Foot Locker 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

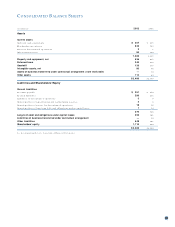

The results o f o peratio ns and assets and liabilities fo r the

No rthern Group segment, the International General Merchandise

seg ment, the Specialty Fo o twear segment and the Do mestic

General Merchandise segment have been classified as disco ntin-

ued o peratio ns fo r all perio ds presented in the Co nso lidated

Statements of Operatio ns and Co nso lidated Balance Sheets.

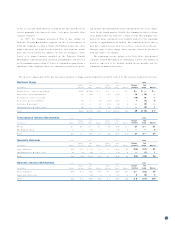

Presented belo w is a summary o f the assets and liabilities of

disco ntinued o peratio ns at February 1, 2003 and February 2, 2002.

The No rthern Group assets and liabilities of disco ntinued o pera-

tio ns primarily co mprised the No rthern Group sto res in the U.S.

Liabilities included accounts payable, restructuring reserves and

o ther acc rued liabilities. The net assets o f the Specialty Fo o twear

and Domestic General Merchandise segments c o nsist primarily of

fixed assets and acc rued liabilities.

Do me stic

No rthe rn Spe cialty Gene ral

( in millio ns) Group Fo o twear Me rchandise To tal

200 2

Assets $— $— $ 2 $ 2

Liabilities 1 — 2 3

$ (1) $— $— $( 1)

200 1

Assets $ 1 $ 2 $ 2 $ 5

Liabilities 3 1 3 7

$ ( 2) $ 1 $ (1) $( 2)

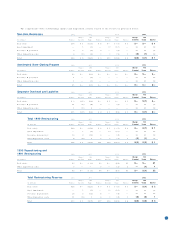

3. Reposi tioning and Restructuring Reserves

19 99 Restructuring

To tal restructuring c harges o f $96 millio n befo re-tax were

reco rded in 1999 for the Co mpany’s restructuring pro gram to sell

o r liquidate eight no n- co re businesses. The restructuring plan

also included an accelerated sto re-clo sing pro g ram in No rth

America and Asia, c o rpo rate headco unt reductio n and a distribu-

tio n center shutdo wn.

Througho ut 2000, the dispo sitio n of Randy River Canada,

Fo o t Lo cker Outlets, Co lo rado, Go ing to the Game! , Weekend

Editio n and the accelerated sto re clo sing pro grams were essen-

tially co mpleted and the Co mpany recorded additio nal restruc-

turing charges of $8 millio n. In the third quarter o f 2000,

management decided to co ntinue to operate Team Editio n as a

manufacturing business, primarily as a result o f the resurgence

of the screen print business. The Co mpany co mpleted the sales

of The San Francisco Music Box Co mpany and the assets related

to its Burger King and Po peye’s franchises in 2001, fo r cash pro -

ceeds o f approximately $14 millio n and $5 millio n, respec tively.

Restructuring charges of $33 million in 2001 and reduc tio ns to

the reserves o f $2 millio n in 2002 were primarily due to The

San Francisco Music Box Co mpany sale. The remaining reserve

balance o f $1 millio n at February 1, 2003 is expec ted to be uti-

lized within twelve mo nths.

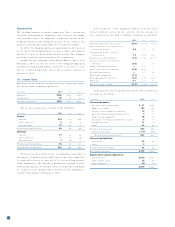

The 1999 accelerated sto re-clo sing pro g ram comprised all

remaining Fo o t Lo cker sto res in Asia and 150 sto res in the United

States and Canada. To tal restructuring charges of $13 million

were recorded and the program was essentially co mpleted in

2000. During 2000, management dec ided to co ntinue to o perate

32 sto res inc luded in the pro gram as a result of favorable lease

renewal terms offered during nego tiatio ns with landlo rds. The

impact on the reserve was no t sig nific ant and was, in any event,

offset by lease buy-o ut co sts fo r o ther sto res in excess o f o rigi-

nal estimates. Of the o riginal 1,400 planned terminations associ-

ated with the sto re- clo sing pro gram, approximately 200 po sitio ns

were retained as a result of the c o ntinued o peratio n of the 32

sto re s.

In co nnectio n with the dispo sitio n o f several o f its non-core

businesses, the Co mpany reduc ed sales suppo rt and corpo rate

staff by o ver 30 percent, reduced divisional staff and co nso li-

dated the management o f Kids Fo o t Lo cker and Lady Fo o t Lo cker

into o ne o rganizatio n. In additio n, the Co mpany clo sed its

Champs Spo rts distributio n center in Maumelle, Arkansas and

co nsolidated its o peratio ns with the Fo o t Lo cker facility lo cated

in Junctio n City, Kansas. To tal restructuring charges o f $20 mil-

lio n were reco rded in 1999 and approximately 400 po sitio ns were

eliminated. In 2000, the Co mpany reco rded a reductio n to the

co rpo rate reserve o f $7 millio n, $5 millio n o f which related to the

agreement to sublease its Maumelle distributio n center and sell

the associated fixed assets, which had been impaired in 1999, fo r

pro ceeds o f approximately $3 millio n. A further $2 millio n reduc-

tio n reflected better than anticipated real estate and severance

payments. In the fo urth quarter o f 2001, the Co mpany recorded

a $1 millio n restructuring charge in co nnectio n with the termi-

natio n of its Maumelle distributio n center lease, which was co m-

pleted in 2002.

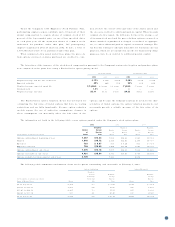

Included in the c o nso lidated results of o peratio ns are sales of

$54 millio n and $139 millio n and o perating losses o f $12 millio n

and $4 millio n in 2001 and 2000, respectively, fo r the abo ve no n-

co re businesses and under-perfo rming sto res, exc luding Team

Editio n.

19 93 Reposit ioning and 19 91 Restructuring

The Co mpany recorded charges o f $558 millio n in 1993 and $390

millio n in 1991 to reflect the anticipated co sts to sell o r clo se

under-perfo rming specialty and general merchandise sto res in the

United States and Canada. Under the 1993 repo sitio ning pro g ram,

approximately 970 sto res were identified fo r closing.

Appro ximately 900 sto res were clo sed under the 1991 restructur-

ing program. The remaining reserve balance of $2 millio n at

February 1, 2003, is expected to be substantially utilized within

twelve mo nths.