Food Lion 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

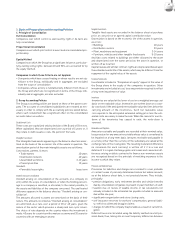

Financial Risk Management

As an international market participant, Delhaize Group has

exposure to different kinds of fi nancial risk. The major exposures

are foreign currency exchange rate, interest rate and self-

insurance risks. Delhaize Group does not trade in commodities nor

does it have signifi cant concentration of credit risk. Accordingly,

Delhaize Group does not believe that commodity risks or credit

risks pose a signifi cant threat to the Company.

Delhaize Group’s treasury function provides a centralized service

for the management and monitoring of foreign currency exchange

and interest rate risks for all of the Group’s operations. The risk

policy of Delhaize Group is to hedge only interest rate or foreign

exchange transaction exposure that is clearly identifi able.

Delhaize Group does not hedge foreign exchange translation

exposure. The Group does not utilize derivatives for speculative

purposes.

Currency Risk

Because a substantial portion of its assets, liabilities and

operating results are denominated in U.S. dollars, Delhaize Group

is exposed to fl uctuations in the value of the U.S. dollar against the

euro. In line with its risk policy, the Group does not hedge this U.S.

dollar translation exposure.

In 2003, a variation of one U.S. cent in the exchange rate of the

euro would have caused sales of Delhaize Group to vary by 0.8% or

EUR 155.5 million and earnings before goodwill and exceptionals

by 0.9% or EUR 3.3 million. During the period 1995-2003, sales of

the Group increased annually on average by 10.1%, of which 8.4%

was at identical exchange rates and 1.7% was due to currency

fl uctuations. Earnings before goodwill and exceptionals of

Delhaize Group increased annually on average by 20.9% during

the period 1995-2003, of which 19.5% was at identical exchange

rates and 1.4% was due to currency fl uctuations.

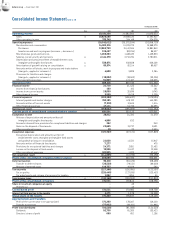

Effect of Exchange Rate Movements on Average Annual

Growth Rates 1995-2003

Average

Growth Rates

(as published)

Average Growth at

Identical Exchange

Rates in 1995-2003

Sales 10.1% 8.4%

Operating profit 12.2% 10.2%

Net earnings 8.5% 6.2%

Earnings before good-

will and exceptionals

20.9% 19.5%

A signifi cant transaction risk for the Group due to variations in

currencies is the payment of dividends by the operating companies

to the parent company. When appropriate, Delhaize Group entered

into agreements to hedge against the variation in the U.S. dollar

in relation to the payment of the dividend of Delhaize America to

the parent company. Additional currency exposure arises when

the parent company or Delhaize Group’s fi nancing companies

fi nance the Group’s subsidiaries in their local currency. Any

sizeable intra-Group cross-currency lending is generally fully

hedged through the use of foreign exchange forward contracts

or currency swaps. Delhaize Group’s subsidiaries borrow, in most

of cases, directly in local currencies. As a result, fl uctuations in

Delhaize Group’s balance sheet ratios resulting from changes in

currencies are generally limited.

Interest Rate Risk

Delhaize Group manages its debt and overall fi nancing strategies

using a combination of short, medium and long-term debt.

The Group fi nances its daily working capital requirements,

when necessary, through the use of its various committed and

uncommitted lines of credit and commercial paper programs.

The interest rate on these short and medium-term borrowing

arrangements is generally determined either as the inter-bank

offering rate at the borrowing date plus a pre-set margin or based

on market quotes from banks.

The Delhaize Group interest rate risk management objectives are

to limit the effect of interest rate changes on earnings and cash

fl ows and to lower borrowing costs. The mix of fi xed-rate debt and

fl oating-rate debt is managed within policy guidelines. At the end

of 2003, 80.4% of the net debt of the Group was fi xed-rate debt and

19.6% fl oating rate debt.

During the fourth quarter of 2001 and the third quarter of 2002,

Delhaize America entered into interest rate swap agreements to

manage its exposure to interest rate movements by effectively

converting a portion of its debt from fi xed to variable rates.

Variable rates for these agreements are based on six-month or

three-month U.S. dollar LIBOR and are reset on a semiannual

basis or quarterly basis. On December 30, 2003, the Company

cancelled USD 100 million of the 2011 interest rate swap

arrangements. The notional principal amounts of interest rate

swap arrangements as of December 31, 2003 were USD 300

million (approximately EUR 237.5 million) maturing in 2006 and

USD 100 million (approximately EUR 79.2 million) maturing in

2011.

During the second quarter of 2003, Delhaize Group entered into

interest rate swap agreements converting a portion of its debt

from fi xed to variable rates. Variable rates for these agreements

are based on the three-month Euribor and are reset on a

quarterly basis. The notional principal amount of these interest

rate swap arrangements as of December 31, 2003 was EUR 100

million maturing in 2008.