Food Lion 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2003

48

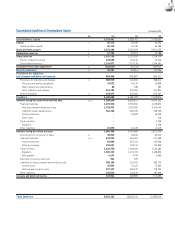

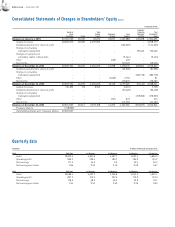

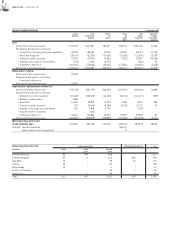

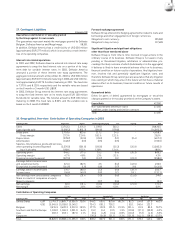

10. Cumulative Translation Adjustment

(in millions of EUR)

Year USD Euro Zone Other Difference Change Cumulative

Companies Companies Companies on Results over the Year Total

1999*95.9(4.8)(1.2)(7.0)82.982.9

2000 46.6(1.6)(0.9)(0.8)43.3126.2

2001 73.5-9.10.983.5 209.7

2002 (263.1)-0.7(21.4)(283.8)(74.1)

2003 (265.7)-(0.3)(12.9)(278.9)(353.0)

(312.8)(6.4)7.4(41.2)(353.0)

(*) Cumulative 1977-1999

The negative movement of the translation adjustment is mainly due to

the decrease of 17.0% in the year-end USD rate compared to the euro

as of December 31, 2002, used to translate the value of assets and

liabilities of the U.S. companies.

Existing cumulative translation adjustments related to companies of

the euro zone will be maintained as they are in the account

“Cumulative translation adjustment” until the sale of these holdings.

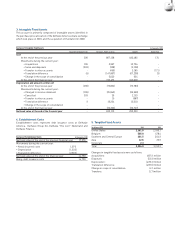

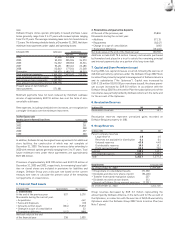

11. Minority Interests

This account covers third-party interests in the equity of fully consoli-

dated companies which are not wholly owned by Delhaize Group.

(in millions of EUR) 2003 2002

Belgium 0.40.4

Southern and Central Europe 30.028.9

Asia 4.95.0

Total 35.334.3

Changes in minority interests are as follows:

(in millions of EUR)

Balance as of December 31, 2002 34.3

Changes in consolidation scope and percentage held -

Minority interest in the consolidated profit 3.3

Dividends paid to minority shareholders (1.5)

Translation difference (0.8)

Balance as of December 31, 2003 35.3

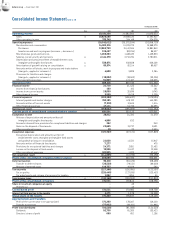

12. Provisions for Liabilities and Charges

(in millions of EUR) 2003 2002

United States 146.3186.6

Belgium 7.03.6

Southern and Central Europe 9.38.7

Asia 0.40.1

Corporate 117.9125.9

Total 280.9324.9

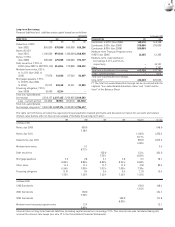

The amount of EUR 146.3million at Delhaize America mainly consists

of :

• Provisions for store closings (EUR 110.8million), representing

essentially rents to be paid and estimated lease related costs of 204

closed stores and 2planned store closings. During 2003, Delhaize

America recorded new provisions of EUR 25.7million for the clos-

ing of 60 stores.

• A pension liability (EUR 24.4 million), recorded to reflect the differ-

ence between the accumulated benefit obligation related to the

Hannaford defined benefit pension plan and the value of plan assets.

The provisions at Corporate level mainly represent:

• Self-insurance reserves at The Pride Reinsurance Company Ltd

(Pride) amounting to EUR 102.8 million as of December 31, 2003.

Delhaize Group self-insurance reserves relate to workers’ compen-

sation, general liability, vehicle accident and druggist claims.

• The provision (EUR 8.1million) recorded at the end of 2001 by

Delhaize Group to cover its share of the estimated future expenses

(mainly employee benefits and non-cancelable lease obligations)

that were guaranteed by Super Discount Markets’ two sharehold-

ers.

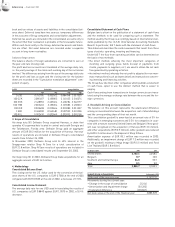

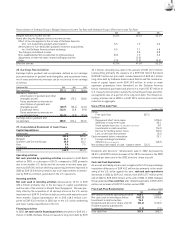

13. Deferred Taxation

(in millions of EUR) 2003 2002

• Deferred taxes in the accounts of

Delhaize America 198.9329.7

• Taxes on consolidation adjustments

relating to Delhaize America 125.6165.4

• Taxes on consolidation adjustments

relating to Delhaize Belgium 39.843.0

• Taxes on consolidation adjustments

relating to Alfa-Beta 8.17.1

• Others 6.70.7

Total 379.1545.9

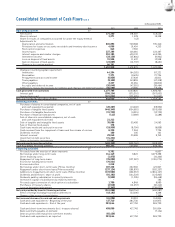

14. Amounts Falling Due after More than One Year

Analysis of Long-Term Debt Payable by Due Date (in thousands of EUR)

Debts by Due Date

Due in Less than One Year Due in More than One Year Due in More than

and Less than Five Years Five Years

Financial liabilities 38,822 1,043,279 2,229,351

Non-subordinated debenture loans 9,951 905,301 1,824,201

Liabilities under capital leases 28,853 137,978 405,150

Credit institutions 18 --

Other debt - 15,700 170

Total 38,822 1,058,979 2,229,521