Food Lion 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Authorized Capital

As authorized by the Extraordinary General Meeting held on May 23,

2002, the Board of Directors of Delhaize Group SA may, for a period of

five years expiring in June 2007, within certain legal limits, increase the

capital of Delhaize Group SA or issue convertible bonds or subscription

rights which might result in a further increase of capital by a maximum

of approximately EUR 46.2million corresponding to approximately 92.4

million shares. At the end of 2003, the Board of Directors had, after dif-

ferent uses of the authorization granted in 2002, a remaining authori-

zation to increase the capital by a maximum of approximately EUR 43.2

million corresponding to approximately 86.4million shares. The

authorized increase in capital may be achieved by contributions in cash

or, to the extent permitted by law, by contributions in-kind or by incor-

poration of available or unavailable reserves or of the issuance premi-

um account. The Board of Directors of Delhaize Group SA may, for this

increase in capital, limit or remove the preferential subscription rights

of Delhaize Group's shareholders, within certain legal limits.

To the extent permitted by law, the Board of Directors is authorized to

increase the share capital after it has received notice of a public take-

over bid related to the Company. In such a case, the Board of Directors

is especially authorized to limit or revoke the preferential right of the

shareholders in favor of specific persons. Such authorization is grant-

ed to the Board of Directors for a period of three years from the date

of the Extraordinary General Meeting of May 23, 2002. It may be

renewed under the terms and conditions provided for by law.

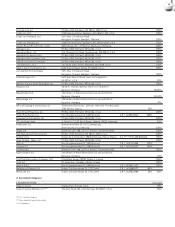

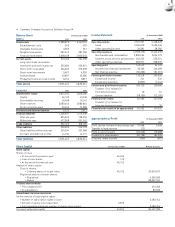

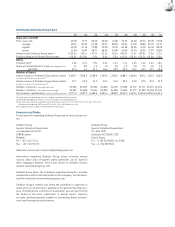

Plans for Management Associates of non-U.S. Operating Companies

2003 Stock Option Plan June 2003 Stock Options 379,200 379,200 EUR 25.81 514 Jan. 1, 2007 – June 24, 2010

2002 Stock Option Plan June 2002 Stock Options 158,300 158,100 EUR 54.30 425 Jan. 1, 2006 - June 5, 2012*

2001 Stock Option Plan June 2001 Stock Options 134,900 133,900 EUR 64.16 491 Jan. 1, 2005 - June 4, 2011*

2000 Warrant Plan May 2000 Warrants 115,000 114,200 EUR 63.10 461 Different exercise periods between

June 2004 and Dec. 2009*

* In accordance with Belgian law, most of the beneficiaries of the stock option and/or warrant plans agreed to extend the exercise period of their stock options and/or warrants for a term of three years.

The very few of the beneficiaries who did not agree to extend the exercise period of their options and/or warrants are still bound by the initial expiration of the exercise periods of the plans, i.e. June 5,

2009 (under the 2002 SOP), June 4, 2008 (under the 2001 SOP) and December 2006 (under the 2000 Warrant Plan) respectively.

Plans Mainly for Management Associates of Delhaize America and U.S. Subsidiaries

2002 Restricted May 2003 Restricted ADRs 249,247 243,762 Not applicable 185 25% of the grant will become

Stock Unit Plan unrestricted each year starting

on the second anniversary

following the date of the grant

May 2002 Restricted ADRs 120,906 91,685 Not applicable 140 25% of the grant will become

unrestricted each year starting

on the second anniversary

following the date of the grant

2002 Incentive Plan May 2003 Warrants 2,132,043 2,024,450 USD 28.91 5,301 Exercisable until 2013

May 2002 Warrants 3,853,578* 3,051,094 USD 44.86 5,328 Exercisable until 2012

2000 Stock Incentive Plan Various Stock options 700,311 536,435 USD 10.85- 4,497 Various

USD 63.28

Various Restricted ADRs 342,771 52,772 Not applicable 128 25% of the grant will become

unrestricted each year starting

on the second anniversary following

the date of the grant

*: Out of the 3,853,578 warrants issued, 1,793,825 are newly issued warrants. The other 2,059,753 represent outstanding stock options previously issued under Delhaize America's 2000 Stock Incentive

Plan and transferred to the Delhaize Group 2002 Stock Incentive Plan (the “2002 Incentive Plan”) in connection with the share exchange with Delhaize Group.

**: Vesting period for restricted ADRs under the 2002 Restricted Stock Unit Plan and the 2002 Incentive Plan

Incentive Plans Adopted by the Company Based on Delhaize Group Equity

Plan Effective Type of Award Number of Number of Shares Exercise Number of Exercise Period

Date of Grants Shares Underlying Underlying Awards Price Beneficiaries (as Applicable)**

Awards Issued Outstanding (at the Moment

Dec. 31, 2003 of Issuance)

Authorized Capital as approved at the May 23, 2002 General Meeting 92,392,704 46,196,352.00

May 22, 2002 Issuance of warrants under the Delhaize Group 2002 Stock Incentive Plan

maximum shares/capital to be issued upon exercise -3,853,578 -1,926,789.00

May 22, 2003 Issuance of warrants under the Delhaize Group 2002 Stock Incentive Plan

maximum shares/capital to be issued upon exercise -2,132,043 -1,066,021.50

Balance of remaining authorized capital as of December 31, 2003 86,407,083 43,203,541.50

Authorized Capital - Status Maximum Number of Shares Maximum Amount (excl. Share Premium) in EUR