco n-

ciles the numerato r and deno minato r used to compute basic and

diluted earnings per share fo r continuing o peratio ns.

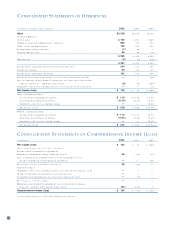

( in millio ns) 2002 2001 2000

Numerator:

Inco me from co ntinuing o perations $ 162 $111 $107

Effe ct of Dilutio n:

Co nvertible debt 53—

Inco me from co ntinuing o perations

assuming dilutio n $1 6 7 $114 $107

Denominat or:

Weighted- average co mmo n

shares o utstanding 14 0 .7 139.4 137.9

Effe ct of Dilutio n:

Sto ck o ptio ns and awards 0.6 1.3 1.2

Co nvertible debt 9.5 6.2 —

Weighted- average co mmo n shares

o utstanding assuming dilutio n 1 50 .8 146.9 139.1

Optio ns to purchase 6.8 millio n, 3. 1 millio n and 4.5 millio n

shares o f co mmo n sto ck fo r the years ended February 1, 2003,

February 2, 2002 and February 3, 2001, respectively, were no t

inc luded in the co mputatio ns bec ause the exercise price of the

o ptio ns was greater than the average market price o f the co mmo n

shares and, therefo re, the effect o f their inclusio n wo uld be

antidilutive.

St ock-Based Compensation

The Co mpany acco unts fo r sto ck- based co mpensatio n by applying

APB No . 25, “Acco unting fo r Sto ck Issued to Emplo yees” ( “APB No .

25” ) , as permitted by SFAS No . 123, “Acco unting fo r Sto c k-Based

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS