Food Lion 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2003

50

In May 2003, Delhaize Group issued bonds having an aggregate prin-

cipal amount of EUR 100 million for net proceeds of approximately

EUR 98.7million (the “2003 Eurobonds”). The 2003 Eurobonds

mature in 2008 and bear interest at 8.00%, payable in arrears on May

22 of each year. The 2003 Eurobonds are subject to redemption in

whole , at the principal amount, together with accrued interest, at the

option of Delhaize Group at any time in the event of certain changes

affecting taxes in the Netherlands. At the same time, Delhaize Group

entered into interest rate swap agreements to swap the fixed interest

rate of the 2003 Eurobonds for variable rates. (see Note 17 to the con-

solidated financial statements).

During the fourth quarter of 2001 and the third quarter of 2002,

Delhaize America entered into interest rate swap agreements to manage

the exposure to interest rate movements by effectively converting a

portion of the debt from fixed to variable rates (see Note 17 to the con-

solidated financial statements).

Delhaize Group has a multi-currency treasury note program in

Belgium. Under this treasury notes program, Delhaize Group may

issue both short-term notes (commercial paper) and medium-term

notes in amounts up to EUR 500 million, or the equivalent thereof in

other eligible currencies (collectively the “Treasury Program”). EUR

12.4million in medium-term notes were outstanding at December 31,

2003 and 2002 under the Treasury Program.

Delhaize Group had EUR 16.1million outstanding at December 31,

2002, in European Medium-term Credit Institution borrowings, under

its credit facilities (see Note 15 to the consolidated financial state-

ments).

The fair values of Delhaize Group’s long-term borrowings were esti-

mated based upon the current rates offered to Delhaize Group for

debt with the same remaining maturities or generally accepted valu-

ation methodologies. The estimated fair values of Delhaize Group’s

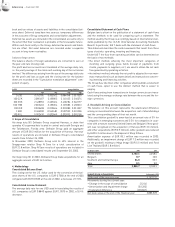

long-term borrowings including current portion were as follows:

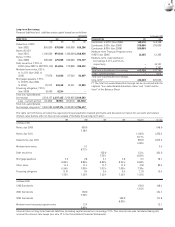

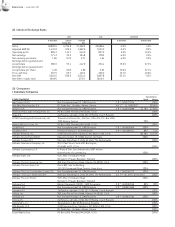

(in millions of EUR)

2003 2002

Fair value 3,083.0 2,847.2

Carrying amount 2,739.5 3,149.4

Capitalized Lease Commitments

(in thousands of EUR)

2003 2002

Capitalized lease commitments 571,981 698,959

Less: current portion (28,853)(32,410)

Total capitalized lease commitments,

long-term 543,128 666,549

Principal payments of capitalized lease commitments:

(in millions of EUR)

2005 2006 2007 2008 Thereafter

30.3 32.8 35.7 39.2 405.1

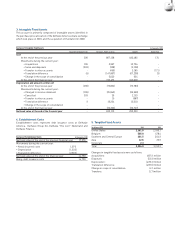

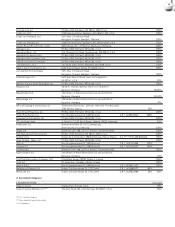

15. Financial Liabilities due within One Year

(in thousands of EUR)

2003 2002

Short-term credit institution borrowings 85,995 337,273

Short-term treasury program notes 153,021 128,131

Total short-term borrowings 239,016 465,404

Delhaize America maintains a revolving credit facility with a syndicate of

commercial banks providing USD 350 million (EUR 277.1 million) in

committed lines of credit, which expires in July 2005. The credit facility

is secured by certain inventory of Delhaize America’s operating compa-

nies. The credit facility contains affirmative and negative covenants,

including a minimum fixed charge coverage ratio, a maximum leverage

ratio and an asset coverage ratio. As of December 31, 2003, Delhaize

America was in compliance with all covenants contained in the credit

facility. Delhaize America had no outstanding borrowings under this

facility as of December 31, 2003. During 2002, Delhaize America had

under this facility average borrowings of USD 4.7million (EUR 5.0mil-

lion) at a daily weighted average interest rate of 3.19%. This facility is uti-

lized to provide short-term capital to meet liquidity needs as necessary.

At December 31, 2003 and 2002, the European and Asian companies of

Delhaize Group had together credit facilities (committed and uncommit-

ted) of EUR 655.3million and EUR 686.2million, respectively under

which Delhaize Group can borrow amounts for less than one year

(Short-term Credit Institution Borrowings) or more than one year

(Medium-term Credit Institution Borrowings). The Short-term Credit

Institution Borrowings and the Medium-term Credit Institution

Borrowings - see note 14 of the consolidated financial statements - (col-

lectively the “Credit Institution Borrowings”) generally bear interest at

the inter-bank offering rate at the borrowing date plus a pre-set margin

or based on market quotes from banks. Delhaize Group had in Europe

and Asia EUR 86.0million and EUR 337.3million outstanding at

December 31, 2003 and 2002, respectively in Short-term Credit

Institution Borrowings, with an average interest rate of 3.17% and 3.79%

respectively. During 2003, Delhaize Group had in Europe and Asia aver-

age borrowings of EUR 251.0million at a daily weighted average interest

rate of 3.31%.

In Belgium, Delhaize Group had approximately EUR 153.0million and

EUR 128.1million in short-term notes outstanding under the EUR 500

million Treasury Program (see Note 14 to the consolidated financial

statements) at December 31, 2003 and 2002 respectively.

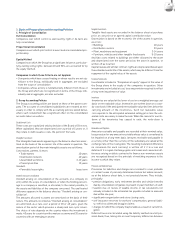

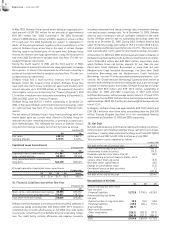

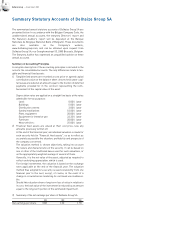

16. Net Debt

Net debt, defined as long-term financial liabilities (including current por-

tion) plus short-term financial liabilities minus cash short-term invest-

ments (excl. treasury shares) and trust fundings, went from EUR 3,897.8

million as of end 2002 to EUR 3,024.6 million as of end 2003.

This movement can be explained as follows :

(in millions of EUR)

Net debt at the end of previous year 3,897.8

Cash flow before financing activities (366.2)

Investments in debt securities (74.2)

Dividends and directors’ share of profit 82.9

Other investing activities (treasury shares, stock

options, direct financing costs) (3.5)

New debt under capital leases 20.5

Change in consolidation scope (1.0)

Unrealized losses on debt securities 1.1

Translation difference (532.8)

Net debt at the end of the year 3,024.6

Reconciliation of Net Debt

2003 2002 2001

Amounts falling due after more

than one year

Financial liabilities 3,272.63,790.54,529.9

Amounts falling due within

one year

Current portion of long-term debt 38.859.666.6

Financial liabilities 239.0465.4571.3

Trust fundings (66.7)--

Short-term investments

Other investments (218.1)(100.5)(27.7)

Cash (241.0)(317.2)(364.2)

Total 3,024.63,897.84,775.9